5 Simple and Profitable Forex Scalping StrategiesCody WallsThose doing their research on

5 Simple and Profitable Forex Scalping Strategies

Traders need data to be able to accurately predict the movements of currency pairs on the foreign exchange as well as other necessary things that are required to take better trading decisions.

To collect and analyze the data, different traders use different methods that suit their skills and style of trading.

Following the news, reading economic variables, keeping up with the ever-changing interest rates of currencies, etc are some of the ways traders collect important data for their analysis.

However, at the end of the day, it doesn’t matter what style of trading someone has or from which medium they’ve been collecting their data from because every trader has to read forex charts sooner or later.

Luckily, we are going to teach you everything you need to know about forex charts so that you can read them and make sense of its data with ease as beginners can often get confused looking at the complex graphs and numbers that are displayed on them.

Before that, let us cover the basics that will familiarize you with all the terminologies used in trading charts.

Source: https://www.forexlive.com/news/!/5-forex-charts-that-you-have-to-see-before-trading-this-week-20140921

Let us take a look at the things that you will need to familiarize yourself with before looking at a forex chart.

Currency Quotes: Forex is always quoted in pairs such as USD/JPY or GBP/EUR. These pairs are made up of two things. One is called the base currency while the other is called the quote currency.

In the case of the USD/JPY pair, the USD is the base currency and the JPY is the quote currency which essentially dictates how many Japan yen a trader will get for 1 US dollar.

Pip: Pip stands for Percentage in Points which is nothing more than a unit used to calculate a trader’s profit or loss.

Forex pairs are usually quoted to four decimal places. The only exceptional currency that does not follow this rule is the Japanese yen which is quoted to two decimal points.

Source: https://virginiamnmuseum.com/examples-of-opportunities-and-risks-in-forex-trading/

Forex charts are nothing but a graphical representation of data such as the exchange rates between two specific currencies.

While referring to such charts, traders can easily ascertain how the exchange rate of given currencies changes with time to make future position predictions an easier task.

A forex chart can be made for any currency pair such as NZD/USD, AUD/EUR, etc.

A variety of forex charts have been developed over the years for traders to plot and analyze data related to training.

All trading charts are set to a default time frame of 24 hours for the sake of convenience but that can be easily altered to suit the trader’s requirements.

For example, you can set the time frame for a forex trading chart to 60 minutes so that it displays relevant data of only the last 60 minutes.

Source: https://www.markettraders.com/blog/read-forex-chart/

Price charts are typically one of the very first tools that a trader picks up when he starts his technical analysis phase.

These charts visually represent each and everything that takes place during a trading activity of any given period whether its minutes, hours, days, weeks or months.

As you must be aware, a chart consists mainly of two axes which are called x and y respectively.

The x-axis is the vertical line and the y-axis is the horizontal line that is drawn on a graph.

Price scales are plotted on the y-axis while the time scale is plotted on the x-axis.

When prices are plotted on a forex chart, they are always plotted in a left to right order going across the x-axis.

Additionally, forex charts also have a variety of characteristics which may depend on the chart that you have in your hands.

Source: https://www.learntotrade.com.au/blog/monthly-market-reports/a-day-in-the-life-of-a-trader/

Source: https://www.tradingsetupsreview.com/10-types-of-price-charts-for-trading/

These are the most commonly used forex trading charts on the market.

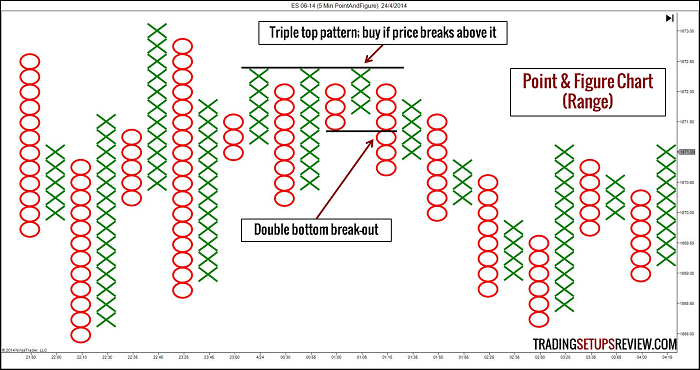

A chart that uses points and figures gives traders the freedom of identifying support and resistance levels with ease, filter out exchange rate moves as well as analyzing trader patterns.

A point and figures chart will not have constant time intervals and they are usually represented on a graph paper.

As for symbols, X is used to denote the rising column of boxes whereas O is used to denote the falling column of boxes.

Source: https://www.tradingsetupsreview.com/10-types-of-price-charts-for-trading/

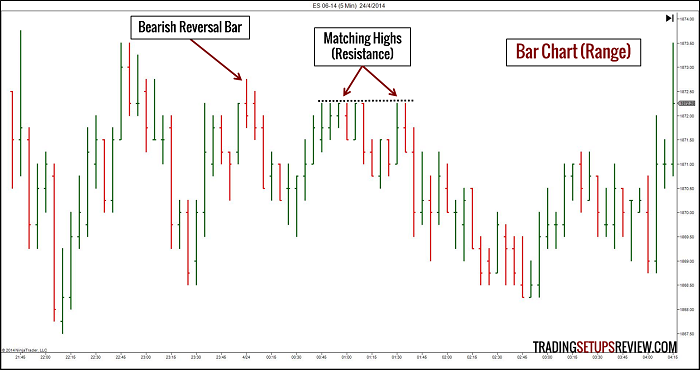

Traders employ the use of bar charts to ascertain the price range of each period.

In case price fluctuations are very high, the bars will take a larger form while on the other hand if the price fluctuations are low, the bars will become smaller in size.

Furthermore, the opening and closing prices are also represented clearly on a bar chart with the horizontal hash on the chart’s left side representing the opening price and a similar-looking hash on the right representing the closing price for that period.

Source: https://www.tradingsetupsreview.com/10-types-of-price-charts-for-trading/

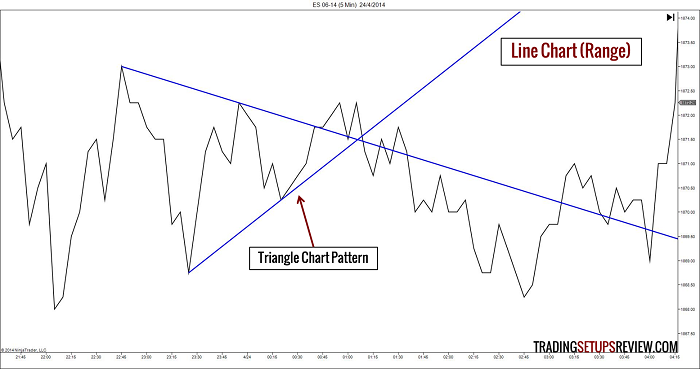

Line charts are a simply drawn out representation of a closing price to the succeeding closing line.

Line charts are the most basic forex charts available to a trader and they are mainly used to represent the relevant price of any particular period.

They are very easy to understand but their only downside is that they cannot provide us with precise details about the price behavior of a given period.

Line charts are predominantly used to get a look at the bigger picture as it is not too complicated which also makes it an excellent tool for beginners.

Source: https://ndkthechartist.com/technical-analysis-candlestick-chart-series-day-12/

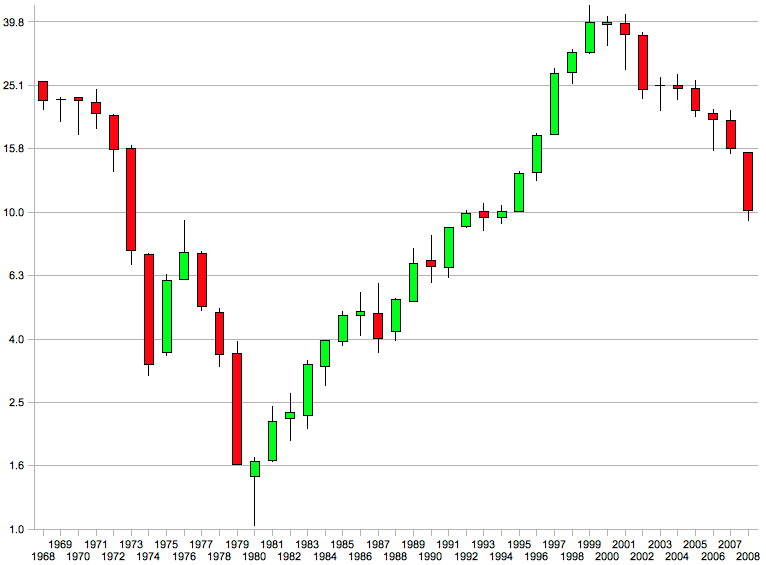

This is the most famous forex charts on the market as every trader likes to use them because they are easy on the eyes and are easy to understand as well.

A candlestick chart is like the upgraded version of the bar chart and is almost identical to them too in many aspects.

Traders love the candlestick featured charts as they are very helpful in visualizing bearish or bullish signs on the market in a rather colorful manner.

What we mean is that Candlesticks are represented in different colors which adds to the aesthetic appeal of the entire indicator.

Here’s how you can go about reading a candlestick chart: look for the candle body and note its color, if it is green then that is a representation of the opening price being lower than the closing price.

Similarly, if the color is red then that is considered as a sign that the opening price is higher than the closing price.

Furthermore, the black lines that can be seen both above and below the colorful candlesticks are known as wicks that represent either the highest or the lowest prices that a commodity has reached for any given period.

Source: https://www.dailyfx.com/education/beginner/what-is-forex.html

For a forex trader, several types of charts and indicators have been designed specifically with only one purpose in mind which is to make technical analysis easier in general.

Experiment with the charts and see which one fits your style, you can even combine different charts to enhance your analytical skills and data collection.

Remember to start with the basics and work your way up to different combinations once you have mastered using them on their own.

Related Articles

5 Simple and Profitable Forex Scalping Strategies

5 Simple and Profitable Forex Scalping StrategiesCody WallsThose doing their research on

Olymp Trade Charity Work: Going Beyond Trading

Olymp Trade Charity Work: Going Beyond Trading Cody WallsAlthough Olymp Trade is

How to Calculate Cross Rate of Exchange?

How to Calculate Cross Rate of Exchange?Cody WallsBelieve it or not, but