Skrill India Review 2022 – Is It Safe and Reliable?

Recommended

Total Skor: 97/100

Skrill Pros

As one of the most recommended e-money transfer platforms in the industry today. Skrill has continued to impress its clients with simple, secure, and quick digital payments. Being the U.K.’s oldest digital payment services provider has pushed Skrill to continue to be a digital transaction pioneer.

Trusted by businesses and individuals around the world, this company orchestrates billions of dollars’ worth of transfers each year.

Skrill India Review

Firm | Paysafe Group Ltd. |

Official Website | |

Since | 2001 |

Regulation | Financial Conduct Authority (UK) |

Platform Type | E-Money/ Transfer |

Mobile Platform | Yes |

Compatibility | Mac OS, Windows, IOS, Android |

Free Account | Yes |

Skrill Fees

Personal Transaction Fee | 1.45% |

Currency Exchange Fee | 3.99% |

Withdrawal/ Receiving Fee | 7.5-11% |

Total Fees | 13-16.5% |

Transfer Limit | $10,000 |

Pros & Cons

To sum things up, the services of the Neteller e-wallet can be broken down to the following advantages & disadvantages:

Pros

Contras

What is Skrill?

Skrill has been working diligently to provide the best digital payments service since 2001; as an acknowledged world-leader in developing global payment solutions for people’s business and pleasure, whether they’re depositing funds on a gaming site, buying online or sending money to family and friends. Services also meet the needs of businesses worldwide, helping them build a global customer base, and drive growth.

Based in London with offices throughout Europe and the US, Skrill’s staff of over 500 people represents more than 30 nationalities, Skrill is undoubtedly a global company.

Deposit Fees

Regardless of which payment method a client uses to deposit funds into his or her Skrill account, they will be charged a fee. To keep things simple, all payment methods have the same 1% fee. Therefore, depositing $500 into an account, you would be charged a $5 fee.

The fee amount is automatically deducted from the total amount that is deposited. Continuing with the example given above, a $500 deposit would actually be $495 once it has been processed.

Withdrawal Fees

One of the most beloved parts of Skrill’s services is that clients are able to withdraw funds back to their chosen payment method.

When withdrawing funds back to a bank account, a client will pay €5.50 or the corresponding amount in their local currency. Whereas to withdraw funds from an account back to a Visa debit/credit card, then Skrill will charge 7.5%.

Transfer Fees

To transfer money, Skrill will charge 1.45% of the total transfer amount. Therefore, a customer’s transfer of $400, would accrue $5.80 in fees. Compared to rival payment method PayPal, Skrill charges half as much for the same service.

When transferring funds to a person who utilizes a different currency, it is important to keep in mind that the sender will have to pay a currency exchange fee.

Is Skrill Safe and Reliable?

Skrill is safe and reliable, as a subsidiary of Paysafe Group Limited, Skrill is authorized by the Financial Conduct Authority under the Electronic Money Regulations 2011 for the issuing of electronic money. Authorized by the Financial Conduct Authority in the UK, Skrill upholds the highest standards throughout its business and services around the world.

Traders around the world trust Skrill to be their e-wallet for their trading and gambling accounts.

Legally, Skrill provides its clients with the privacy needed to be able to trade or gamble online without the fear of raising suspicion. Combined with the two-factor authentication implemented by Moneybookers India doubly secures each account making it impossible for a customer’s account to be opened by anyone other than the owner.

What Makes It Special?

Skrill accounts can support 40 different currencies. Though one is selected when opening an account, users are able to add other currencies to their accounts as they are needed. Unlike many other e-money platforms, Skrill allows VIP clients to have more than one fiat currency in his or her wallet. This allows users to be paid in and spend different currencies all from the same place.

Skrill is an easy-to-use payment platform and offers its clients a range of financial services. The three features that help this company stand out are that Skrill doesn’t charge its clients to receive money, accounts can hold and transact with small amounts of money without requiring a full ID verification process, and its inexpensive option for a prepaid Mastercard.

Customers can purchase a Skrill prepaid Mastercard that is linked to their account in one of these four currencies EUR, GBP, PLN, and USD to be used at ATMs and shops anywhere.

VIP status is offered to high-volume customers. This premium membership is known as, “Skrill VIP”. There are four levels of VIP status with many benefits including loyalty rewards points, multi-currency wallets, a security token, much more. The Knect rewards program is available to all users, giving this company a leg up on much of its competition.

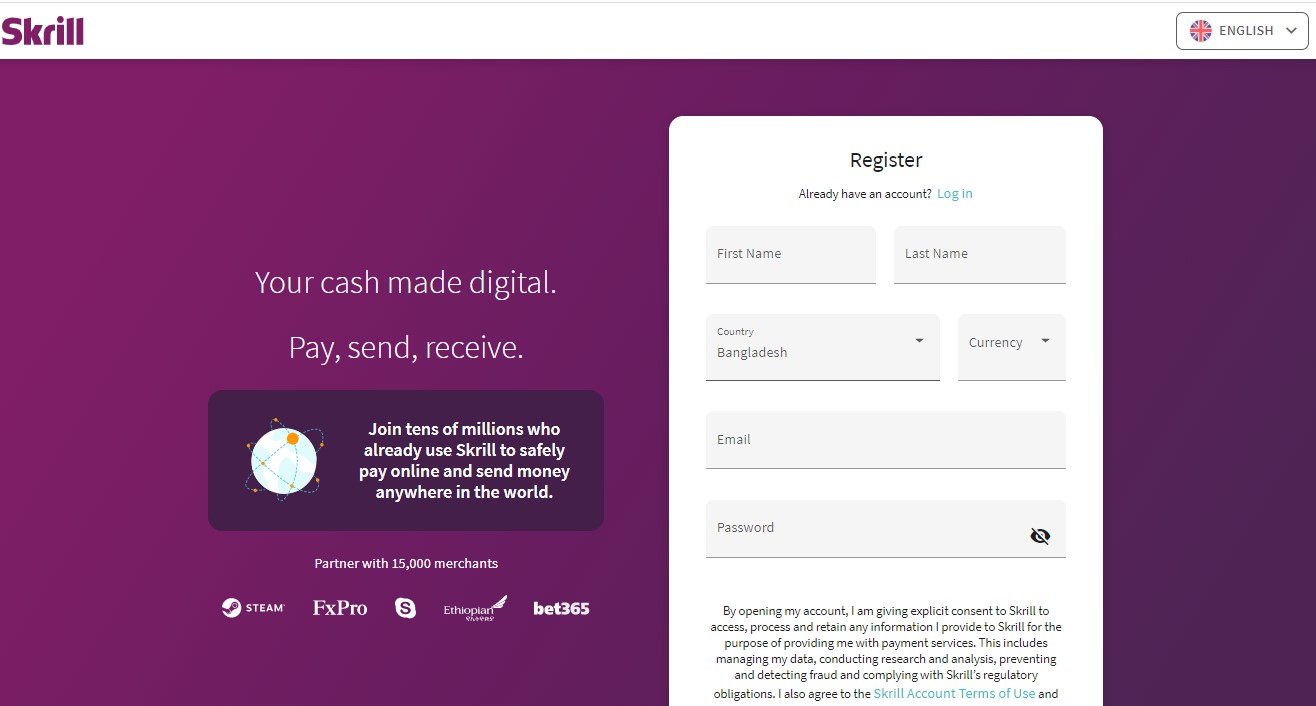

Skrill: Sign Up/ Open an Account from India

Becoming a Skrill client is simple from India; start at the Skrill homepage, then click the ‘Register’ button in the top right corner of the screen.

Next, you will fill in your full name, email address, street address, and a password for the account. Be sure to use a complex password, because the account will be at risk if the password is too simplistic and becomes compromised.

Once all personal data has been entered, click ‘Register Now’.

After clicking through to the next page, Skrill will ask you to choose your country of residence, along with the preferred currency for the account. It is best to select the currency of your home nation to avoid unnecessary extra currency conversion charges.

On the next page, you will select one of the payment methods that will be used with the account. Each payment method requires different personal information, this information will be requested once you have selected the payment method.

Skrill Offers Many Payment Platforms

Take time to analyze all of the payment options that are available with Skrill before making your decision. Not all of this company’s platforms are accessible through a personal account, therefore users cannot take advantage of the lowest rates for a given transaction solely from their Skrill Payments account, but Skrill’s various platforms allow clients to choose the best possible option, though occasionally requiring another account.

- Skrill Prepaid Debit Mastercard for a €10 annual fee, members can buy a Skrill prepaid debit Mastercard that is directly connected to their personal Skrill account. This card provides free in-store purchases, and permits Skrill users to withdraw money from ATMs, for a 1.75% fee. The fee does not change depending on where in the world the ATM is located.

- Skrill Payments An account that allows users to send payments to people and companies that are also a part of the Skrill ecosystem. The fee is 1.45% to make payments along with exchange charges if the person or company receiving the money has a different account currency than the sender. These payments are often instantaneous.

- International Money Transfer (Not Skrill Money Transfer) When a Skrill client sends money internationally, in addition to the automatic 1.45% sending fee, an additional 3.99% is added to the mid-market foreign exchange rate between the currencies.

- Skrill Money Transfer A different section of the Skrill platform. To send money to and from bank accounts, credit or debit cards to bank accounts in other countries through Skrill Money Transfer people do not need to be registered with Skrill. With essentially no fees to send money through Skrill Money Transfer, and same-day deposits it is Skrill’s best option for sending money abroad.

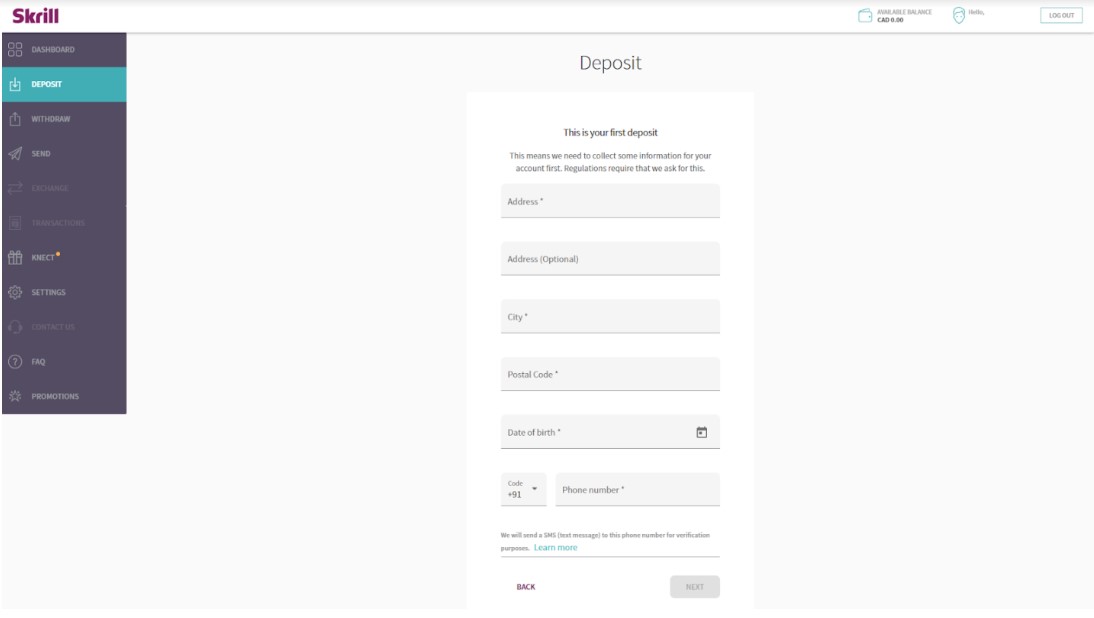

Skrill Account Verification from India

To verify your identity and increase your account limits, open the settings page, which can be accessed by clicking and looking through the left-hand-side bar. Then click on ‘Verification’

Complete the Anti-Money Laundering requirements with your name, address, and phone number after selecting your method of deposit. Once your information has been entered into the system, part one of the verification process is complete.

To confirm your identity, you will be required to upload a copy of your government-issued ID; a passport, driving license, or a national ID card.

Through your computer, you can upload the document straight from your device along with a selfie of you holding a handwritten note with the current date. However, when using the mobile app to verify your identity, your smartphone camera be used to take the photo of your ID and selfie.

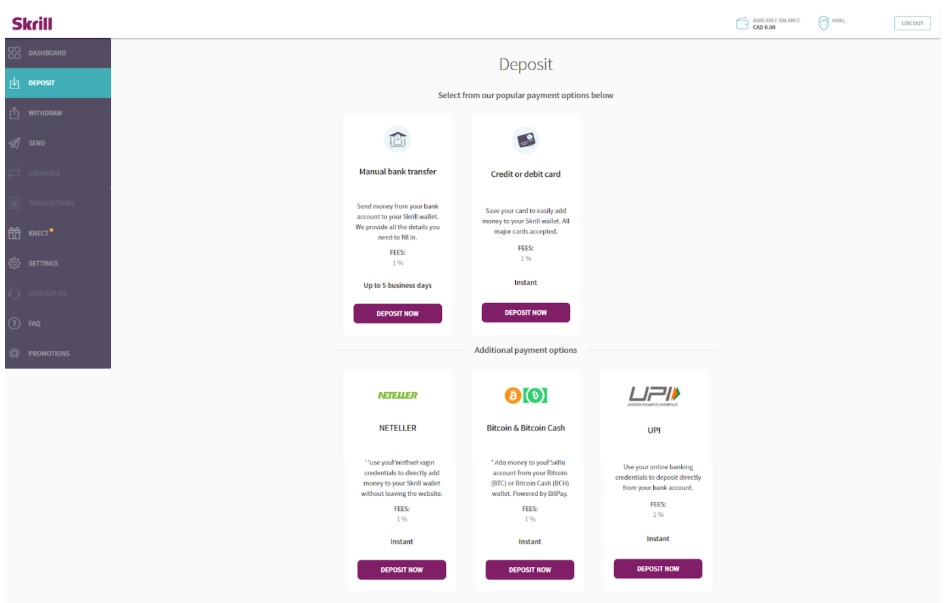

How to Make a Skrill Deposit from India?

Indian users most often make deposits via credit or debit cards, as laws limit international bank transfers, though some of the bigger banks do allow Skrill transfers. Deposits to a Skrill account are charged a 1% fee in addition to the fees charged by the sending institution.

Skrill accepts bank transfers, Bitcoin & Bitcoin Cash, debit/credit cards, Klarna, Neteller, Paysafecard, and Trustly as deposit methods.

Are there Indian banks that support Skrill?

Unlike many other international transfer platforms, most of the larger banks allow their customers to transfer funds to Skrill. Users that hold accounts at ICICI Bank, Punjab National Bank, State Bank of India, or SBI can transfer funds back and forth without fees (excluding possible exchange fees).

How to Withdraw Money from Skrill to an Indian Bank Account?

Money is typically withdrawn to the same account or card used to deposit money. In India people most often use a credit or debit card, because when you withdraw from Skrill to an Indian bank account or bank card the transaction could be audited by the government. Therefore, withdrawing money directly to a bank account in India is not the most pragmatic way to move your money.

The safest method is to purchase a Skrill prepaid Mastercard and use it for purchases and ATM withdrawals.

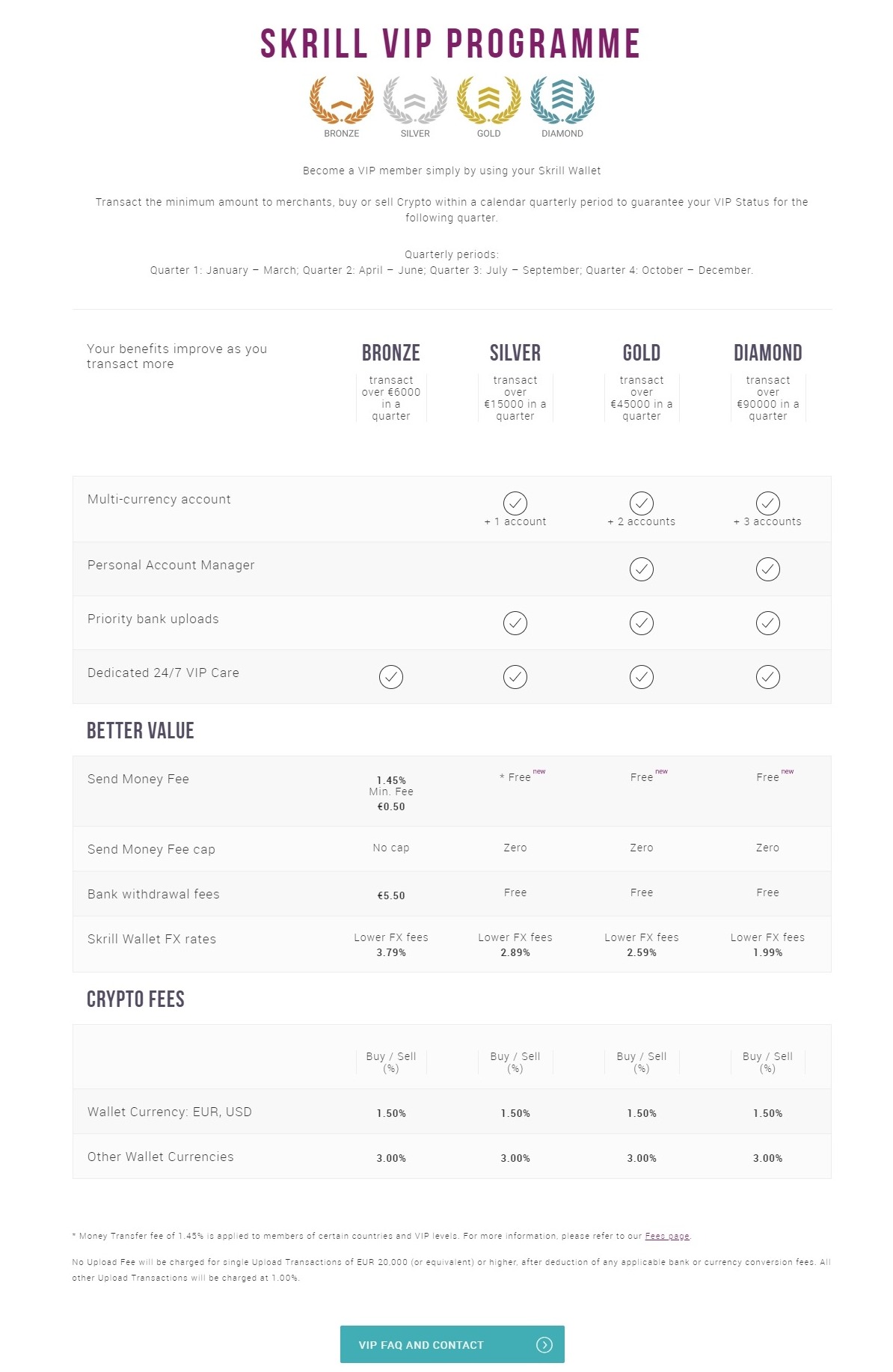

Skrill VIP

This platform provides users with four levels of membership, each with benefits ranging from dedicated support, lower fees, and higher transaction limits.

- Bronze members receive 24/7 VIP dedicated care and a lower foreign exchange fee at 3.79%.

- Silver members, in addition to Bronze level perks can send money and withdraw to bank accounts for free, an additional account in a second currency, priority bank uploads, and lower fx fees at 2.89%.

- Gold members receive all of the perks of Silver, with two additional accounts in different currencies, a personal account manager, and exchange fees at 2.59%.

- Diamond members get all of the benefits of Gold plus currency exchange fees of 1.99%

Skrill and Trading

Traders around the globe trust Skrill to be their e-wallet when investing online. Through connections with platforms like Olymp Trade, clients receive reduced transaction fees for deposits and withdrawals from the platform.

When trading from India transactions are well disguised when funds are leaving India. While the prepaid Mastercard allows investors to access the money without drawing attention to their trading or gambling, making it the best withdrawal option for Indian traders.

The Skrill Loyalty Program Knect

Clients are able to earn points through every transaction with friends, family, with businesses you admire or websites you like to support. Points lead to a variety of rewards like cash vouchers, discounts, free bets or risk free trades and more.

Skrill Mobile App

The mobile app allows customers to spend, send, and receive on the move. Available on the Apple App and Google Play Stores, it is a great way to maintain access to your money and cryptocurrencies anywhere. Highly rated in both stores, Skrill’s app keeps clients happy with the app’s ease of use.

Yes, We Recommend Skrill

Skrill stands out above its competition in part thanks to the company’s determination to be the fastest, simplest, and most secure transfer service in the world. The merchant network, client security, and the sophisticated mobile app combined to create a top notch transfer platform.

Skrill has made sending money between the two between a platform account and traditional banking institutions simple and secure. On the whole, Skrill provides payment solutions that are perfect for people around the world.

Check out Skrill today and unleash your money.

About Cody Walls

Menjadi Trader Profesional selama 8 Tahun terakhir; Berbagi Pengalaman saya dari Dunia Perdagangan dan berbagai Platformnya.

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch