Yandex Money India Review 2022 – Is it Safe?

Not Recommended

Total Skor: 62/100

Yandex Money is a well-equipped e-wallet with many benefits, especially if you live in or are doing a lot of business in Russia.

This transfer service is one of the best bridges between the Russian market and the world. Read on to learn more.

Yandex Money India Review

Firm | Yandex |

Official Website | https://money.yandex.ru/eng |

Since | 1999 |

Regulation | Financial Conduct Authority (UK) |

Platform Type | E-Money/ Transfer |

Mobile Platform | Yes |

Compatibility | Mac OS, Windows, IOS, Android |

Free Account | Yes |

Yandex Money Fees

Deposit Fee | 1% - 4% |

Transfer Fee | 0.8% |

Currency Exchange Fee | 1.29-3.99% |

Withdrawal Fee | 0.6% - 3% |

Transfer Limit | $50,000 |

Pros & Cons

Pros

Contras

What is Yandex Money and how does it work

Yandex Money is the largest online payment service in Russia with approximately 52% of people using it. This e-wallet has made shopping online accessible. People around the world are able to take advantage of world of online retail. The platform also allows users to pay for services andutility bills within Russia. Yandex Moneywas created as a joint venture between Yandex, the most popular search engine in Russia, and Sberbank Eastern Europe’s largest bank. With a proclaimed, 18 million and counting e-wallets registered on the Yandex Money platform, and 12,000+ new accounts opened daily.

Yandex Money offers businesses around the world a simple and efficient online payment platform.

Yandex Money’s mission is to bring customers and merchants together seamlessly to further enhance commercial efficiency on the internet by way of an adaptable payment platform. By partnering with a myriad of businesses including game producers, online retailers, banks, various service providers, payment integrators, and much moreYandex Money has a large network; though most partners are in Russia.

Is Yandex Money Safe & Reliable

Yandex Money is licensed by the Bank of Russia. Though great for Russian users, this may not be the best for user in other countries, as conflicts with the company will be handled according to Russian law.

Looking at security protocols Yandex Money employs the Payment Card Industry Data Security Standard (PCI DSS), which is a security standard of the payment card industry. Including 12 requirements of information security developed by the international payment system powerhouses Visa and MasterCard, it is the forefront of security.

Yandex Money operates under the PCI DSS standard. Find them listed on the official registers of Visa International and MasterCard Worldwide.

