How to Trade Falling Wedge and Rising Wedge Chart Patterns?Cody WallsForex traders

How to Trade Falling Wedge and Rising Wedge Chart Patterns?

Suppose you have been researching forex reversal patterns such as the head and shoulders or the falling wedge pattern. In that case, you may have come across the term trend lines and wondered what they are and how you can use them.

To understand what a trend line is, let us first understand what trend is. In simple words, a trend refers to the scenario in which the price follows an imaginary path or a trend in a single direction.

Trend lines are drawn to understand the trend further. These trend lines connect the relevant lows during upward trends and the highs during a downward trend.

Drawing trend lines is essentially a massive part of technical analysis done by any forex trader. These lines are drawn to either depict either support or resistance levels for the trader.

To summarize, trend lines are the lines drawn at an angle either above or below the price. The reason they're used is mainly to give indications about the changes in a trend.

Alternatively, forex traders can also use trend lines as either resistance or support and drum up possibilities to either open or close their positions as per their convenience.

Let us take a closer look at trend lines and see how they are drawn.

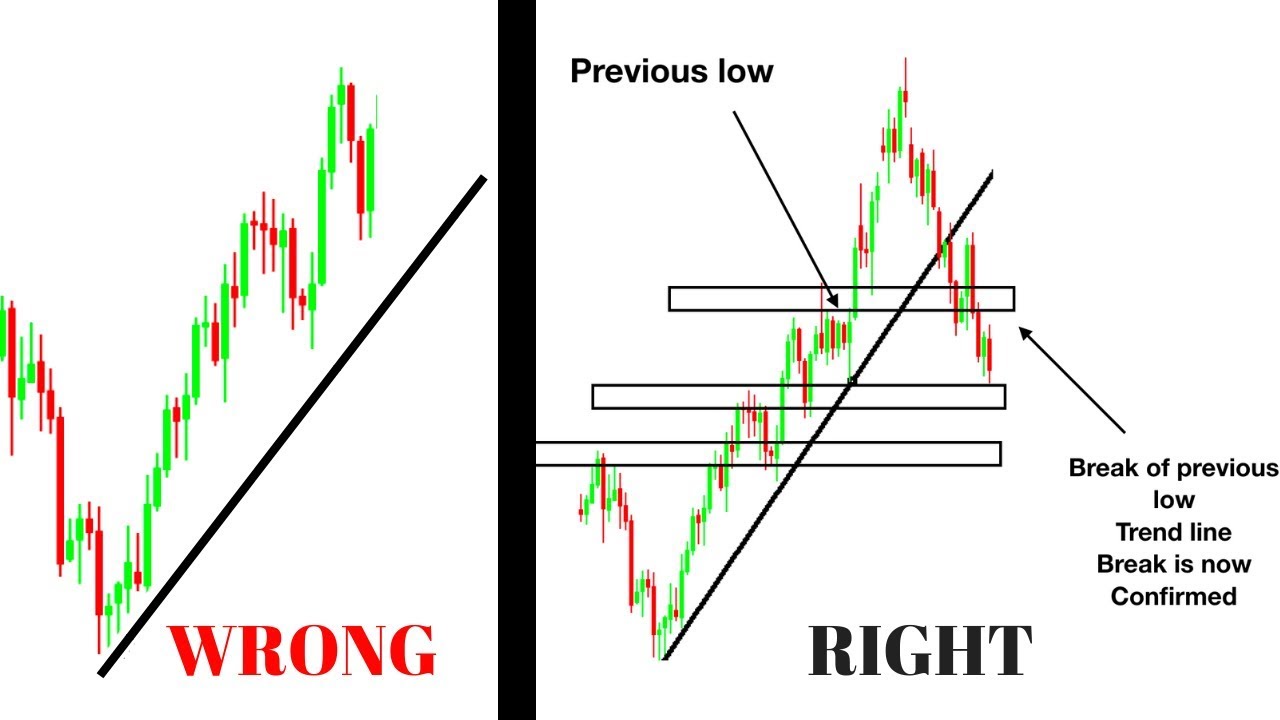

Source: https://www.youtube.com/watch?v=zicJFrHKTfs

Trend lines are common in technical analysis. They are one of the most underappreciated forms of technical analysis too.

That usually happens due to misinformation that traders using this pattern may have regarding it, making them draw trend lines inaccurately. Ultimately renders their analysis entirely utterly useless.

Since trend lines are a technical aspect of trading that depends on data to give you accurate readings, you must draw them as accurately as possible to avoid any trades' failure.

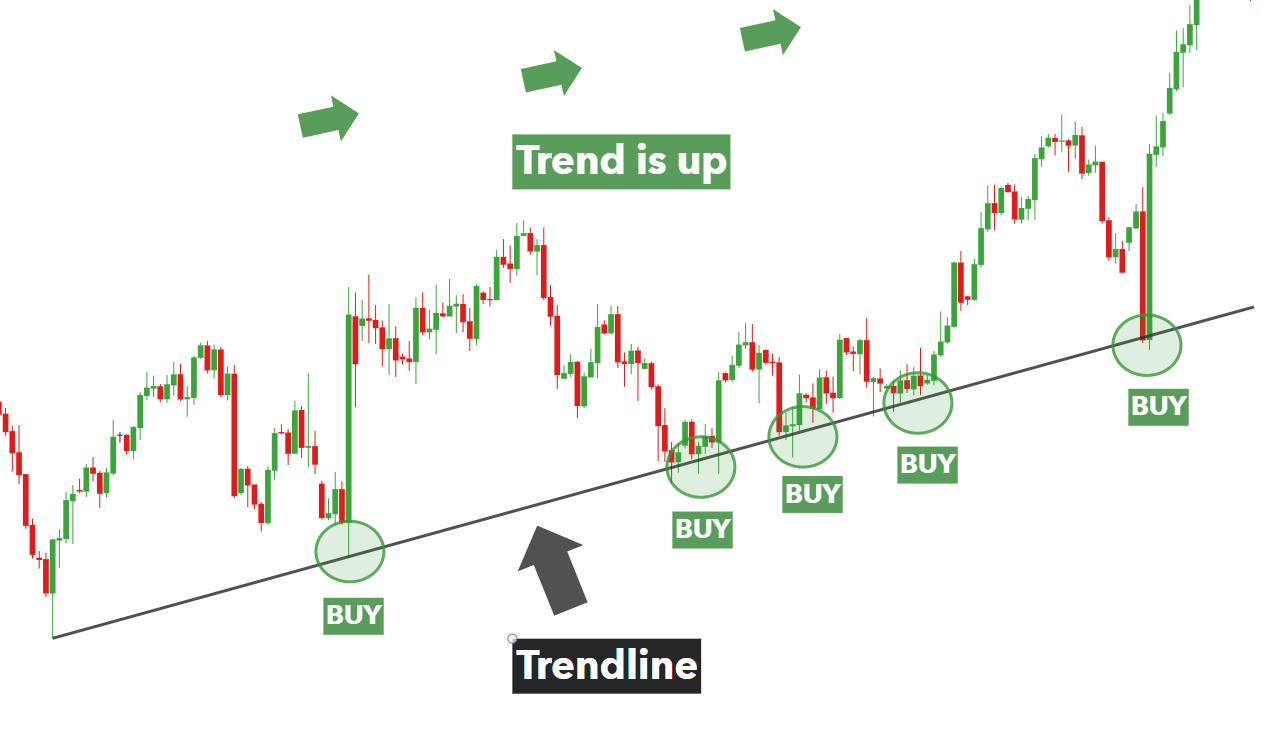

The most basic trend line is just an uptrend line that runs alongside the lower side of support areas that are easy to spot. You may call these lines the ascending trend line.

Quite similarly, you can draw the descending trend line by tracing the trend line on the top of resistance areas.

Source: https://fxtradingpro.com/everything-you-need-to-know-about-forex-trend-trading/

There are a handful of reasons why a trader such as yourself will need to use the trend line sooner or later in their trading career.

Every forex trader wants to know what the future holds and technical analysis is the most logical way of realizing that goal.

Using trend lines helps traders gather the necessary data which is required to identify both long-term uptrends as well as downtrends which consequently increases the chances of their trades being successful.

It is not uncommon for the support or resistance drew up by traders to be inaccurate and useless for them.

This is where trend lines come in as they can be your backup in such scenarios as they will give you more context about the market in which you’re trading in.

Once you have good data in your hands, you will be able to make better decisions as a trader. For example, if your data tells you that the market will go in an upward trend for a little while then you can choose to buy your trades very close to the trend line.

If your calculations indicate a downtrend then you can take appropriate entry decisions accordingly.

In essence, trend lines are invaluable for creating trading opportunities and they come in handy for traders who regularly hunt for reversal patterns in trends to find an opening.

Source: https://www.dailyfx.com/education/learn-technical-analysis/the-trend-is-your-friend.html

A trend line is said to be formed when a diagonal line forms from one price swing point to another. Trend lines are made up of three major points:

The initiating point is the point where your line starts from. Keep in mind that for someone to draw a conclusive trend line, they will need at least two points to start.

The confirming point is the second point in the trend line's structure. These lines can are drawn as soon as the swing high/low is picked up.

The validating point is the last point on a trend line whose primary purpose is to verify whether your line is a good trend line or not.

When traders successfully identify a trend line that is holding as either support or resistance depending on the market circumstances, they can choose to enter the market using that particular trend line as soon as the price touches it again.

The most common strategies employed for this trading style are to go for a short entry as soon as the price finds resistance at the trend line and place stop loss just above the trend line.

The size of the stop loss is entirely dependant on the trader's strategy and market conditions.

Now that you are familiar with the bells and whistles of a trend line, let us learn how to draw them.

There are two simple things that you need to keep in mind when drawing trend lines as a forex trader which are:

Furthermore, you will require at least three highs or lows for your trend line to be valid.

When more and more traders use the trend line as either support or resistance which will, in turn, have the price touch have the price the trend line repeatedly further validating it.

Look for higher time frames as they are known to give out some of the best trend lines but make sure you are not forcing the trend line to fit. In case it does not, then it means you have an invalid trend line on your hands.

Nothing can we can do without a proper strategy or plan, which is why there are a handful of trend line trading strategies that you, as a forex trader, need to be familiar with.

One of the most important aspects of forex trading is keeping up with the time frames. Traders tend to gravitate towards the daily time frame for drawing trend lines as most of them take the day trading route.

Additionally, trend lines that have extended for two years at the least are respected more and given more preference by traders than over lines that have only been up for a couple of weeks.

Different trend lines come with other decisions, which is why questions like whether you should trend lines from high or low of a candle are met with vague answers.

It's sporadic to find a trend line that lines up perfectly with the highs or the lows. Similarly, it's rare to find a trend line that lines up perfectly with each candle's opening or closing.

Since the foreign exchange or any other financial market, for that matter, is an extremely volatile platform that experiences fluctuations in prices all day, it will be infrequent to spot a perfect trend that is lined up to the highs or lows properly.

Now, suppose you come across a trend line that draws up imperfectly. In that case, there's no need to abandon it just yet, as your line may not necessarily be an invalid one.

Just look for the line sections with the most touches with a few parts of the candlestick been cut off, and you'll be fine.

The biggest mistake an inexperienced trader makes while drawing trend lines to try to force the line to fit by curving it to his convenience.

They usually do that when they are entirely sure about a level that should exit, and they force it to fit the price action on their charts.

Keep in mind that if a trend line is not fitting correctly, then it probably is not worth your time. Just look for other opportunities and move on to different patterns.

Now you know all the essential things to consider while drawing trend lines, such as needing either two tops or bottoms to draw a good line and needing at least three of them to confirm one.

Remember to draw trend lines above the price and connect the two lows in a straight line during a downtrend and below the price with the two highs combined in a straight line during an uptrend.

Using daily time-frames will almost always give you accurate data to draw the most reliable trend lines.

Lastly, always ensure that your trend lines don't force you to fit the market because that is still an invalid trend line.

Related Articles

How to Trade Falling Wedge and Rising Wedge Chart Patterns?

How to Trade Falling Wedge and Rising Wedge Chart Patterns?Cody WallsForex traders

Olymp Trade Market and Platform Extensions

Olymp Trade Market and Platform Extensions - Complete GuideCody WallsOlymp Trade is

Olymp Trade Affiliate Programs: Join and Earn Commissions Up to 50-60%

Olymp Trade Affiliate Programs: Join and Earn Commissions Up to 50-60%Cody WallsMany