5 Easy and Profitable Forex Strategy for Your TradesCody WallsStarting your journey

5 Easy and Profitable Forex Strategy for Your Trades

A trader’s ability to open up new trading opportunities for himself is considered to be his best trait.

One can’t expect to have the same level of skills for a long time if they want to make it as a forex trader. It is very important to keep looking for new strategies to try and perfect.

Since the foreign exchange is a highly dynamic marketplace it would make sense for the trader to keep changing their game to keep up with it.

It is common knowledge that the foreign exchange marketplace is one of the world’s biggest and the most liquidated market in the whole world where trades worth trillions take place each day.

The main objective of trading forex is to make a profit and traders always take advantage of the volatile big moves that take place to make their profits.

Most traders can make profits in the tight spaces that these volatile conditions bring but even they need a little bit of that extra volume for their strategies to work successfully.

This is where volume comes in forex trading as a trading tactic.

Volume is said to be the indicator of a market’s strength especially when market trends rise on increasing volume.

That being said, we shall take a look at the volume indicator forex tactic that is being used by many big traders to reel in big profits and try to learn more about its role in fx trading.

Source: https://www.learntotrade.com.au/blog/trading-tips/how-to-manage-forex-trading-risks/

Forex is traded over the counter which is the reason why you can’t ascertain the total volume of the market.

This inability gives rise to the need for Volume Forex Indicators so that every retail forex trader can have an estimate of their average trading volume.

One can almost say that volume is the liquid fuel that runs the entire market because a currency pair’s price has a good chance of trending if there is sufficient volume in it.

Some commonly used volume indicators preferred by traders are Chaikin Money Flow, Klinger, and On Balance Volume.

Source: https://alltopstartups.com/2018/12/19/is-forex-trading-easy-or-difficult/

There are a few rules and general guidelines that one is supposed to be aware of while analyzing volume. Some of which are:

Confirm Trends: increasing prices and decreasing volume is a clear indication of a bad trend and the opposite of that can be seen as an opportunity.

You must take a closer look at your volume indicator as it may give you a clue as to where the trend is going to go next.

Keep in mind during your analysis that price drops or price rises on little volume are not as significant as the price drops or rises in large volumes as the latter can be an indication of something big and juicy.

Identify Bulls: Bulls are the type of investors who are too optimistic about the market trends. Bulls often purchase commodities in the hopes of selling them off later for a good profit.

You can use volume indicators to look out for bullish signs to safeguard yourself beforehand.

You just have to keep an eye out on the prices that dip and climbs back up which is followed another swift dip.

If the volume is lower on the second downward spiral and the price on it is not lower than before, then you may interpret the mentioned phenomena as a bullish signal.

Exhaustion Moves: These are generally said to be the sudden movements in prices combined with a spike in their volumes.

You can interpret this sign as the beginning of the end of that particular trend.

This happens because of impatient traders who are afraid that their positions are gonna spiral and want to squeeze every last ounce of profit from their trend before it dies.

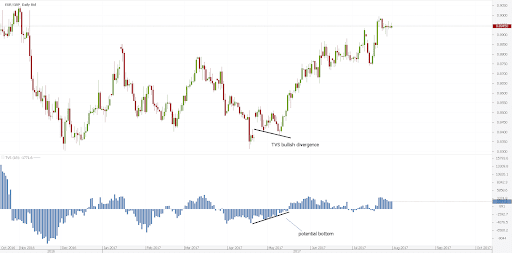

Source: https://tradingstrategyguides.com/volume-trading-strategy/

If you are interested in trading volume then you have to pay extra attention to the most important thing in the market which is called the forces of supply and demand.

Pay extra attention to current market trends and try to predict the directions of these trends as well to give you an edge.

Increased buying and selling are where all the action is as an increase in trade volume is generally goes in the direction of buy orders which encourages traders to open new positions.

The next thing that requires your attention is the relative volume. Always try to estimate what the performance of the asset is as compared to its expected performance.

Source: https://www.forexboat.com/forex-volume-indicator-mt4-trading-strategies/

At the end of the day, a volume indicator boils down to a combination of mathematical formulas and equations that are represented visually in the form of charts.

Different indicators used slightly altered formulas to try to compete with each other. At present, there are three famous volume indicators

Chaikin Money Indicator (CMF)

Developed by Marc Chaikin who is an accomplished trader himself, CMF indicator works by measuring institutional accumulation as well as distribution.

Traders like to use this particular volume indicator due to its oscillations or to seek out divergence.

Klinger Oscillator

This volume indicator was developed by a person called Stephen Klinger who wanted to build an indicator to predict and analyze the long-term trends of the market.

The Klinger Oscillator works by comparing the volume of the securities and compares it with its price movement to give the result as an oscillator.

On Balance Volume (OBV)

This is easy to use and a simple volume indicator that was made by Joseph Granville.

It works by analyzing volume flow to predict the ups and downs in stock price.

The On Balance Volume indicator can also be used to detect a divergence.

Source: https://admiralmarkets.com/education/articles/forex-indicators/forex-volumes-indicator-mt4

Volume indicator forex is a surprising strong strategy that can help you with your trading endeavors effectively and there are numerous other ways to use the indicators to your advantage.

Be sure to learn the volume indicator that you use inside out so that there’s no room for error in your analysis

Related Articles

5 Easy and Profitable Forex Strategy for Your Trades

5 Easy and Profitable Forex Strategy for Your TradesCody WallsStarting your journey

How to Download and Login on Olymp Trade App?

How to Download and Login Olymp Trade App on PC & Mobile?Cody

Olymp Trade Charity Work: Going Beyond Trading

Olymp Trade Charity Work: Going Beyond Trading Cody WallsAlthough Olymp Trade is