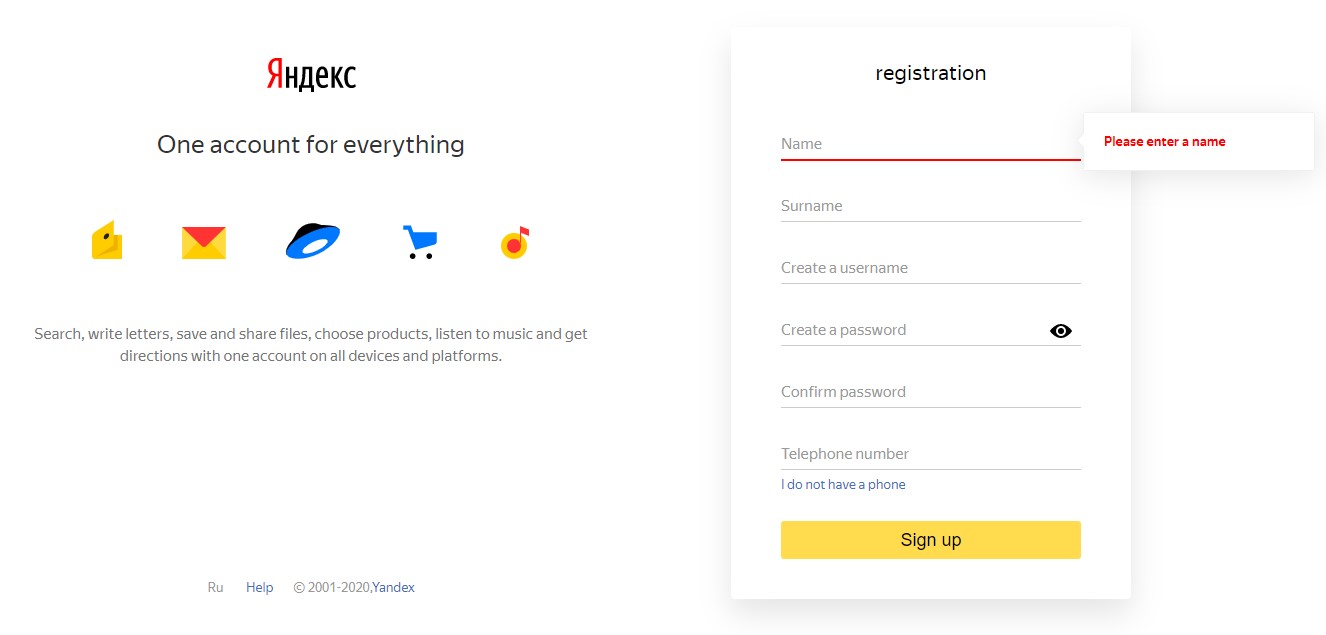

Yandex Money: Sign Up/ Open an Account from India

Signing up for an account is simple, click ‘Create a wallet’ in the top right of the page. If the website comes up in Russian, switch it to English in the lower right corner, by clicking on the flag and selecting the English flag. Fill in your desired login name, password, email address, and phone number. To be able to register with Yandex Money you will need to create a new email through Yandex or log in with a social network account like Facebook or VK. Once this information is provided, and your phone number has been confirmed your wallet is open.

You will be taken to the Yandex Money main screen once you have submitted the form and your account has been created. Before the verification of your account, you are unable to take advantage of all that Yandex Money offers. Documents will be sent to Moscow and some may be required to be translated and notarized into Russian.

The hassle of having documents translated is the main hurdle stopping many potential customers from joining Yandex Money. With so many other platforms like Neteller and Skrill that do not require such efforts, Yandex Money has not grown very quickly outside of Russia and former Soviet countries.

Yandex Money Account Verification from India

To use the account outside of Russia clients must complete verification and confirm your identity. You will be asked to provide your personal details, (name, nationality, date of birth) and permanent residence. Make sure the information entered into these fields matches the documents you will present; you will be asked to upload identification documents like a government issued ID or passport, as well as proof of address like a utility bill, mortgage statement, etc.

First, fill in this application, print it out,then find a Russian translator to translate the page with your photo, signature, and any other relevant pages of your passport. Next, have your translated passport pages notarized, and finally, send both documents to the office in Moscow.

How to Deposit Money to Yandex Money from India

In India, deposits are most often made by credit or debit cards, though verified users could also make a deposit using Western Union. To transfer money from a bank card incurs a 1% commission.

Latvian, Lithuanian, and Turkish citizens are able to fund their Yandew.Money accounts using VISA/MasterCard. For the rest of the EU countries, the US, and the rest of the world you have three options before verification:

- Receive a payment from another Yandex Money user

- Make a bank transfer

- Use an online e-money exchanger,

Once verified clients can make deposits through credit and debit cards as well. Though it is possible to fund your account from abroad it is least complicated in Russia, where clients can make deposits in person at banks, from a phone, and more.

How to Withdraw Money from Yandex Money to an Indian Bank Account

Clients can withdraw funds from their accounts by bank card, or Western Union if verified, or to a prepaid Mastercard. Money is typically withdrawn at any ATM using Yandex Money card, to a bank account, or for those in Moscow at the RIB counter in Moscow.

In India people most often use a credit or debit card to both deposit and withdraw money.

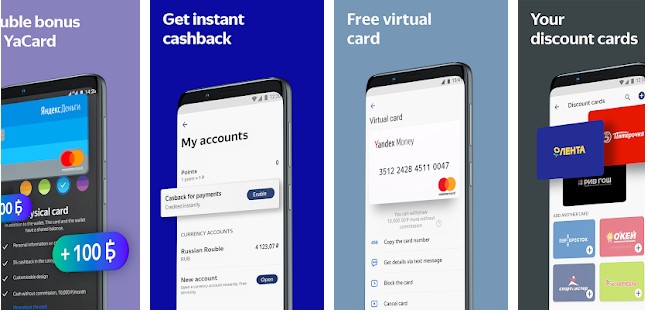

Yandex Money Virtual/ Prepaid Card

Yandex Money has virtual and prepaid cards available for users. The prepaid card allows customers to access their money anywhere. Virtual cards allow people to pay online without jeopardizing the data from their physical card minimizing the risk of identity theft.

The Virtual Card is for free and can be used to pay on any sites or add it to an app for contactless payments and pay offline. Get it instantly on the app or on the website.

The Plastic card can be ordered from the Yandex Money site for 300 rubles and the card comes with your name on it. This card allows you to pay at any store: online or brick & mortar, and withdraw cash from any ATMs.

This is an alternative physical access point to yourYandex Money Wallet. The card withdraws directly from the wallet.Having the card allows you to pay from your Yandex Money account without any hassle.

Unfortunately for clients in South East Asia cards are not shipped beyond Russia and Europe.

Card Perks

Both cards offer a 5% CashbackBonus on purchases made with the Yandex Money Mastercard. Each month has a different category for which all purchases receive a 5% bonus, whereas the bonus is accredited to every 5th non-category purchase.

Cards can be multicurrency, with 10+ different currencies to switch between. The physical card can also be purchased without first opening an account.

Funding Your Trading Account with Yandex Money

Traders can instantly deposit and withdraw funds to and from their trading accounts on a number of platforms like Olymp Trade. Generally, these deposits are executed without commission.

However, depending on the site currency may need to be converted as Yandex Money only operates in EUR, RUB, & USD. Though deposits are made without commission if the currency must be converted then there will be a charge 3.99% applied to the transaction.

When withdrawing to your Yandex Money account deposits can be made in any currency and it will be converted to the chosen currency of the account. The money may take one to five days to reach the account, depending on the platform you are withdrawing from. Brokers like Olymp Trade offer instant withdrawals to Yandex MoneyWallets.

How much is it to Transfer Money with Yandex Money?

- BetweenYandex Money Wallets the commission is 0.5% or from a bank card, the commission is 1%.

- The commission is 3% + 45 rubles, to transfer to a bank cardfrom a Yandex Money Wallet, yet from a bank card, the commission depends on if you have a Wallet or not.

To be able to make transfers and receive moneywith your wallet, you must provide personal information, identification, and finish the verification process. Verified users can transfer money to bank accounts or friends and family through Western Union.

Fundraising

As a Yandex Money Wallet owner you also have your individual page for accepting money. Click the wallet number to reveal the link. The link can be sent to anyone or shared on social media to spread the word about the cause and fundraiser.

How your fundraising page works

When someone views the fundraising page, he or she will see the following:

- Your Wallet number and Profile picture

- A field for entering amount they wish to donate

- Two options for how to transfer the money—an e-wallet or debit/ credit card.

The visitor enters the amount, selects transfer method, and transfers money.

Fundraising pages can be set with a fixed amount, to take the decision making out of the visitor’s hands.

Fees and limits

The commission is the same as a normal money transfer and is charged to the sender.

- 5% of the total amount for transfers from another Yandex Money Wallet

- 1% of the total amount for transfers from debit or credit cards

- Limits depend on the transfer method and the recipient’s user status: anonymous users are allowed to keep up to 15,000 rubles, whereas identified users can keep up to 500,000 rubles.

Yandex Money Mobile App

The Yandex Money app allows customers to add money to a mobile phone, prepaid card, and trading account balances all through a mobile device. Within Russia pay for Internet and utility services, send transfers, and get cashback for online and offline payments.

The app is nothing too special; unlike some bigger e-wallets and transfer platforms with more features this app does not really push its competitors. Though it offers great access to the Russian market of service providers and merchants, these connections and ease of access do not mean much to anyone outside of the country.

Conclusion: 65/100 – Not Recommended

Yandex Money is a powerful e-wallet with many capabilities. Unfortunately, the majority of what sets this wallet apart is only applicable to Russian users. Not the best for Indian users, but fantastic for traveling to Russia.

With much of the site’s information in Russian, finding the resources and answers you need is not always easy. Even when Google translates some of the pages there can be information lost or jumbled in the translation.

For traders planning to travel to and from Russia, to work with Russian companies, or living in a country that speaks the language Yandex Money is a good option. For traders looking for a simple easy to use transfer service that will grant them access to a more global market it is not the system for them. Clients have come to this platform for years and will continue to for its perks within the Russian and former Soviet countries, but it is likely not worth the hassle and inconvenience for others.

Yandex does seem set on becoming a larger player on the global stage and has laid serious ground work towards those efforts. In the years to come Yandex Money could pivot and put more of a focus on the rest of the world possibly resulting in a payment method more powerful than most with a network growing from its current roots making for more a solid foundation going forward.

Check out this article to find better transfer services

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch