Can You Get Rich by Trading Forex? - Honest BreakdownCody WallsWhenever someone

Can You Get Rich by Trading Forex? – Honest Breakdown

Capitalizing on the smallest opportunities and minimizing risk and loss is one of the many virtues of a successful forex trader on the market.

That said, it is not easy to keep your loss at a minimum at every step of the way. However, with enough practice and implementation of sound tactics, you can keep them at bay for the most part.

For a forex trader, there are multiple strategies available to help you make the best of his trades. One such beneficial method in a forex trader's arsenal is the forex breakout strategy.

The best thing about this particular strategy is that it is applied to other financial markets such and instruments other than currency such as bonds, commodities, and even cryptocurrencies as well.

There are many different types of breakout strategies available for you to learn and implement into your daily trades to improve your accuracy and turn more profits while trading forex, which we will be discussing in detail.

That said, you need to learn and understand what breakouts are to trade them properly, so let us take a closer look at what breakout strategy means.

Source: https://dotnettutorials.net/lesson/breakout-trading-strategy/

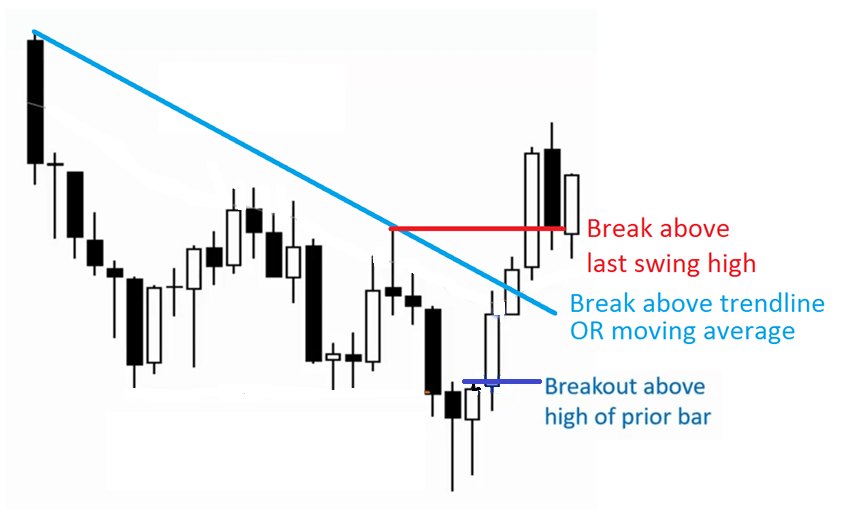

In simple words, traders make use of the breakout strategy when they need to enter a trade in the initial developing stages of its trend. If properly utilized, the trader can experience profitable price change trends, increase volatility, and even manage and keep risks at a minimum.

Breakouts tend to occur when the prices are moving beyond a certain level. Breakout trading merely is entering trades when the trend's momentum is determined to be in your favor.

The breakout itself is the price movement outside the general support or resistance areas. It can occur either horizontally or diagonally, depending on the price action pattern of that duration.

Breakouts can be bullish or bearish, making it easier for traders to sniff them out before they dissipate. During a bullish breakout, the market tends to go in an upward trend.

Similarly, during a bearish breakout, the market will go down in a downward trend. Traders tend to look for such breakouts as they indicate the beginning of volatility in market trends.

They wait for a breakout to appear so that they can take advantage of the volatility it drums up by joining the newer trend in its initial stages.

Needless to say, if you want to be successful at trading forex using a breakout strategy, then you will have to pay special attention to the timings and match your decisions accordingly.

Source: http://www.finsmes.com/2020/06/five-reasons-to-invest-in-forex-trading.html

A few simple steps are involved in successfully implementing a breakout strategy while trading on the foreign exchange market.

Usually, the entry points come on a re-examination of previous support or resistance levels depending on the markets' strength. If the market is strong, you can expect a retest based on prior levels, but you may not get a retest if the market is not that strong.

It is advisable to enter the market on a retest of previous support or resistance levels owing to the direction in which the market is taking a break.

Forex traders should set up their stop loss above or below the breakout candle to make the best of their trades. The retest of the previous support or resistance levels can help set up a valid stop-loss point while trading.

Stop losses can ensure that you don't suffer heavy losses if something unpredictable happens during the trade duration.

Once the trader has determined where he will set up his stop losses and his entry point, he can start setting a target.

The key is to identify and isolate a local target for a breakout trade before the trend dies. Vital support areas are usually the ideal spot for such marks.

Now that you are familiar with the initials settings of breakout trading, let us look at the various strategies used:

Source: https://www.dailyfx.com/forex/education/trading_tips/post_of_the_day/2013/04/02/A_Basic_Indicator_Breakout_Strategy.html

In the breakout pull-up strategy, the trader usually has to identify and isolate essential support and resistance levels in at least two contacts.

When the number of buyers or the number of sellers present increases, then the chances of a successful breakout also increases with it.

The second thing traders using the breakout pull-up strategy need are breakout setups to observe, forming around the trend.

Afterward, the traders can move forward and implement the breakout pull-up strategy armed with the knowledge as mentioned above.

As soon as the price closes above the key support or the resistance levels, the trader can choose to set up an order limit to only conduct trade in the breakout direction to maximize profits.

Consequently, whenever the trader identifies a possible breakout, there will already be sufficient flow in the breakout's direction. The trader can choose to go either long or short on the pullback.

To summarize, long bearish candlestick breaking support level and closing below that level or long bullish candlestick breaking resistance level and finishing below are the two scenarios that traders need to watch out for a while implementing this strategy.

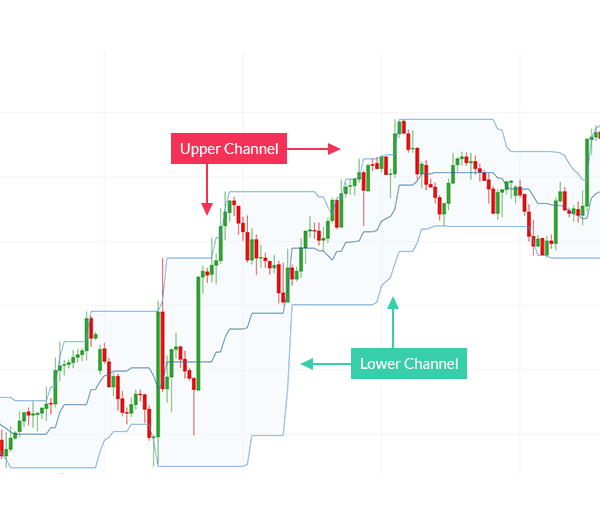

The first most crucial thing to consider when using the momentum breakout strategy is finding out the critical support and resistance levels.

They can be usually found by looking closely for a very long bearish candlestick that's breaking the support level and closing underneath it or a long bullish candlestick breaking and approaching a resistance below its closing level.

Traders can use the momentum breakout strategy on charts with a time interval of 15 minutes to 4 hours.

The loss distance tends to be relatively wide because the momentum candlestick is rather large.

One more upside of the momentum breakout strategy is using numerous indicators to implement it properly, leaving a lot of relevant data in your hands.

Traders hoping to capitalize on using the moving breakout strategy will need to familiarize themselves with the ABC pattern first.

Furthermore, the use of the 25 periods Simple Moving Average is also employed here.

To understand this strategy using the ABC pattern, we will assume that prices move from point:

A to point B before starting a pullback represented by C.

Since C is the initial point of a new bearish trend, we will wait for a reversal candle to form at point C and trade from there.

C is very volatile during both bullish and bearish scenarios.

To make the most of this strategy, the breakouts need to have strong momentum.

Source : https://forextradingstrategies4u.com/20-pips-daily-candlestick-breakout-forex-strategy/

Traders should also be aware of the fact that there are both good and bad aspects of breakout trading in forex which are:

Source : https://intpolicydigest.org/2019/11/13/four-major-types-of-forex-trading-to-make-a-profit/

Whenever you are trading breakouts, always avoid buying breakouts after a strong bullish momentum. The market will most definitely go in a reverse trend afterward.

Instead, buy breakouts that have a buildup to them and ensure the market is in range because that is the sign of a strong breakout.

You can also look for higher lows in resistance levels as they are also a sign of a strong breakout. Conversely, lower highs in the support levels are the signs of a weak breakout.

False breakouts are also something you need to watch out for always if you don't want to end up losing your precious time and money.

Use filters to reduce the number of false breakouts that turn up during your reconnaissance. You will be making a handsome profit in no time.

Related Articles

Can You Get Rich by Trading Forex? – Honest Breakdown

Can You Get Rich by Trading Forex? - Honest BreakdownCody WallsWhenever someone

Olymp Trade Affiliate Programs: Join and Earn Commissions Up to 50-60%

Olymp Trade Affiliate Programs: Join and Earn Commissions Up to 50-60%Cody WallsMany

Olymp Trade Market and Platform Extensions

Olymp Trade Market and Platform Extensions - Complete GuideCody WallsOlymp Trade is