Perfect Money Review 2022 – Is it safe to use in India?

Not Recommended

Our rating: 62/100

Perfect Money is a e-transfer system based around its own e-currency. Users are able to hold multiple currencies and assets in their accounts. This company has been pushing to gain more of a share of the market among its competition, though it has definitely been an uphill battle.

Well established in Russia, this company is still pushing to be a major player on the international stage. Offering less accepted currencies and a short list of companies that use the payment system Perfect Money has a long way to go before it takes the top spot.

Perfect Money Review

Firm | Startup Research & Investments LTD |

Official Website | |

Since | 2007 |

Regulation | Financial Conduct Authority (UK) |

Platform Type | E-Money |

Mobile Platform | No |

Compatibility | Mac OS, Windows |

Free Account | Yes |

Perfect Money Fees

Deposit Fee | From 0% |

Withdrawal/ Receiving Fee | 0.5-2.85% |

Total Fees | 13-16.5% |

Transfer Limit | 600,000 ruble |

Pros & Cons

Pros

Contras

What is Perfect Money and how does it work

Perfect Money, founded in 2007, is a “universal system” that was founded in Panama to be a flawless platform for online payments. System users can transfer money between each other, accept payments, store funds, and more. Storing your money in an account can accrue interest while providing a wallet from which topay for goods and services at a number of online stores make regular payments online, or. Users are also able to purchase and hold Bitcoin, gold, USD and EUR within their wallets.

Each user’s account is multicurrency capable and is subdivided into four different currency accounts holding each assets value in Perfect Money Units:

- USD

- EUR

- GOLD

- Bitcoin

Perfect Money Units are used inside of the system as a store of value. This is part of the reason Perfect Money does not directly handle deposits or withdrawals as the entire system is based on their own cryptocurrency. When sending or receiving money from or to a Perfect Money account the money is handled by Certified Exchange Service providers that convert fiat currencies into Perfect Money Units.

What is an Exchange Service Provider?

Exchange Service providers help Perfect Money users to top up their accounts through a number of different payment methods i.e. credit/debit cards, money transfers, bank wires, cash and other payment solutions. These funds are credited to client accounts as Perfect Money Units, though they will be stored in subdivisions of the accounts that correspond with the deposited asset.

Clients can choose which service provider to withdraw funds through, as each offers different e-wallets, payment systems, credit/debit cards, bank accounts, bank wires, or cash.

To learn more about the payment tools offered by individual exchange services,please head to the “Certified Exchange Service Partners” page under their individual profiles. The exchange service providersdetermine their own fees, to learn more visit their websites.

Is Perfect Money Safe & Reliable

Perfect Money is a safe system,account security is a top priority. If a new IP address or browser attempts to log in to an account access is initially denied and a message is sent to the user’s given email address with a PIN code to verify that it is the account owner logging in. The user must then enter the code to gain access. This is an automatic procedure enabled on every account.

Communication in English

Perfect Money’s English site has many mistakes, more than ought to be accepted from a company seeking to hold your financial assets online. Much of the site is understandable, but there are sections of entirely incomprehensible language.

For example this bit of text can be found on the company’s ‘About page’, “The pink of absolute perfection that crowns world e-commerce henceforth will be presented by an ideal financial institution – Perfect Money which aims to bring the transactions in Internet to the supreme level.”

Though this is not a particularly important sentence, it is an example of the more extreme mistakes on the site. Seeing that the company does not have a close eye for detail on the page that describes who the company is, begs the question could they be cutting corners in other places.

When dealing with an e-wallet or any payment system understanding the information provided to you is essential. Not making the effort to ensure all of the text on their site is clear could be a sign of a lack of focus.

Online trading brokers accepting Perfect Money

Perfect Money is not the most popular payment method in the online trading world, yet there are a handful of brokers accepting withdrawals and deposits using it:

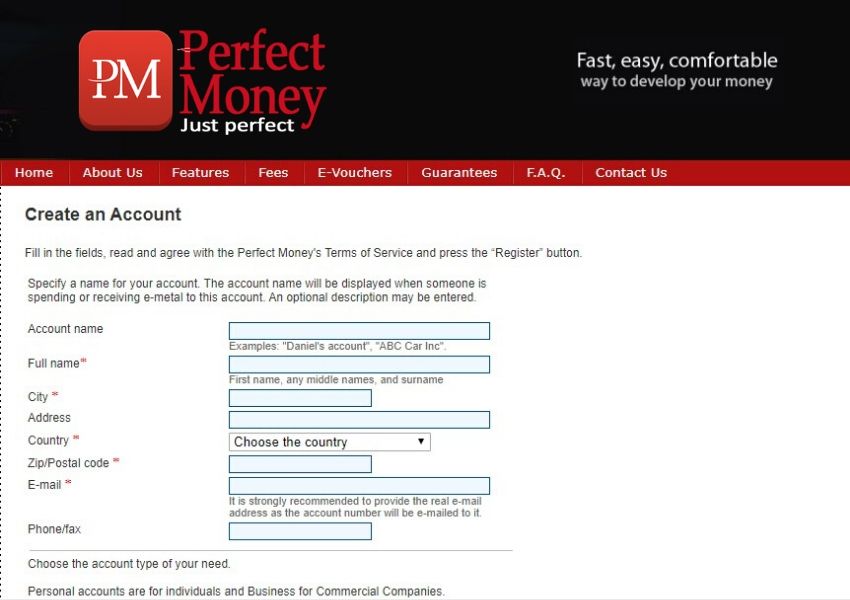

Perfect Money: Sign Up/ Open an Account from India

To register an account on the Perfect Money system, click the “Sign up” link at the top of the home page, and then enter the requested information: name, email address, phone number, etc.Choose whether the account will be Personal or Business: as an individual trader who is not operating this account as a part of a larger company select Personal.

Next begin the account verification process to gain access to a wide range of features and increase the trust among other platform users and businesses.

Perfect Money Account Verification from India

To verify an account from India, go to “Settings” and select “Verification management” to begin the process. There are three steps to the verification process. All documents must be presented in English and translations are required to be notarized.

- Verify your name -to confirm your name, upload a scanned copy of a government issued photo ID (passport or driving license). Company employees will individually compare the name on your account with the one on the documents. If the information does not match your account will not be verified, however if it does, your name will be verified.

- Verify your address – to verify your address, provide a scanned copy of a utility bill (gas, electric, or water) from a local service company that shows your name and addresson it clearly.

- Verify your phone number –receive an automated phone call from Perfect Money and write down the provided code. Enter the provided code into the correspondingfield on the website. If input correctly the code is, your phone number will beverified.

Verified accounts are subject to lower fees.

How to Deposit Money to Perfect Money from India

Depositing into a Perfect Money account is not as easy as some other payment systems. Accepted deposit methods include bank wires, instant bank transfers (Germany, Austria, Switzerland and Belgium only), Certified Exchange Partners, cash terminals (Russia and Ukraine only), Bitcoin, and

e-currency.

Since Perfect Money does not handle all deposits and withdrawals of fiat currencies, and encourages its users to interact with Exchange Service providers; the exception to the rule being bank wires, which can be sent directly to an account once it has been completely verified. These accounts only hold Perfect Money Units (a form of cryptocurrency), which is why an exchange is required to load the accounts.

Though they add an extra step and often time to the deposit process, the fact that there are so many different Exchange Services means there are also a plethora of accepted payment methods to use. Each Exchange Service is different and offers its own list of payment methods, accepted currencies, and fees.

Visit Perfect Money’s Frequently Asked Questions section for more information.

How to Withdraw Money from Perfect Money to an Indian Bank Account

Converting Perfect Money electronic currency to fiat currency or other payment tools is simple. Money can be withdrawn through bank wires, a Perfect Money Prepaid Card, e-Voucher, e-currency, Bitcoin, or Certified Exchange Service providers.

What are the differences between a Premium and a Partner account?

The differences are simple; a Premium account has exclusive features like more specialized customer service and reduced fees. To be granted Premium status members must meet certain criteria. A client should be registered with the system for a year and deposit no less than $100,000 USD(or thecurrency equivalent) into their account.Exceptions are made and can be applied for provided the client’s turnover has surpassed the $100,000 mark.

