Opções binárias para Iniciantes 2022 – Absolutamente TUDO que você precisa saber

As opções binárias têm se tornado uma das formas mais populares de investimentos da atualidade. Esse sucesso é justificado principalmente pela relativa facilidade na operação. Contudo, é muito importante tomar alguns cuidados antes de começar a investir em opções binárias. Compilamos aqui todas as informações relevantes e super atualizadas, focando em tudo aquilo que precisa saber sobre opções binárias.

Os 3 corretores preferidos para negociação online em 2021

O que são opções binárias?

As opções binárias são um tipo de instrumento financeiro no qual o investidor indica se o valor de um ativo irá subir ou baixar em um determinado período. Trata-se, portanto, de uma forma de investimento absolutamente simples, sendo acessível aos investidores com mais variados níveis de conhecimento.

Origem: IQ Option

Embora os ativos negociados sejam geralmente os mesmos ativos que podem ser operados em um mercado de valores tradicional, nas opções binárias o investidor não compra e vende efetivamente as ações, ele simplesmente investe na perspectiva da valorização ou desvalorização deste ativo.

Caso o investidor esteja certo em sua previsão, recebe um valor pré-fixado, que costuma variar entre 70 e 90%.

O valor do retorno pode variar de corretora para corretora, ou de acordo com o tipo de conta que o investidor possui no site.

Caso o ativo se desenvolva de uma maneira diferente da previsão, o investidor perde o valor investido. É importante ressaltar que essa simplicidade na operação pode ser associada, de alguma forma, a jogos de azar. Contudo, trata-se de uma opção de investimento legítima e o domínio de estratégias de investimento permite que o investidor aufira ganhos consistentes.

Opções binárias é um investimento seguro ou fraude?

As opções binárias são um tipo de investimento legítimo, com milhões de investidores operando em escala global. Devido à sua simplicidade, é muito importante que o iniciante invista algum tempo em estudar para compreender as nuances do mercado e assim investir com maior perspectiva de lucro a longo prazo.

Contudo, tão importante quanto estudar o mercado e analisar as tendências,necessário também que se escolha uma plataforma legítima e confiável para investimento.

O que determina se o investimento é seguro ou fraude é justamente a corretora escolhida.

Existem sim corretoras fraudulentas. Por este motivo, empenhamo-nos em disponibilizar todas as informações necessárias para que você seja capaz de identificar as armadilhas, escolhendo assim somente corretoras idôneas para operar.

Como começar a investir em opções binárias?

Operar com opções binárias é muito fácil, mesmo para marinheiros de primeira viagem. O passo fundamental antes de qualquer coisa é munir-se das informações mais atualizadas possíveis.

- Encontre uma boa corretora de opções binárias. É preciso encontrar o equilíbrio entre os recursos e a rentabilidade dentro da sua faixa de negociação. Esteja atento a todos os pontos mais importantes ao escolher uma corretora.

- Crie uma conta de demonstração. Aproveite para testar se a plataforma é confortável, fluída e observe se ela possui todos os recursos que deseja.

- Envie fundos para sua conta para começar a lucrar. Assim que dominar a utilização da plataforma, talvez seja um bom momento para começar a investir através de depósito de dinheiro, e assim poder buscar a lucratividade.

- Utilize nossas ferramentas e estratégias ou negocie por sua própria conta.O mais importante é perceber que as opções binárias devem ser levadas muito a sério, pois existe sim o potencial de perda financeira.

Separamos uma lista com as melhores corretoras indicadas para o mercado brasileiro. Considerando todos os pontos mais importantes em nossa análise, a corretora vencedora foi a IQ Option.

Desde o início, a IQ Option notabilizou-se no mercado de opções binárias como uma empresa inovadora, tanto no que concerne à plataforma quanto aos serviços prestados ao investidor.

Os valores de operação da corretora são baixos, o que a torna uma opção perfeita não só para investidores iniciantes, como também para investidores regulares que ainda estão em fase de consolidação no mercado. O site, aplicativo e suporte estão em português (além de 8 outros idiomas).

→ Crie uma conta demonstração no IQ Option ou confira a Revisão.

Vale ressaltar que a rentabilidade mais alta está associada ao tipo de conta com maior valor de depósito ou movimentação financeira durante um período. Portanto, caso você queira depositar um valor abaixo de US$ 1.000, nossa recomendação é que você escolha a IQ Option.

Quais os pontos mais importantes ao escolher uma corretora de opções binárias?

Escolher uma boa corretora de opções binárias é fundamental, independentemente se você busca ser um investidor constante ou apenas um especulador casual. A escolha de uma corretora não confiável pode traduzir-se em perda total do valor investido. Por isso é muito importante comparar as corretoras disponíveis, utilizando a lista de critérios que criamos abaixo.

Primeira impressão e informações públicas

A primeira impressão diz muito sobre a empresa. Se o site não é agradável ou não disponibiliza informações transparentes sobre a empresa de forma direta e objetiva, talvez seja um bom indicativo de que é melhor procurar outra corretora.

Navegue por todo o conteúdo disponibilizado no site antes mesmo de decidir criar sua conta, buscando por toda informação que possa parecer relevante sobre o funcionamento da empresa no mundo real. Confronte as informações disponibilizadas no site com informações garimpadas na internet. Cruzar as informações ajuda identificar a idoneidade da empresa.

Caso o material didático esteja disponível publicamente – ou para contas demonstração – aproveite para dar uma boa olhada na sua qualidade. Confronte o conteúdo do material didático com o material disponibilizado pela concorrência buscando pelos aspectos coerentes.

Erros de português no site ou traduções automáticas podem ser um indicador de fraude ou no mínimo de desinteresse no mercado brasileiro.

Regulamentação e segurança

Regulamentação é a palavra de ordem no universo das opções binárias. A CySEC ( Comissão de valores mobiliários de Chipre) é considerada a mais respeitada instituição de regulamentação do mercado, embora não seja a única. A britânica FCA (Financial Conduct Authority – Autoridade de conduta financeira) é outra organização financeira não governamental com plenos poderes legais para atuação de acordo com a Lei dos Mercados e Serviços Financeiros do reino unido, datada do ano 2000.

Os objetivos de uma entidade regulamentadora consistem em – embora não se limitem só a isso – proteger o consumidor e melhorar a inclusão do modelo no mercado financeiro, além de assegurar e promover a competição entre as empresas com regras justas para que assim o consumidor possa fazer valer o seu direito de escolha.

Para que uma corretora de opções binárias seja regulamentada é preciso que ela satisfaça uma série de requisitos da entidade reguladora e opere de acordo com as normas estabelecidas pela mesma. Dentre os requisitos estão os protocolos de segurança e os procedimentos de combate à lavagem de dinheiro e fraudes.

Conta demonstração e tipos de conta

Procure por plataformas que te permitam testar antes de investir o seu dinheiro. Nem toda plataforma de opções binárias possui este recurso.

Através da conta de demonstração você pode verificar se a plataforma funciona de maneira satisfatória; se possui métricas, indicadores e gráficos necessários para aplicar sua estratégia; e se possui os ativos e recursos disponíveis que possam te interessar.

Plataformas que trabalham com vários tipos de conta diferentes têm a vantagem de oferecer conteúdo mais didático e estratégico, além de ferramentas diferenciadas com maior rentabilidade, geralmente de acordo com os depósitos realizados pelo investidor. Por isso, faz-se necessário ponderar a sua realidade e expectativa. É a partir de seu grau de investimento nos depósitos que a corretora de opções binárias te oferecerá a melhor rentabilidade dentro de sua expectativa de operação.

Opções de depósito e saque

Olhe atentamente para os métodos de depósito e retirada de fundos. É fácil depositar e retirar fundos do Brasil [ou de seu país]? No caso de utilizar carteiras eletrônicas, permita as que disponibilizem a opção de sacar o valor para sua conta corrente no Brasil, como o PayPal e Payoneer, Webmoney, VISA, Mastercard.

Sites que já aceitam depósitos e retiradas diretamente em sua conta corrente podem ser uma opção interessante.Contudo, tente comparar as cotações e tarifas para esta operação direto do site ou das carteiras eletrônicas que você opera.

Leia atentamente as regras da corretora relacionadas à política de saque. Algumas corretoras somente permitem que seja utilizada para sacar a mesma carteira que foi utilizada para depositar. Em alguns casos, quando o investidor depositou a partir de mais de uma fonte a corretora calcula a proporção dos depósitos e realiza o saque proporcional em cada uma das carteiras depositantes.

A política de saque também indica o tempo necessário para que a retirada seja efetivada para a conta corrente. Avalie esta informação dentro de seu contexto.

ATENÇÃO: Devido à política de prevenção de lavagem de dinheiro e fraudes, é muito provável que seu primeiro saque somente seja liberado mediante ao envio e confirmação dos documentos, o que pode ocasionar alguma demora no primeiro saque.

NUNCA FORNEÇA DADOS FALSOS POIS VOCÊ CORRE O RISCO DE TER O DINHEIRO APREENDIDO PELO DEPARTAMENTO ANTIFRAUDE.

Plataforma e funcionalidades adicionais

De modo geral, as plataformas de corretagem de opções binárias são muito parecidas, fluídas e intuitivas. Algumas características, contudo, podem não estar disponíveis em todas as plataformas ou para todos os tipos de conta.

Vale a pena comparar entre todas as plataformas que você achou confiável, qual possui a melhor rentabilidade e o melhor conjunto de recursos para o tipo de conta que você estima ter.

Compare os recursos abaixo:

- Material de Estudo: Quais os tópicos e estratégias abordadas para seu tipo específico de conta.

- Análises e projeções: Algumas plataformas disponibilizam análises e prognósticos para alguns ativos. Esse recurso possibilita uma maior compreensão do cenário e por consequência aumenta a probabilidade de acertar, melhorando, por consequência, o ROI (Retorno sobre investimento) do investidor.

- Gráficos Avançados: Os gráficos proporcionam ao investidor a melhor visualização do cenário. Por mais que simplicidade seja uma boa meta, quando se trata de investimentos a capacidade de visualizar rapidamente a situação ajuda na identificação das tendências. Muitas estratégias são baseadas na interpretação de cenários através de gráficos, portanto esse recurso não deve ser facilmente descartado.

- Gerente de Conta VIP: São um tipo bem especial de serviço de atendimento ao consumidor. O Gerente de Conta atua tanto de maneira receptiva, recebendo e atendendo às solicitações dos investidores, quanto de maneira proativa, notificando aos usuários sobre algo que pode ser importante para o mesmo.

- Consultor Pessoal: Consultores pessoais estão disponíveis para fornecer dicas de investimentos valiosas com o intuito de maximizar sua lucratividade. Este recurso normalmente está disponível para usuários com um volume maior de depósito.

- Investimento Social: Este é um recurso presente em algumas corretoras que pode ser interessante. Através deste recurso é possível acompanhar como outros usuários (incluindo investidores experientes) estão investindo. É possível aprender muito observando atentamente aos investidores experientes.

Opções de Forex e Criptomoedas

O mercado de divisas – Foreign Exchange ou simplesmente ForEx – consiste no mercado de câmbio estrangeiro. Neste mercado os ativos são compostos da relação de valorização entre duas moedas.

O mercado de divisas – Foreign Exchange ou simplesmente ForEx – consiste no mercado de câmbio estrangeiro. Neste mercado os ativos são compostos da relação de valorização entre duas moedas.

A grosso modo o FOREX reflete o fluxo monetário global, onde a entrada e saída de recursos financeiros em um país – ou região econômica, como é o caso do euro – controla a valorização de uma moeda através da relação entre oferta e procura.

Os ativos são expressos utilizando a abreviação das duas moedas em questão. Por exemplo, o ativo EUR/USD corresponde a relação de valorização entre o euro e o dólar americano. Já o AUD/USD equivale à valorização do dólar australiano em relação ao dólar americano.

Já as criptomoedas são os equivalentes digitais do dinheiro de papel. O volume do mercado hoje já orbita a casa dos 100 bilhões de dólares americanos. A maior parte desse capital – cerca de 45% – está com a primeira e mais difundida das criptomoedas, o Bitcoin.

A título de comparação, o volume de capital nas criptomoedas ultrapassou o valor de mercado de muitas das mais famosas startups do mundo:

- AirBNB, avaliada em US$ 31bi;

- Xiaomi, com valor de mercado na casa dos US$ 46 bi;

- Uber, valor estimado em US$ 68 bi;

Assim como no FOREX, as criptomoedas são ativos comparativos. No ativo ETH/BTC, investe-se na valorização da criptomoeda Ethereum em relação ao Bitcoin. Quando o nome do ativo contempla somente o nome da criptomoeda a sua valorização é medida em relação ao dólar americado.

Tome nota: Devido ao fato do volume do mercado de criptomoedas ser bem menor do que o volume de seus equivalentes do mundo real, as flutuações tendem a ser muito maior. As subidas e descidas podem ser acentuadas muito mais facilmente de acordo com as movimentações dos compradores.

Como ganhar dinheiro com opções binárias?

Ganhar dinheiro com opções binárias provavelmente foi o que te trouxe até aqui. Antes de mais nada é muito importante ter disciplina. É através da disciplina de se ater à estratégia e à gestão de banca que é possível se transformar em um investidor profissional.

Ganhar dinheiro com opções binárias provavelmente foi o que te trouxe até aqui. Antes de mais nada é muito importante ter disciplina. É através da disciplina de se ater à estratégia e à gestão de banca que é possível se transformar em um investidor profissional.

Use estratégias

Para investir em opções binárias, não necessariamente deve-se utilizarde estratégias.Contudo, sem uma estratégia bem definida, dificilmente você terá retorno lucrativo no longo prazo. E tenha isso em mente pois a palavra de ordem quando se trata de investimento em opções binárias é justamente longo prazo.

Investir para o longo prazo não significa necessariamente que todas as suas operações individuais terão lucro, mas sim que você tem uma expectativa de valor positiva e ao final de um período isso deve resultar em ROI (retorno sobre o investimento) maior que zero.

Na prática isso quer dizer que ao final de uma série de investimentos o valor total recebido será maior que o valor total investido.

Existem inúmeras estratégias conhecidamente lucrativas e que podem variar no quesito simplicidade de uso. Conheça algumas:

- The trend is your friend: Essa estratégia consiste em identificar pontos no gráfico que sinalizam uma tendência de subida (uptrend) ou descida (downtrend) para melhorar as probabilidades de acerto.

- Martingale: Esta estratégia é bem conhecida de apostadores em roleta. Inicialmente concebida para apostas de azar é um dos métodos mais populares entre investidores com pouca ou nenhuma experiência. Consiste em dobrar a última aposta feita caso perca. Caso ganhe volta-se a ir dobrando até acertar novamente.

- Getsuga Tensho: Essa é uma “receita caseira” complicada que vem ganhando popularidade. Utiliza-se de 4 indicadores – XPMA, HAMA, MACD e Stochastic – e combina essas informações para determinar a hora mais provável de investir na valorização ou na desvalorização do ativo.

- Best MACD Entries: Com regras bem simples é fácil para os investidores iniciantes. A única questão é que esta estratégia trabalha somente com uma única granularidade (timeframe) por vez.

Para conhecer em detalhe essas e outras estratégias conhecidamente lucrativas, para todos os níveis de conhecimento acesse o nosso guia de estratégias para investimento em opções binárias.

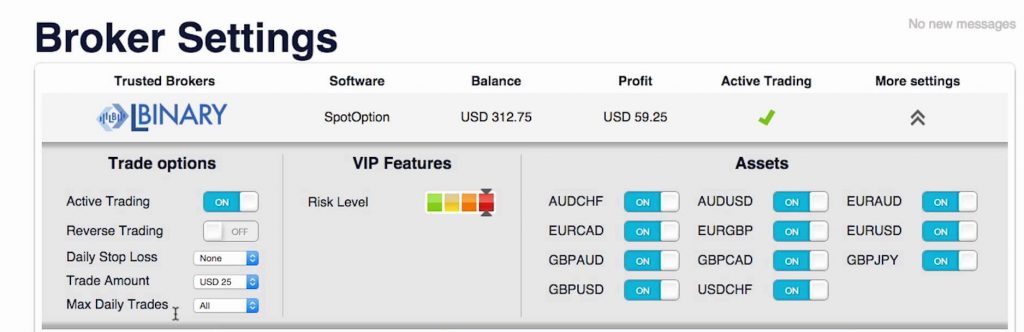

Robôs de investimento em opções binárias

Quanto mais tempo você investe em estudo e compreensão do mercado, dos indicadores e dos mecanismos à disposição do mundo das opções binárias, mais você consolida o conhecimento adquirido que te possibilitará alcançar um excelente ROI (retorno sobre investimento). Mas para que esse conhecimento se transforme em resultados é necessário utilizá-lo, ou seja, realizar efetivamente as operações de investimento.

Na prática isso significa investir tempo e dinheiro para realizar as operações. Com os robôs de investimento em opções binárias é possível maximizar o tempo que se passa operando e assim extrair todo o potencial da sua estratégia de investimento 24 horas por dia, sete dias por semana, se atendo exclusivamente às estratégias definidas, não perdendo o desempenho por cansaço, por exemplo.

Os principais benefícios ao utilizar um robô de investimento em opções binárias são:

- Gestão de um grande volume de informações: De maneira muito mais eficiente que um ser humano, os computadores tomam decisões instantâneas baseadas nos modelos matemáticos e estratégias configuradas.

- Negociação sem o componente emocional: Operar em modo instintivo é normalmente um dos principais fatores de perda de lucratividade (ou prejuízo efetivo) no mercado de investimento em opções binárias. Robôs não agem por instinto.

- Permite ao investidor realizar outras atividades:Você não precisará passar o tempo todo com a atenção no que está acontecendo com seus investimentos. Desta forma é possível levar a vida com mais tranquilidade e menor nível de estresse.

- Demanda muito menos conhecimento: Não é necessário estudar o mercado, tendências, ativos e nem outra peculiaridade sobre as opções, permitindo focar os estudos nas estratégias gerais de investimento.

- Trabalha dia e noite: Assim você não perde oportunidades de lucrar quando está dormindo ou realizando outras atividades.

O objetivo dos robôs é executar a sua estratégia de maneira consistente, durante todo o tempo programado, maximizando seus lucros.

Contudo, perceba que para que o robô atue de forma lucrativa é preciso que sua estratégia tenha uma expectativa de valor positiva. Embora não seja necessário estudar o mercado propriamente dito, será necessário buscar melhorar os seus conhecimentos sobre as estratégias de investimento, para maximizar a performance do robô.

Você também tem a opção de copiar configurações e estratégias lucrativas de outros usuários e assim iniciar lucrativamente a sua campanha pelo mundo das opções binárias, mas com o domínio do assunto será possível maximizar os ganhos e obter um retorno sobre o investimento maior.

Conclusão: Comece agora!

Agora que você já sabe o que são opções binárias, como escolher uma corretora e que investir nelas é sem sombra de dúvidas uma das formas mais interessantes de investimentos através da internet é hora de dar os primeiros passos e criar sua conta demonstração na IQ Option, eleita pela nossa equipe como a melhor corretora para investidores brasileiros.

Crie já a sua conta de demonstração na IQ Option de conheça a plataforma!

É claro que você não precisa depositar 1.000 dólares para começar, mas é recomendável que você deposite um valor que te permita conhecer a plataforma e buscar operar lucrativamente de acordo com a sua estratégia preferida.

Caso queira saber mais sobre o IQ Option, acesse nossa análise completa atualizada da IQ Option e tire suas próprias conclusões.

Enfim, acreditamos que agora você já saiba tudo o que precisa para investir em opções binárias. Estamos muito felizes de ter contribuído para sua trajetória como um investidor competente e ambicioso. Esperamos que alcance o sucesso de maneira consistente e duradoura.

Esforçamo-nos para manter este site sempre atualizado, trazendo informações e análises recentes das mais diversas corretoras, para que você possa escolher com sabedoria.

Try online trading now!

Open a demo account at IQ Option and get

$10,000 Virtual money.

About Lucas Goncalves

Lucas Goncalves é Trader Profissional há 8 anos. Levar sua experiência ao longo do caminho está aqui para compartilhar seu conhecimento e experiência de negociação com traders novos ou experientes.

English

English  Tiếng Việt

Tiếng Việt  Thai

Thai  Italiano

Italiano  Français

Français  Deutsch

Deutsch