Olymp Trade Education: A Good Resource for Beginners?Cody WallsBesides being a highly

Olymp Trade Education: A Good Resource for Beginners?

Experienced traders will agree to the statement that timing is the key to everything when it comes to fx trading.

Every forex trader puts in a lot of time and effort in choosing the right time to enter a trade. However, all your efforts may end up being for nothing if you pick the wrong time to exit!

The success of every trade heavily depends on the time the trader chooses to exit a trade and that itself can be a tricky decision for many.

If you exit too soon, you may end up losing on some of the extra profit that gets accumulated after your departure. Similarly, sitting on one position for too long may end up as a loss for you if the price moves down.

Veteran traders are well aware of the significance of exiting at the right time when their profit is at its peak.

They are experienced and smart enough to make use of a forex exit indicator which helps them get an insight into their investments and allows them to experiment with various exit strategies.

In the sections below, we will explore the most useful forex exit indicators that you may choose to implement in your trading endeavors.

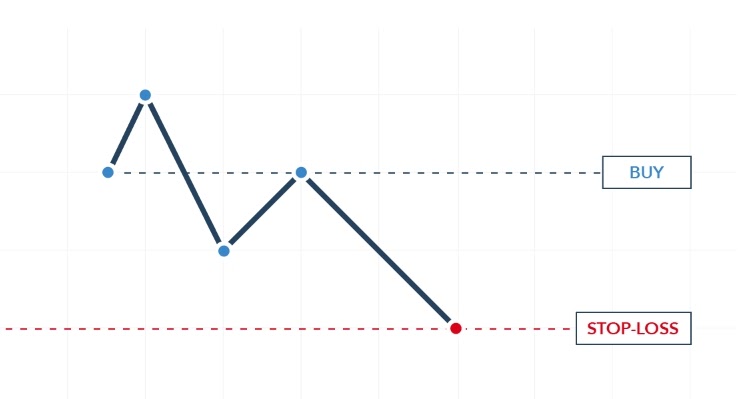

Source: https://www.ig.com/en/trading-strategies/stop-vs-limit-orders-what-are-the-types-of-orders-in-trading-190509

Stop limit in one of the most basic forex exit indicators that are used to aid traders in case the price movement goes in an unplanned direction.

The stop-limit forex indicator is best suited for traders who are new to forex as it leaves no room for uneducated guesses.

To implement the stop limit forex indicator in your trades, simply analyze the currency pair you’re interested in and ascertain where the lines of resistance and support are in that particular pair’s price movement.

Once you are satisfied with that, you can choose to place a stop near the line of resistance so that you will automatically exit that particular trade if the price starts to plummet.

Furthermore, another stop can be added near or over the line of resistance so that the trade is automatically exited once the desired profit level is reached.

Once you have got both stops set, you won’t have to guess every time to decide when to exit a trade.

Stop limit strategy ensures that your losses are not that severe and you get a healthy profit from your favorable trade positions.

This is the reason why the stop limit is said to be the best forex exit indicator for beginners as it minimizes their capital risk and lets them have the maximum amount of profit.

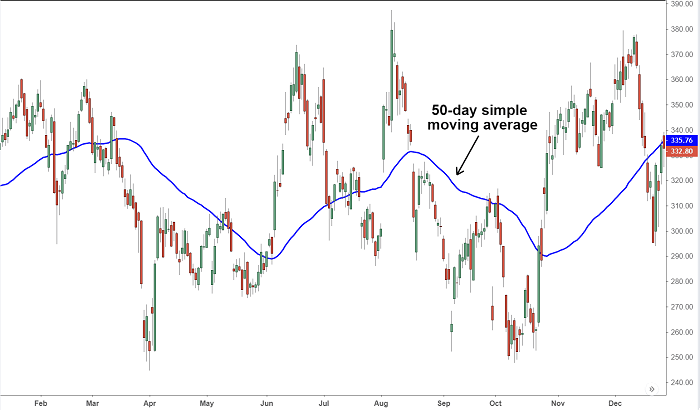

Source: https://www.investopedia.com/terms/s/sma.asp

Forex traders have identified long ago that moving averages are a very useful indicator that can be used to determine the direction in which a currency pair is trending.

Traders use a very simple concept with the moving average indicator. If the price is found to be hovering above the moving average then its time for the trader to look for buying options.

Similarly, if the price is looming below the moving average line then it is time for the trader to look for selling options.

The moving average is a highly effective forex exit indicator that is very simple and easy to implement.

In addition to that, the moving average indicator helps traders in simplifying exit positions. It also acts as a deterrent of sorts against the unconscious impulses of a novice trader to stay with an open position.

Source: https://www.dailyfx.com/forex/education/trading_tips/daily_trading_lesson/2019/07/12/relative-strength-index.html

Traders use this forex exit indicator to find out when currency pairs are being overbought or oversold.

This can prove to be very useful for traders as they can easily plan an exit way before any major price movement takes place.

For example, if the relative strength indicator indicates that a currency is being overbought, then you can easily exit before the price dips any further.

Traders often use the relative strength indicator in combination with forex exit indicators such as the moving average indicator or the stop limit indicator to enhance their analytical strategy.

Source: http://plusforex.blogspot.com/2012/11/tsi-macd-true-strength-index-with.html

This is an indicator used by traders to ascertain the instability or the volatility of the currency pair that they are interested in.

Using that data, they can effectively set up stops and limits on their positions to make the best on their trades.

However, traders should be cautious while setting up the stops and limits using the average true strength indicator as the volatile conditions of the market can prove to be very problematic for them.

Traders should note that setting the range too narrow can lead to your positions being closed too early which will consequently be a loss for you.

On the other hand, if your limit has been set too low then your positions may end up being closed before the maturity period rolls by and you may lose future profits.

Another upside of the average true strength indicator is that you are free to use it for however long you see it fit which makes it quite a versatile forex indicator on this list.

Source: https://smartforexlearning.com/best-take-profit-exit-strategies/

The scaling exit indicator can also be used in combination with any other forex exit indicator of the trader’s choosing.

In the scaling exit strategy, the user has the choice to set the stop limit at the profit line that will ensure that they exit the trade with all their earnings in time.

The most common tactic employed via the scaling exit indicator is to let the price flow freely because the scaling exit strategy nullifies the risk.

Traders are also known to raise their stop limits to capture bigger profits if they feel like taking an aggressive stance.

Source: https://blog.stockarchitect.com/tag/success/

Perfecting your trading strategies is a lengthy process that required patience and hours of research. Various tools besides the forex exit indicator can be used by the traders to improve their skills and come up with better strategies.

With time and practice, you will gain more experience and that will consequently give your confidence a major boost as you go on to find the tools and strategies that give you the best results.

Ultimately, you will be able to choose the best forex indicator that fits your style of trade whether its an aggressive one or a passive one.

Related Articles

Olymp Trade Education: A Good Resource for Beginners?

Olymp Trade Education: A Good Resource for Beginners?Cody WallsBesides being a highly

7 Best Forex Trading Strategies for Beginners

7 Best Forex Trading Strategies for BeginnersCody WallsThe simple act of buying

Trading Forex For a Living: 10 Things You Should Know

Trading Forex For a Living: 10 Things You Should KnowCody WallsIt is