On the other hand, a Partner account is a privileged account as well,however, it is generally opened by an agent of an exchange or payment system. This status is only awardedby the Perfect Money Administration. This status helps optimize B2B payment processing for online businesses.

Basically Partner and Premium are like VIP statuses for business and individuals respectively.

Perfect Money Prepaid card/ e-Vouchers

Though Perfect Money claims to offer a prepaid Visa card there is little information about how to go about purchasing one and the fees around using it. More often mentioned are e-Vouchers which act as cashier’s checks for users.

E-Vouchers are special codes that can be used to deposit or withdraw to and from Perfect Money accounts. They can also be sold or given to other users, and can be created instantly in the withdrawal section of your account. Convenient as they may be unless you know another user who is willing to give you cash or make an immediate bank transfer these vouchers are not a great way to withdraw money. When creating e-Vouchers unverified customers are charged 1.9% of the amount, while Premium members pay only 0.5%.

E-Vouchers can be quite a convenient way for users to send money, they can even be sent to people who are not yet a Perfect Money member, unfortunately, not many companies accept them. The point of a system like this one is that it is supposed to make sending and spending money convenient for its users. Sending money is not overly convenient when the companies you work with or buy from do not accept the payment method.

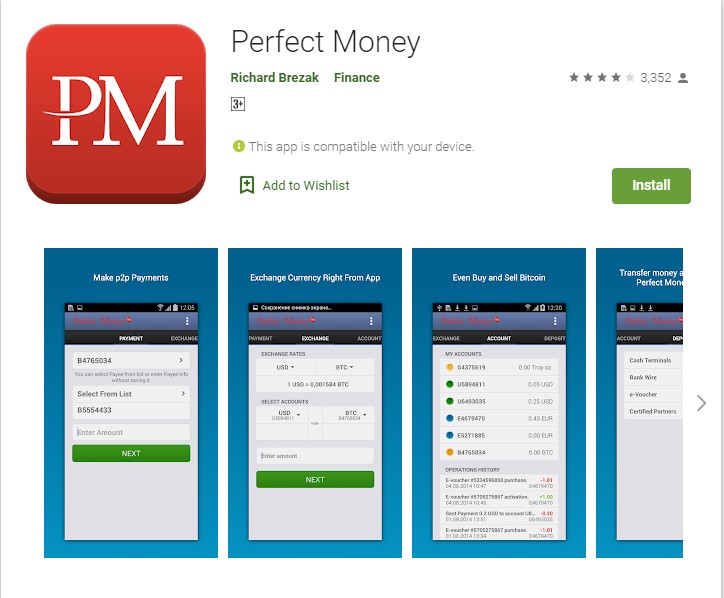

Perfect Money Mobile App

Perfect Money offers a lackluster app. It is capable of the majority of the system’s features including: currency exchange,deposit and withdraw money from the system,make p2p or p2b payments, receive payments, a transaction history overview, and activate/buy Perfect Money e-Vouchers to name a few. The app meets the minimum criteria of an app for an e-transfer platform.

Conclusion: 62/100 – Not Recommended

As an e-wallet and transfer system Perfect Money does what it set out to do in creating a system that works. It is not the best e-transfer platform on the market, but definitely not the worst. Communication in English is not this company’s forte as there are numerous mistakes throughout the company’s site, not an unsurprising problem for a platform geared towards the Russian market.

Consumers continue to trust Perfect Money as their electronic payment system, for its account security and low fees. However, with its small network of accepting business, $100 minimum balance, and irreversible transactions it does not seem to be the most appealing option.

This company works very hard to present as a well-run organization. There are people around the world who trust Perfect Money, the majority of them are in Russia where the company has the most resources. However, there are a number of companies that provide more straight forward deposit and withdrawal methods, have more business they are connected with that accept their payment system, and communicate better. Perfect Money is an example of a middle of the pack service provider; the company does what it set out to do without making headway or striving to lead the pack.

If Perfect Money is high on your list of e-wallets and e-transfer services, some of its competition deserves another look: Neteller, Skrill, and WebMoney all provide superior service, have many more perks including prepaid debit cards, and have free instant deposits on more trading platforms.

Take time to look over all of the options you have for online transactions. Like Perfect Money Units each e-wallet has its own special characteristics, these should be considered heavily when making your decision.

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch