Complete Guide to Supply and Demand Forex TradingCody WallsAnyone who has ever

Complete Guide to Supply and Demand Forex Trading

The double top pattern is one of the most crucial trading systems that a trader can learn and implement into daily trading strategies.

As you may already know, technical analysis is crucial for any trader who is serious about his craft and wants to make a big profit and maximize his potential as a trader.

Thorough technical analysis is something that lets a trader do that with extreme precision, and things like double bottom and double top patterns are what you might call an integral part of technical analysis.

This might also come as a surprise to inexperienced traders, but the double top pattern is a technical pattern that often comes upon a forex trader's radar from time to time as they trade.

Usually, such patterns are best suited for analyzing short and long-term views of the market trends and the direction in which they might be headed for.

Typically, the double top pattern's appearance in the trader's analysis charts is taken as the trend reversal indicator. This article will learn how to identify these chart patterns and make successful trades using their help.

https://www.forexschoolonline.com/double-top-and-double-bottom/

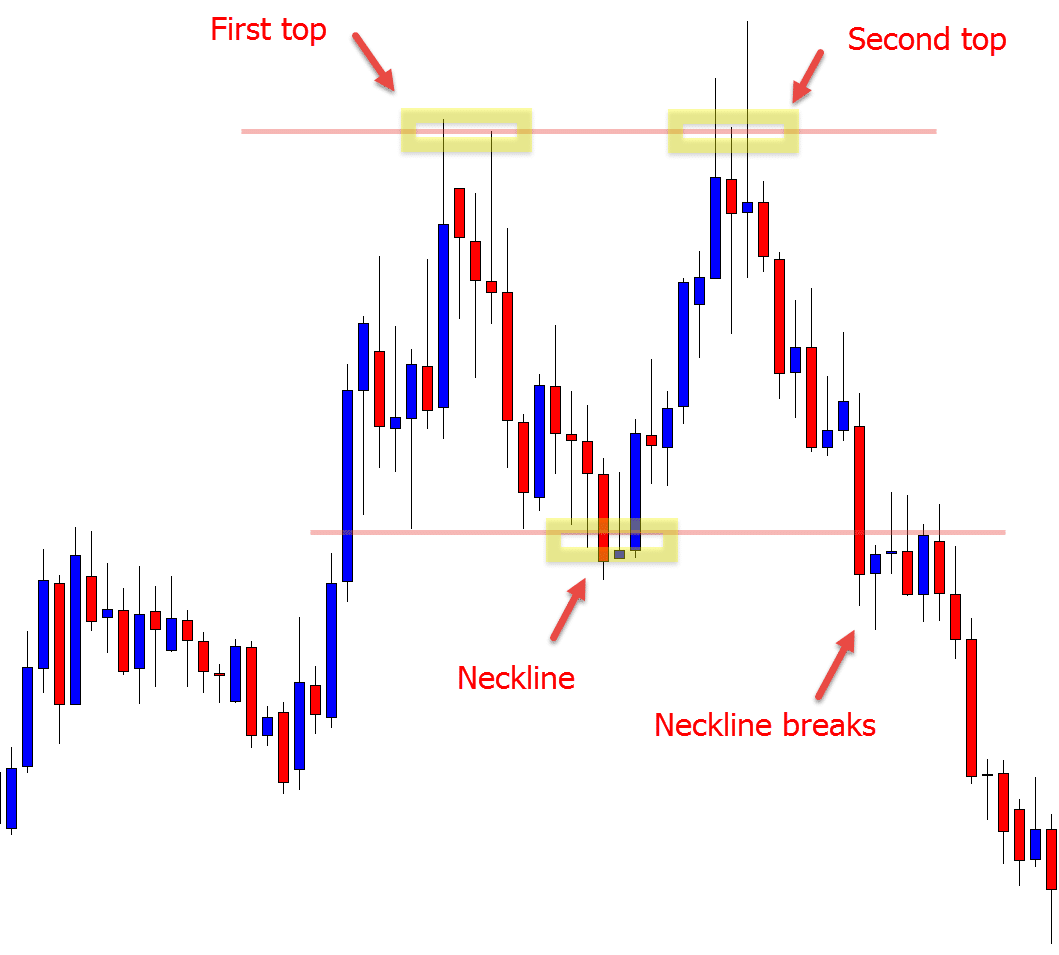

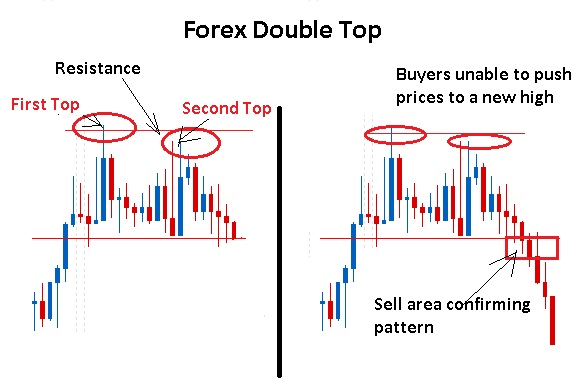

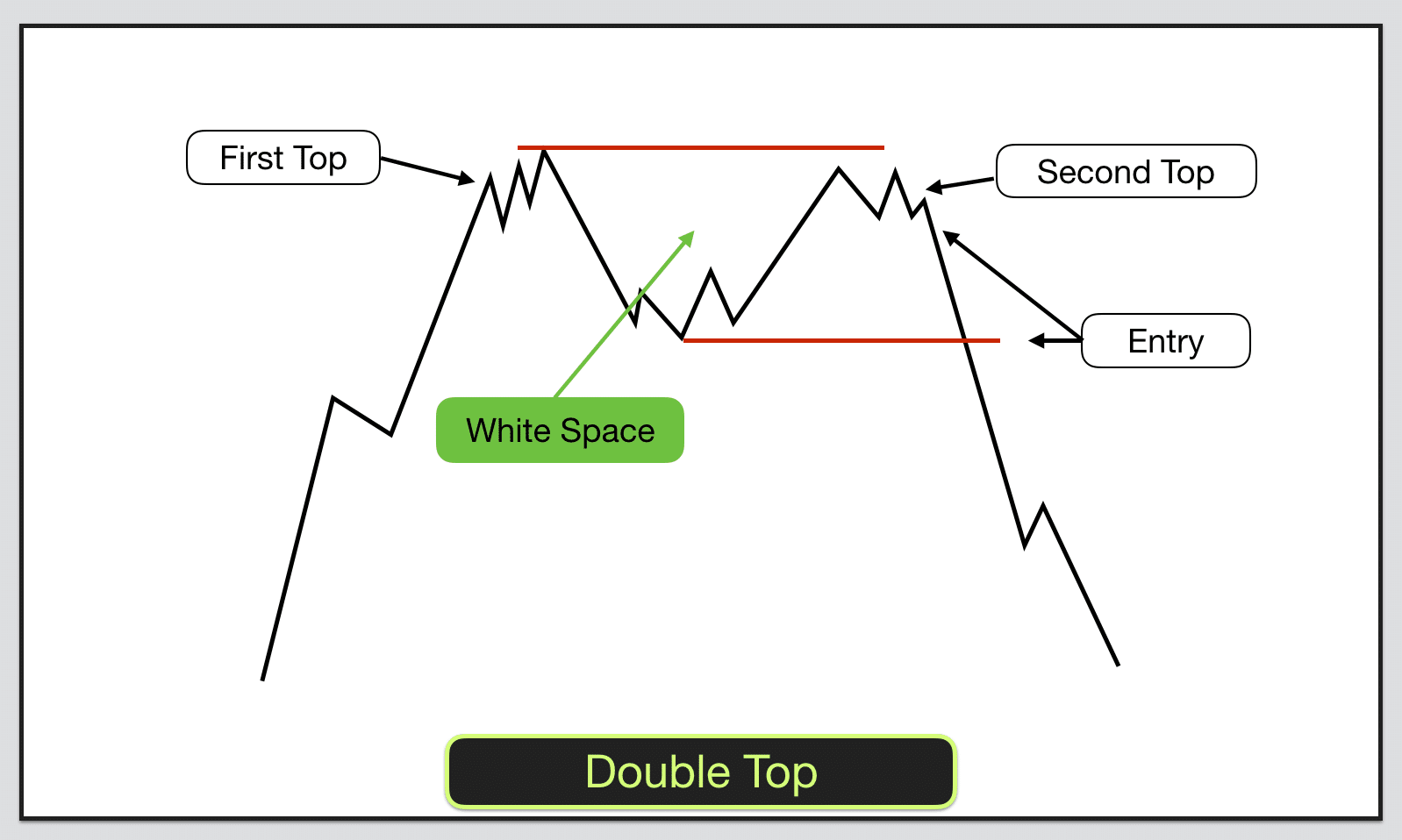

A double top is merely the reversal of a pattern that usually forms after a prolonged move-up. The word top depicts nothing more but peaks that come into existence after the price hits a particular ceiling that it can't break.

Once the price hits this imaginary ceiling, which it can't punch through, it naturally bounces back down but comes back to the top again, creating a cycle of sorts that can be easily plotted on a graph or chart.

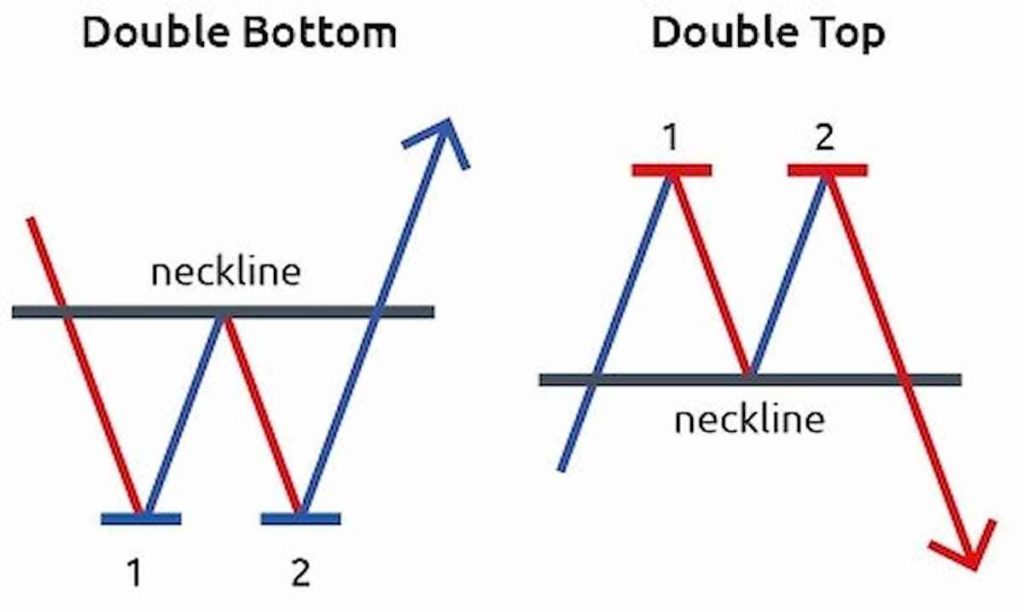

Once the price bounces back a second time, the double top pattern is formed. The downward and upward slope between the first peak and the second peak is called the neckline.

This unique characteristic of this pattern makes it very easy to identify and watch out for a while trading with price charts.

The double top pattern is usually seen as the indicator of the fact that a reversal is just about to occur. One reason for such a thing to happen would be that buying pressure in the market runs out as traders look for more opportunities on the market.

This can prove to be a potent tool for a trader in making trading decisions on the fly and achieving more significant profits.

Source: https://www.youtube.com/watch?v=e6ct8SJCpiM&app=desktop

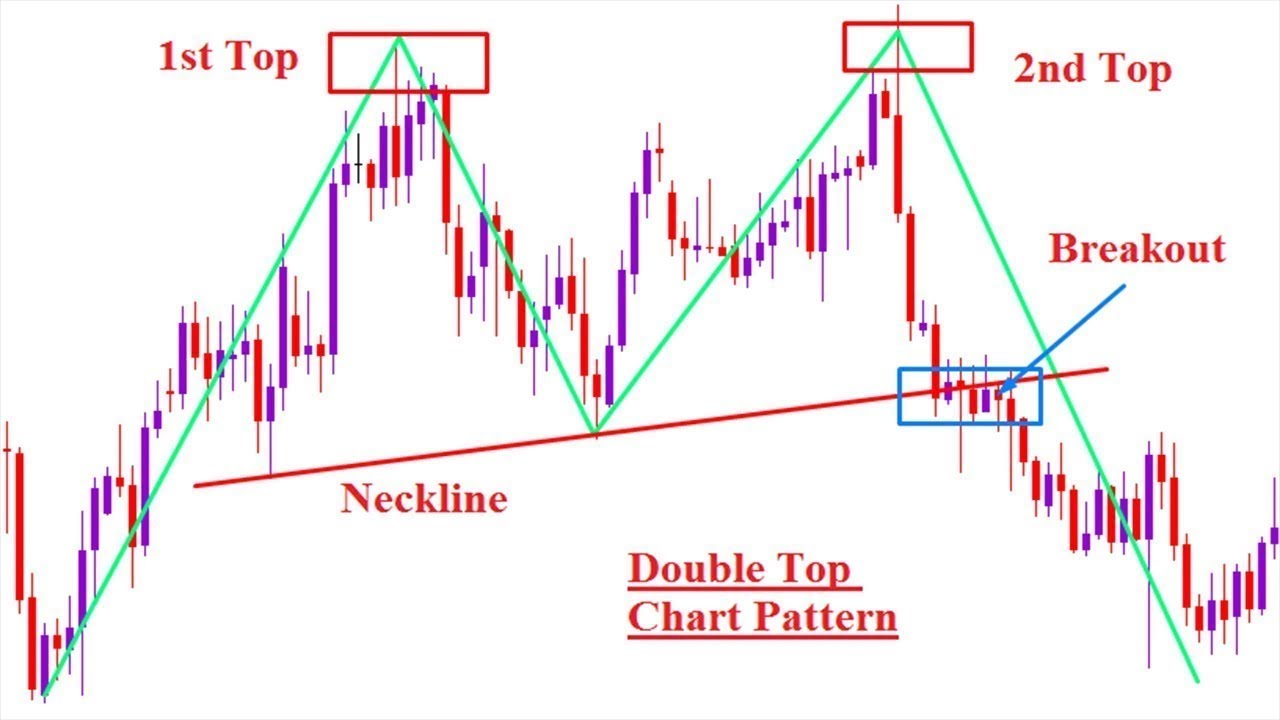

Suppose you are using technical analysis tools and indicators such as a moving average indicator or an oscillator tool such as the RSI Oscillator. In that case, you can look out for the double top bearish signals on your indicator or oscillator charts.

The more straightforward method for identifying such patterns would be to look out for dual peaks with similar height and width where the distance between the two extremes is not too little. The blooms should also be time-frame dependent.

You should also look for the neckline that forms between the two peaks and confirm its support price level.

Traders also use a strategy known only as a measured move to estimate the market's potential movement after a double top has been formed.

A measured move is nothing more than the distance in pips from the established level to any future market point.

Source: https://www.dailyfx.com/education/technical-analysis-chart-patterns/double-bottom-pattern.html

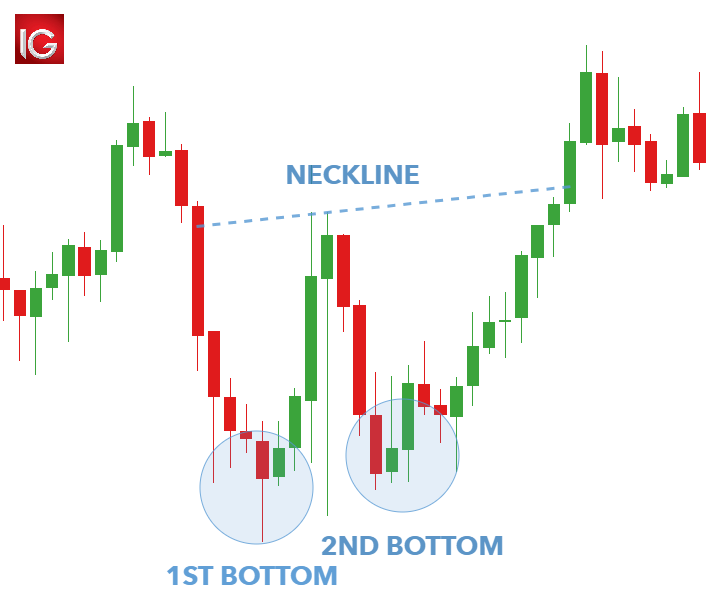

Just as there is a double top, a double bottom pattern indicates the trend reversal indicator. Additionally, the only difference being that traders look to go long when this pattern is detected.

The double bottom pattern shows up during downtrends during the formation of two valleys, which makes this pattern look almost like a crooked W.

Instead of the first peak and second peak, the double bottom pattern has a first bottom and a second bottom where the second bottom does not go past the first, just like the top pattern peaks.

Source : https://fxguys.co.uk/forex-trading-strategies/double-top-and-bottom-trading/

A simple look at the graphical representation tells that double top and bottom patterns are the opposite.

Double tops forms after the two back to back peaks where the second top is usually slightly lower than the first top, which indicates resistance as well as exhaustion

Tops sign a bearish reversal in the market, whereas bottoms signal a bullish reversal in the market.

Source: https://www.dailyfx.com/forex/education/trading_tips/post_of_the_day/2013/09/30/Double_tops_and_bottoms.html

You may be surprised how often this pattern comes in handy for seasoned traders in both the forex and the equity market who use it as their sell signal in their trades.

Traders who employ such patterns go with the strategy of opening a short position on the top of the second peak to a bearish reversal.

The valuable information of trend reversals that both the top and bottom patterns bring with them can be a massive game-changer for anyone who identifies them at the right time and takes advantage of its information.

However, one thing inexperienced traders should take note of is the fact that technical trading patterns may look easier to implement from the outside, but executing them in the real world while you are trading with real money can be rather challenging to manage.

Such patterns form and dissipate almost daily on such a vast market, such as the foreign exchange. The act of identifying them and acting on their information on time is the key to utilizing these patterns to their full potential.

Also, not all top patterns can be approached with the same strategy; sometimes, you may have to wait for a more favorable opportunity. Other times, you may not even have the luxury of considering your options more carefully.

How a trader approaches this situation depends entirely on his or her personality, trading skills, and willingness to take risks as they trade.

Source : https://excellenceassured.com/trading/trade-chart-patterns/double-top-double-bottom

The only time when double top patterns are useful to traders is when they are identified correctly. If the trader is too late to detect them, then they are of no use to him.

However, if the trader identifies a double top pattern on time, it can be extremely invaluable to market decisions.

It is essential to play it safe and not arrive on conclusions prematurely while dealing with forex trading's technical analysis.

Source: https://www.ig.com/en/trading-strategies/social-trading-explained-190314

One of the most commonly appearing patterns in forex charts, the double top design, brings many selling opportunities for traders who can identify and manipulate the pattern information in time.

What you will need to be able to tread and trade the market using these patterns successfully is a health plan or strategy.

Use proper charts and indicators to detect this pattern at the right time and take good advantage of it to further your trading experience.

Related Articles

Complete Guide to Supply and Demand Forex Trading

Complete Guide to Supply and Demand Forex TradingCody WallsAnyone who has ever

Forex vs Stocks: Why Forex Trading is More Profitable?

Forex vs Stocks: Why Forex Trading is More Profitable?Cody WallsTraders in the

Top 10 Best Forex Trading Books For Beginners

Top 10 Best Forex Trading Books For BeginnersCody WallsOver the years technological