IQ Option Withdrawal: How to Withdraw Your Funds in India?

IQ Option is an online trading platform on which investors can trade cryptocurrencies, stocks, exchange-traded funds (EFTs), and forex. In India, it began its operations in 2013. The platform simplifies everything for beginners to help them learn about the market and master the art of investing their money.

Due to IQ Option’s firm security measures and user-friendly interface, the platform enjoys an ever-rising number of users. Several of which are Indian. Further, online traders and investors can comfortably transact money immediately after all their private data has been verified by IQ Option.

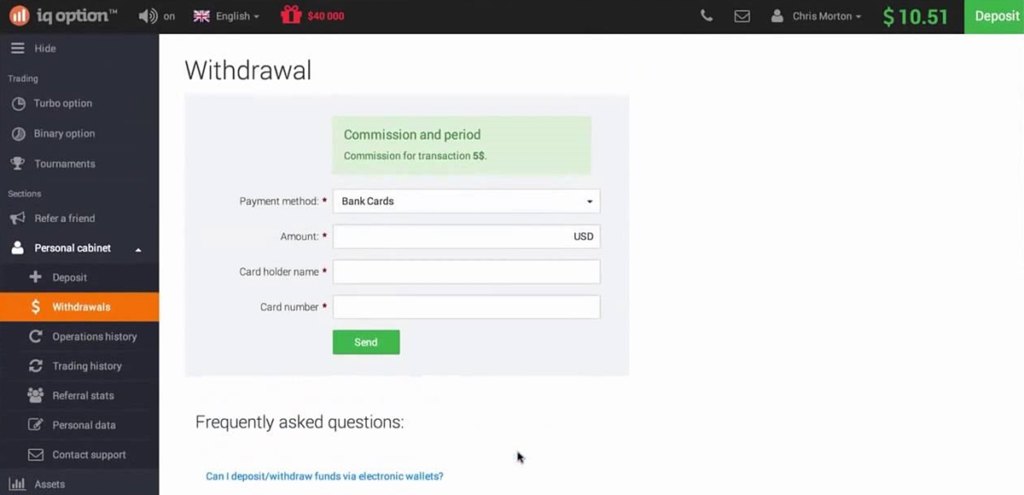

You can withdraw your funds from your IQ Option account in India by following just these simple steps,

- Log in to your IQ Option account

- Click on My account

- Press on the Withdraw Funds tab

- Pick your preferred method of money withdrawal

- Select the payment method

- Enter the amount you would like to withdraw

- Press the withdraw funds button

IQ Option believes in a trader's money being theirs to do with as they please. On the same note, a money withdrawal on IQ Option is a speedy and hassle-free process. Moreover, investors willing to withdraw their money can do it whenever they want. Hence, they do not restrict the number of times a person can withdraw their funds.

IQ Option Withdrawal Methods Available in India

Users can withdraw money from their IQ Option accounts via net banking, e-money transfer services, international payment systems, as well as digital wallets.

Here are a few of the online payment services that allow withdrawals in India:

How to Withdraw Money from IQ Option in India?

IQ Option’s withdrawal method depends on the deposit method of IQ Option traders have used previously. Investors do not have to worry about the number of times they can withdraw their funds. IQ Option, fortunately, has a “your money is always yours" policy.

The steps to withdraw money are as follows:

When using a bank card to receive withdrawals, traders have to use the same card they used to deposit the money in the first place. Additionally, they have to make sure their withdrawal amount is under the total amount of deposit made in the previous ninety days.

If your request goes over the limit, you can use your e-wallet to withdraw the remainder. Furthermore, the same e-wallet that deposited the money needs to be used to allow the withdrawal.

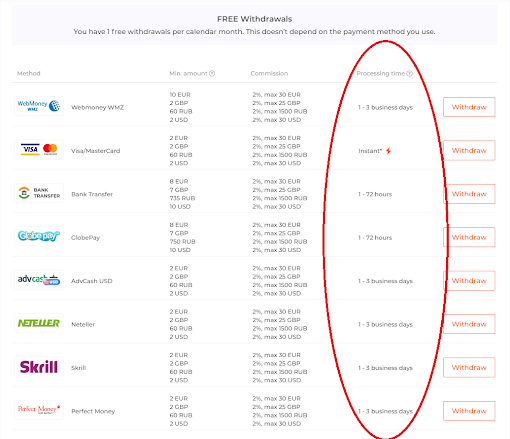

Over and above that, IQ Option gives their clients one free withdrawal per calendar month.

IQ Option Minimum Withdrawal

The minimum amount of money investors and traders can withdraw is based on the withdrawal method used.

In the case of a bank transfer or a UPI transfer, the minimum amount is $7 or 500 INR. Similarly, GlobePay requires a minimum of $7 or 544 INR.

On the other hand, Visa / Mastercard, WebMoney WMZ, Advcash USD, Perfect Money, Skrill, and Neteller need a minimum of $2 or 170 INR.

Moreover, the maximum amount of money you are allowed to withdraw on IQ Option is conditional on the payment method used.

IQ Option Withdrawal Fee

Luckily enough for investors and traders, IQ Option doesn’t charge a withdrawal fee for the first withdrawal transaction each calendar month. However, following the second transaction onwards, the user is asked to pay a 2 per cent withdrawal fee per transaction per calendar month.

The minimum fee per transaction for Indians (on the INR) is 74 Indian rupees. On the other hand, the maximum amount charged is 2207 Indian rupees.

That said, some withdrawal fees may be charged by the payment system you are using, even if you are using IQ Options free withdrawal of the month. Users should check with their payment systems provider for more details.

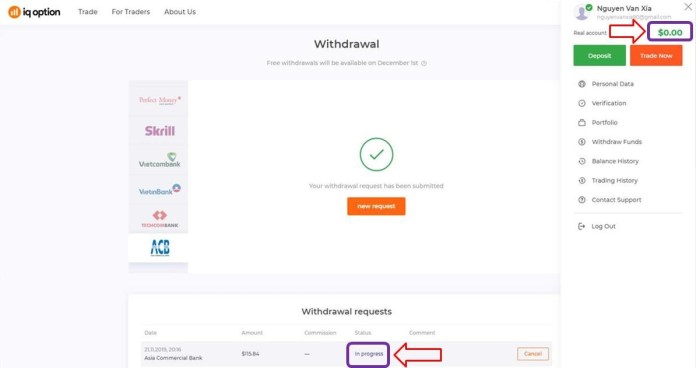

How to Check Withdrawal Status

Withdrawal statuses on IQ Option can be checked by going to the Withdraw Funds section, which can be located in the drop-down menu on the right-hand side. The status is seen beneath the Withdrawal Requests box on the page.

Additionally, if an investor has more than one request, they shall be listed one below the other. Their respective statuses will be written alongside the right.

Once stock traders get done with the last withdrawal step, they will reach the Requested status. After which, the money gets deducted from the account balance.

Next, the payment takes approximately three business days to be processed. Therefore, the status bar shows the words In Progress.

Finally, once the amount is sent to the user's bank account or e-wallet, the status changes to Funds Sent. The withdrawal is finally complete, and traders will be able to see the final status as Completed when the transaction was successful.

Furthermore, a Hold or Cancelled status indicates that either the investor’s ID is not verified yet or the withdrawal request has failed.

IQ Option Withdrawal Proof

The withdrawal proof is found in the Balance History tab, after which investors have to select what type of transaction they want to look at, based on which currency they used and on which dates.

Once selected, you can view each transaction and can subsequently access the withdrawal proof.

How Much Time Does an IQ Option Withdrawal Take?

IQ option withdrawal time varies based on the payment system.

A transaction is processed instantaneously when a Visa / MasterCard / Maestro card is used. This is why this method is the most popular solution for withdrawal from IQ Option. However, the bank may sometimes take three weeks to transfer the money to your bank account, based on which bank you are using.

Most of the other payment systems, such as Neteller, Skrill, Advcash USD, Perfect Money, and bank transfers, take a maximum of three business days to process the payment.

Further, UPI and GlobePay payments take around 1 to 72 hours as processing time.

IQ Option Withdrawal Problems

On a general basis, IQ Option withdrawals go on without a hitch. But traders and investors may face problems due to other reasons.

Those reasons may be:

1. A Lack of ID verification

A user’s ID needs to be entirely verified on IQ Option. IQ Option, to protect themselves from scammers and fraudulent behaviour, demands foolproof identifications.

The verification takes a total of four steps, they are:

- Verify your email ID. A code is sent to the email you have registered with. Then, you have to type the code into the bar, and you’re done

- Next, verify your phone number just as you did with the email address. You will receive a code on your phone that you have to enter

- After that, add your private data. For example, your name, gender, birthday, citizenship, and address need to be uploaded

- Finally, the user’s proof of identity is required to finish the process

Your identity has to be verified before trading as well as withdrawing money.

2. Issues with the Bank

At times the problem may not lie with the user or IQ Option’s website or mobile app but with the trader’s bank.

For instance, if your bank account has surpassed the number of operations for that period, it will not be able to receive the withdrawal money.

Investors should make sure that their bank accounts are up to date. Above this, make sure it is fully functional.

3. Incorrect Payment Details

A trader may accidentally type in the wrong payment details, such as an incorrect account number, name, CVV, credit or debit card number, etc. In such a case, the withdrawal request will not go through.

IQ Option’s system will not register an incorrect detail. Users must make sure that they type their details in with care to avoid a mishap.

4. A Technical Glitch

Sometimes, your network or digital device may have an internal problem. The request will not be registered if your device hangs during the process or your network lags. Be sure to update the devices you are working on, and double-check whether your internet connection is working without any hiccups.

5. Card / E-Wallet Do Not Match

IQ Option has a strict policy of using the same bank card or e-wallet that was used to deposit the money. Only the same account will be allowed to withdraw money. Users should be vigilant about which account they’re using while withdrawing.

Additional problems should be addressed while speaking to IQ Option’s customer support systems. They have four helpline numbers to choose from and an email address (support@iqoption.com). Moreover, they have a live help chat available.Facts and Questions (FAQs}

Let’s have a closer look at the IQ Withdrawal functioning through the help of these FAQs.

The maximum amount withdrawable on IQ Option is 1 million dollars per day, regardless of what method you use. Secondly, even though the number of times a user can withdraw funds is unlimited, there is one restriction. When using a bank card, traders are not allowed to transact a withdrawal that exceeds the amount deposited ninety days ago.

However, e-wallets don’t share the same problem. Except for the million-dollar cap, a withdrawal made using an e-wallet has no limit based on the deposit made a month and a half ago.

Therefore, if an online trader wants to withdraw more money than the amount of their last deposit, they can use their e-wallets instead.

IQ Option allows users to use UPIs to withdraw their money. Traders can use any UPI-based app, for example, Google Pay, RuPay, and Skrill.

No. IQ Option doesn’t allow any withdrawals without an account verification. IQ Option has a strict rule of verification. Simply put, online investors can neither trade, deposit, or withdraw money without identity verification.

IQ Option requires specific documents to verify and accept a user’s withdrawal. For starters, a user needs to give a photo of their ID for their account to be fully functional.

A driver’s license, passport, residence proof, voter ID, national ID such as an Aadhar card, etc., can be submitted as proof.

In addition to that, your bank documents need to be given. Those documents are required if you are utilising a bank card to deposit and withdraw money. Remember to cover your CVV number as a precaution.

Investors should also only show the first six and last four digits of their card number.

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch