Qiwi Wallet India Review 2022 – Is it recommended?

Qiwi has grown rapidly in the Russian market. The company’s focus remains on this market with its site’s major pages in Russian only. This platform is well integrated into Russia with kiosks throughout the country, connections with service providers, and utility companies.

With many perks and connections for users to take advantage of, Qiwi does have drawbacks like transactions are only executed in Ruble or USD, and more. Learn more below.

Qiwi India Review

Firm | Qiwi Group |

Official Website | https://www.Qiwi.com/en/ |

Since | 2007 |

Regulation | Financial Conduct Authority (UK) |

Platform Type | E-Money/ Transfer |

Mobile Platform | Yes |

Compatibility | Mac OS, Windows, IOS, Android |

Free Account | Yes |

Qiwi manages a network of over 169,000 payment terminals and kiosks around the world, making money from commissions charged on payments. The system is used by 40,000+ vendors across 20+ countries, who take in more than 39 billion rubles ($1.1 million) in cash per month from 65 million users.

Qiwi Fees

Deposit Fee | 0% - 12% |

Withdrawal/ Receiving Fee | 7.5-11% |

Total Fees | 13-16.5% |

Transfer Limit | 600,000 rubles |

Pros & Cons

No company is perfect and Qiwi is no exception to that rule. Users make this platform their choice because they have found it works best for what they are trying to accomplish. Used across the globe by gamblers and traders Qiwi has gained a reputation for being a financial gateway for many platforms people want access to, though in some cases an individual’s use of these platforms may not be permitted in their country.

Pros

Contras

Qiwi India – Communication

Qiwi as an electronic payments platform has been in India since 2011. Websites have become increasingly important in the last decade and the level of communication desired from a site and e-wallet that should be clear and informative. Spelling errors and poor punctuation are permissible mistakes, the key is that the message is transparent and understandable.

“You can make payments in favor of the companies – operators of the various services of mobile communication and utility services. The QIWI payment service offers a payment method which each user find convenient and instant.”

This is a prime example of poor communication, unfortunately this is not the only example. Bad translations lose meanings and can negatively skew people’s views. Though the site this was pulled from is intended for individuals looking to create an account, a company of the caliber that Qiwi wishes to present itself as should not have such mistakes. Attention to detail on sites that represent a company shows how seriously a company takes itself, and how much it cares about its clients’ understanding their message and having a positive experience.

What Is Qiwi and How Does it Work?

QIWI Wallet is an e-wallet and transfer platform, established in 2007, built on a Visa Prepaid Account, with over 20.3 million (claimed) active consumer accounts. With QIWI Wallet users can do business directly with over 13,000 merchants. QIWI Wallet offers users the acceptance of Visa products with nearlyglobal acceptance, unmatched reliability, and unbeaten security. Trusted by traders and Poker players around the world, this company has fought for every bit of its market share.

Currently, QIWI provides a universal payment service that includes some of the most popular and convenient tools and technologies. QIWI users can make deposits electronically or in cash, as well as using bank cards and accessing personal accounts on mobile devices. The world’s largest terminal network, convenient electronic wallet, virtual and plastic QIWI bank cards open up easy access to all types of payments.

Qiwi’s services are only available to residents of Armenia, Azerbaijan, Belarus, Canada, China, Estonia, Georgia, India, Israel, Iran, Japan, Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Moldova, Panama, Romania, Russia, Tajikistan, Thailand, Turkey, South Korea, Ukraine, United Kingdom, & Uzbekistan.

This is an issue for traders in most of South East Asia and the majority of the world. To acquire an account with Qiwi from within a country not listed above you would need to take a vacation to a country on the list and register there; not the simplest solution. Without a phone number from a country on the list opening an account is not possible.

Is Qiwi Safe & Reliable?

QIWI was founded on a strong belief in accountability and integrity. QIWI has continued to be committed to an open and honest environment where clients feel they can come forward with complaints and know they’ll be heard.

Customers can use the hotline at www.qiwi.ethicspoint.com , run by a third party – EthicsPoint. Clients are encouraged to report complaints about violation of the company’s well established standards, seek help in carrying out the procedures and share with us suggestions, experiences and any other information.

From a functional standpoint each Qiwi account being a Visa Prepaid account lends the platform Visa’s security protocols. Combined with the systems standard user security initiated when the registration process begins by verifying all platform users before they are granted full access to their account and the platforms features.

Qiwi: Sign Up/ Open an Account from India

Becoming a Qiwi user from India client is simple; in order to use this service, potential clients must register for an account on the Qiwi website. Click the sign up button at the top of the homepage on the right and enter in your mobile phone number: it will be your wallet’s account number. The account’s first password will be sent via text message. You have to be a resident of one of the 26 countries listed above to be able to sign up for an account.

The pages required to create an account are all in Russian, though with Google Translate this may not be much of an issue, but without it registering would be quite difficult.

Qiwi Account Verification from India

Complete the Anti-Money Laundering requirements with your name, address, and phone number. Once the information has been entered into the system verification should be complete. After a successful initial verification clients are able to deposit, transfer, and withdraw money.

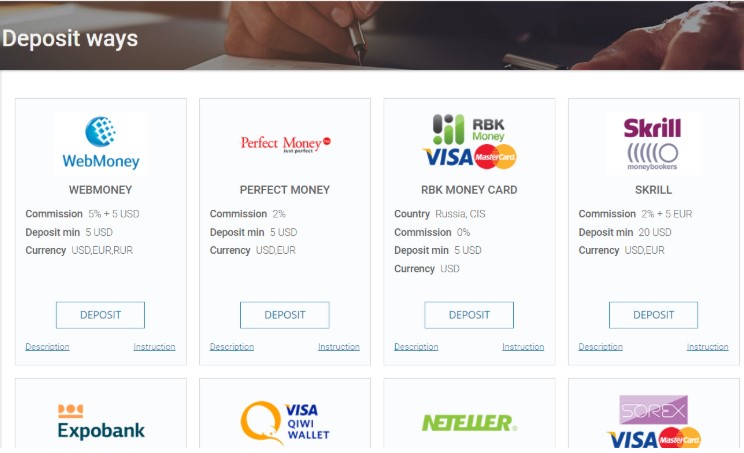

How to Make a Qiwi Deposit from India?

In India deposits are typically made by credit or debit cards. Deposits can be made several different ways. Topping up your account can be done with supported methods including online or wire bank transfers, credit or debit cards, Paypal; Skrill; and other e-wallets. Cash deposits can even be made at one of the terminals found throughout Delhi and India: with more than 1,000 kiosks in the state.

Once you’ve successfully deposited funds into your account they can be used to top up trading accounts. Beyond transfers, filling trading or gambling accounts, and holding money a Qiwi wallet can provide:

- Cash payments at QIWI terminals

- Mobile payments (Some Indian mobile network operators)

- Bank cards – (all countries, where QIWI wallet registration is available)

- Link to a WebMoney (for users who desire to link their WebMoney account to their QIWI wallet)

The GlobalCollect platform supports the following services for QIWI Wallet users:

- Payment transaction

- Refunds, partial refunds, and two step refunds

- Multicurrency (EUR, KZT, RUB and USD)

How to Withdraw Money from Qiwi to an Indian Bank Account

Customers cannot traditionally withdraw funds from their accounts with Qiwi by bank transfer, e-transfer, or a card transfer. Money is typically not withdrawn but used within the platform to pay for goods and services.

Currently, Qiwi India has more than 1,000 sales outlets, including about 200 kiosks in Delhi and in two nearby states. Indian customers use this payment system mostly to pay for utilities, in particular their electricity and water supplies. As a result, one of the largest utility providers whose services can be paid for through the Qiwi system is Delhi Jal Board. Capital residents are also able to pay their phone bill: with one of 12 supported providers, and to pay their digital television providers, as well as to manage their consumer credit.

In India people most often use their prepaid Visa card to withdraw cash. Though an effective way to receive money, it is less efficient if you still have to deposit the cash into your bank account.

Qiwi Physical Prepaid / Virtual Cards

Qiwi offers 2 Cards. Accounts can be linked to a physical or virtual prepaid card. Either card can be used to make purchases from businesses that accept Visa anywhere in the world. The caveat being, the virtual card can only be used for online purchases.Users are able to load their QIWI Wallet prepaid account through different methods like the wallet itself.

Possibly the best feature of these cards is the ability to use them in ATMs to take out cash or brick and mortar stores. Though it does not offer as many perks as some of its competitors cards with cash back and other rewards.

Trading with Qiwi

When using Qiwi as your e-wallet with a trading platform you can choose to deposit money either through a card attached to the account or a direct transfer. Log in to your trading platform and select Qiwi as your deposit method. When using the virtual Visa Prepaid card option, you will need to enter your phone number, which corresponds as the Qiwi account number, as well as the password which was sent to you via SMS. However, if you have a physical prepaid card the process is the same as using any other card. The final option is to use the internet banking method (or e-transfer), which will instantly deposit funds directly from the e-wallet in to your trading account balance.

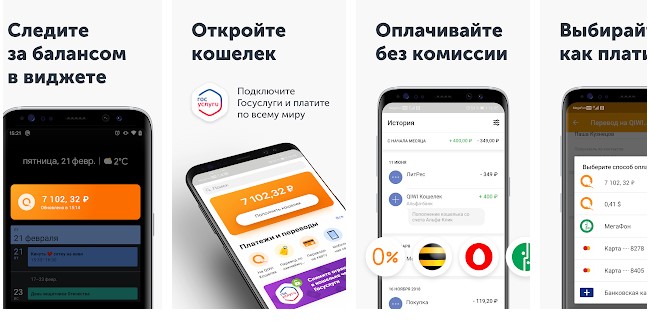

Qiwi Mobile App

The mobile app allows customers to manage their funds, cards, as well as spend, send, and receive money while on the move. Available in both Apple and Google Stores, it is a good way to maintain access to your money anywhere.

Conclusion: 60/100 – Not Recommended

Qiwi stands out above its competition thanks to its kiosks in various countries that clients could use; perfect for Russian users as there are more kiosks there than anywhere else. Their merchant network, three different cards, and the mobile app combine to create what could be a top notch transfer platform. Unfortunately the account set up will be complicated for a non-Russian speaker.

There are few other multinational payment services as active in the Indian market, however Qiwi’s lack of web presence and resources in languages outside of Russian make it a tough choice as the wallet for non-Russian traders. There are many other services that it would be easier for users in South East Asia to register with, making them more appealing. As an e-wallet to handle different bills for utilities and services it is great, if there are kiosks in your area and more importantly if Qiwi has a partnership with them.

Convenience is the name of the game and ultimately Qiwi is just that if you live in the right areas. It is more useful to use Qiwi if you live in Dehli than Mumbai, and even more so if you live in Moscow. Though, Qiwi is working to expand the online face of the company has changed to reflect that. Now to be fair this review was not written from India therefore links to the actual Indian pages provided by the franchisees in may not have been presented. On the other hand the English affiliate sites and pages on Qiwi’s site itself left much to be desired. Communication is key especially when dealing with online entities.

With all the information before you it is up to you to decide if Qiwi is right for you. Though compared to much of its competition, this service falls behind in many ways. Unless there is a specific broker or casino that uses Qiwi and it is the only option for you, it is advisable to look elsewhere for your e-wallet and transfer needs.

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch