The Indecision Candlestick Trading Strategy ExplainedCody WallsTraders unfamiliar with the indecision candlestick

The Indecision Candlestick Trading Strategy Explained

A forex trend indicator is a tool that is used by forex traders to analyze market trends and determine the best trade entries among other things.

Trend indicators are powerful tools that can help the trader make correct predictions about future trends and determine the direction of the prices accurately.

You can find numerous forex trend indicators online such as the RSI Trend Indicator, Bollinger Bands, MACD, etc that are widely used by everyone.

Technical indicators for forex can prove to be an invaluable tool for traders who use them correctly as it makes it easier to predict price movements.

If the trader using one of these indicators applies the right strategy then he might successfully be ten steps ahead of his competition.

However, a forex technical indicator is not an invincible tool as it comes with its set of weaknesses and drawbacks. But there is a way to counter those drawbacks as well.

By combining these indicators, traders can use multiple Forex trend indicators to enhance their trades.

In this article, we shall discuss the multiple strategies through which you can combine a forex trend indicator with other indicators to counter their weaknesses and make them more efficient.

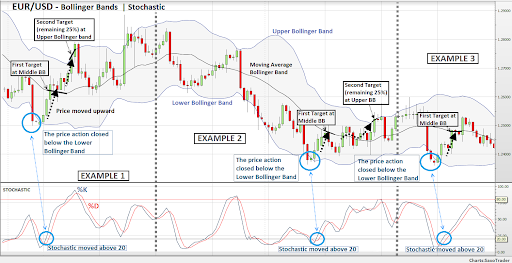

Source: http://www.fxtradermagazine.com/technical-analysis/using-bollinger-band-and-stochastic-along-with-price-action-2.php

The Stochastic Oscillator is a type of forex momentum indicator tool that is used to compare the trading range of any security with its closing price for any given period.

On the other hand, Bollinger Bands is an indicator that creates two distinct price points on the trader’s chart.

Traders who are using the Bollinger Bands indicator to detect and predict volatile conditions end up combining it with the Stochastic Oscillator to detect price trends as well.

The Stochastic Oscillator has three versions that are fully compatible with the Bollinger Bands indicator. Those versions are full, fast, and slow Stochastic Oscillators.

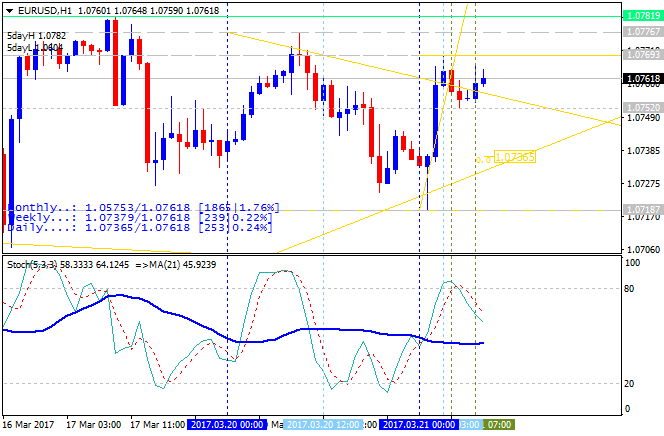

Source: https://www.mql5.com/en/forum/187616

The Stochastic Oscillator is an excellent combination tool for forex trend indicator strategies.

Its combination with the Moving Average indicator is considered to be one of the best trading tactics among short term as well as long term traders worldwide.

The moving average and stochastic oscillator combination can be a handy tool for traders, especially when they are using candlestick formations with it.

Moving average indicators don’t predict where the prices will be going as it only shows data on the past positions of the prices which is why they are also called lagging indicators.

Traders often combine it with the Stochastic Oscillator to counter this drawback.

The stochastic indicator can help traders augment their moving average strategy as the stochastic indicators can help compare any trading ranges that they desire.

Combining the data from both these indicators can be highly invaluable for a trader in their analytical and decision-making stage.

Source: https://www.investopedia.com/articles/trading/08/macd-stochastic-double-cross.asp

As you can see, the stochastic oscillator is one indicator that can be combined with numerous other indicators for the best results as its data can be complementary for the base indicator.

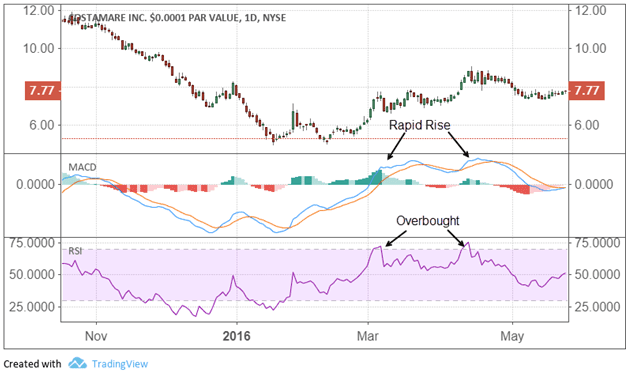

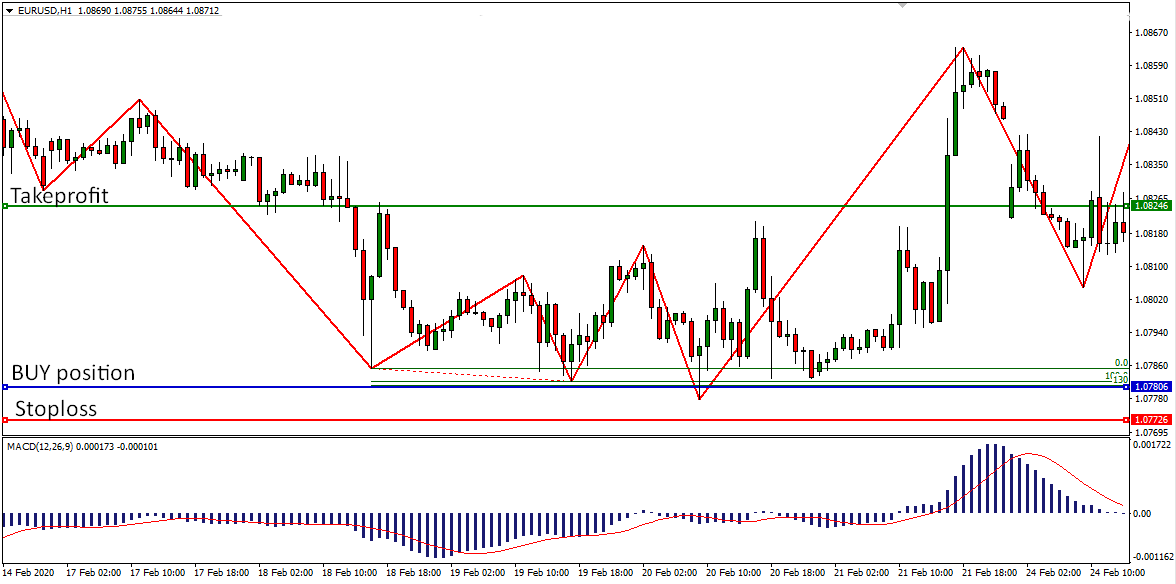

MACD stands for Moving Average Convergence Divergence which is an excellent forex trend indicator.

MACD is considered to be more stable and reliable than the stochastic oscillator when it is being used as a standalone without the help of any other indicator.

It works by forming two moving averages that can be seen diverging from and converging on each other which gives the user a good graphical representation of the data that is being presented to him.

This convergence and divergence in the form of a histogram that helps the trader sift through the data easily and predict the strength of the trend and the direction in which currency pair prices might be heading towards.

Source: https://www.investopedia.com/terms/m/macd.asp

The purpose of the Relative Strength Index is to indicate whether the market is being undersold or oversold by analyzing market trends.

The RSI indicator makes this possible by calculating the average losses as well as the average gains for any given period. The default period for such an analysis is usually set to 14 days.

Combining the MACD and the RSI indicator is a strategy that is often used by short-term traders because both of these indicators provide straight-forward and accurate readings.

The most common way of using these two together is to use two charts that display a daily time frame and the hourly time frame with the MACD applied only to the daily time frame chart.

On the other chart that displays daily time frames, use the RSI indicator to see if the trend is in an upward direction. If the RSI is observed to be breaking the thirty limit from the bottom then that is treated as a green signal for long term positions.

If the MACD indicator is showing a spiraling trend and the RSI indicator breaks the seventy limit from the top then that is treated as a green signal for short positions.

Source: https://www.fxtradingrevolution.com/strategies/zigzag-fibonacci-macd-strategy-using-convergence-divergence-to-make-profits-in-forex

Since the MACD (Moving Average Convergence Divergence) indicator is used to represent the relationship between two distinct moving averages, it is considered a good pair with the Fibonacci analysis style.

Fibonacci analysis in the forex heavily depends on mathematical formulas to function. it identifies support and resistance lines as well as trade breakouts and aids the traders in the placement of stop losses.

The MACD gets stronger when combined with the Fibonacci readings around the support as well as the resistance lines which allows a better decision-making environment for the trader.

Source: https://www.forexstrategiesresources.com/forex-strategies-based-on-indicators/35-parabolic-stochastic-and-macd/

The Stochastic Oscillator makes one last entry on this list as it is an invaluable and useful forex trend indicator.

To idea behind the usage of these two indicators together is to allow the Parabolic Sar to analyze and select the trend with the Stochastic Oscillator acting as a confirmation tool for the trade.

Traders going for a long position should use hourly charts and open their trade when the next candle on their indicator opens up as well.

Furthermore, traders can also use this combination to identify bullish and bearish trends. All you have to do is look out for oversold or undersold conditions.

An oversold stochastic value between 20 and 50 marks is considered a bullish trend while the undersold stochastic value between 80 and 50 marks is considered to be the sign of a bearish trend.

Source: https://www.chelsea98.com/blog/2019/06/28/lets-talk-about-forex-risks/

The bottom line is that the combination of your strategy with the fusion of indicators as we talked about in this article can improve the quality of your readings immensely.

Try these ideas and implement them with the strategies that you have come up with to see which one works the best for you.

Don’t be afraid to alter them to your taste as that will ensure you get the best possible results out of your experiments in the long run.

Whether you are into short term trading or position trading does not matter much when you are using one or more indicators to boost your trading style as they are helping tools designed to augment all styles of trading.

Related Articles

The Indecision Candlestick Trading Strategy Explained

The Indecision Candlestick Trading Strategy ExplainedCody WallsTraders unfamiliar with the indecision candlestick

UN High-Level Panel (HLP)

UN High-Level Panel (HLP)Cody WallsBan Ki-moon (former UN secretary-general) selected 26 members

10 of The World’s Least Valuable Currencies

10 of The World’s Least Valuable CurrenciesCody WallsEveryone is aware of the