Top 10 Best Forex Trading Books For BeginnersCody WallsOver the years technological

Top 10 Best Forex Trading Books For Beginners

Those doing their research on forex trading must have come across the term Scalping once or twice and wondered what that term means in the context of forex trading.

Scalping is somewhat closer to day trading in which traders take to short term trading in the hopes of making quick profits during their trading sessions.

Forex scalping is similar to day trading in a few aspects but it takes place in a comparatively smaller environment and is much faster. Some may even say that scalping is one of the most risk-ridden strategies of trading out there.

That might be true but if executed properly, scalping can rope in great profits for traders and that too in a short period as there are scalpers who have reportedly made millions in a few years using this strategy.

One more thing about scalping is that traders make use of various tools and indicators on their arsenal to properly implement this. Experienced scalpers may also use a combination of indicators to strengthen their strategy.

These tools and indicators allow the trader to analyze and determine where the short term price gaps will open up which are then used by the traders to start scalping.

In this article, we will explain five of the best forex scalping strategies used by traders which you can use to take advantage of the market and how you can implement them into your trades.

Before that let us take a closer look at scalping and how it works.

Source: https://www.dailyfx.com/forex/education/trading_tips/trend_of_the_day/2014/04/07/Who_Can_Trade_a_Scalping_Strategy.html

In essence, a scalper is the type of trader who attempts to make several small-scaled trades to earn a profit on the majority of those trades.

The goal is to do make numerous small profits so that they pool into a large profit once combined.

The trades made by a scalper are usually at 10 pips per trade and they always prefer to trade forex pairs with the lowest possible spreads as scalpers have to keep in mind the various charges that come with each trade or they’ll end up not making anything.

The reason why this style of trading is considered risky is that a few bad trades might affect your profits which could end up being a huge waste of time.

Now that you are familiar with scalping, let us take a look at the five most effective forex scalping strategies.

Source: https://www.youtube.com/watch?v=RMfoJDuavWQ

Most forex scalping strategies work on the principle of volume which states that changes in volume are almost immediately followed by price action.

Needless to say, this scalping strategy is heavily dependant on the use of volume indicators to be able to function properly.

The strategy works by looking at the volume levels. If it is low, then traders prepare for a trend reversal as low volume is generally considered to be a sign of a dying trend.

Subsequently, the low volume will be usually followed by high volume once the trend reversal is complete which the scalpers can also take advantage of due to the high price action.

Since this strategy is heavily reliant on indicator tools, scalpers should be very careful about the source of their volume indication levels and be sure to double-check or cross-check them with others.

Source: https://www.tradingwithrayner.com/bollinger-bands-trading-strategy/

Bollinger Bands makes use of a statistical measuring tool known as the standard deviation.

This indicator also makes use of representational bands called the lower band and the upper band.

Traders generally use Bollinger Bands to check for volatility on the market they are currently trading in.

High volatility can be observed on this indicator when the readings are farthest from the center.

Bollinger Bands work by measuring the highest as well as the lowest points of a currency pair and indicates the result using its bands which helps its user in determining when to avoid or jump into the market.

The implementation of this strategy is rather simple, if the prices are reaching the upper band then that is considered to be an indication to go short.

Similarly, if the prices are reaching the lower band, then it is time to go for a long position.

Source: https://www.investopedia.com/terms/s/stochasticoscillator.asp

Like most forex scalping strategies, the trend line and stochastic scalping strategy are also reliant on indicators which in this case is the stochastic indicator complimented with trend lines.

Scalpers use the stochastics indicator to determine whether a currency pair is overbought or underbought. That is determined by the readings you get from the indicator.

A stochastic reading of 20 or below is classified as an underbought condition whereas a stochastic reading of 80 or above is classified as an overbought condition.

The best way to implement this strategy successfully is to avoid the ranging market and focus on the market when it is in an upward trend or a downward trend.

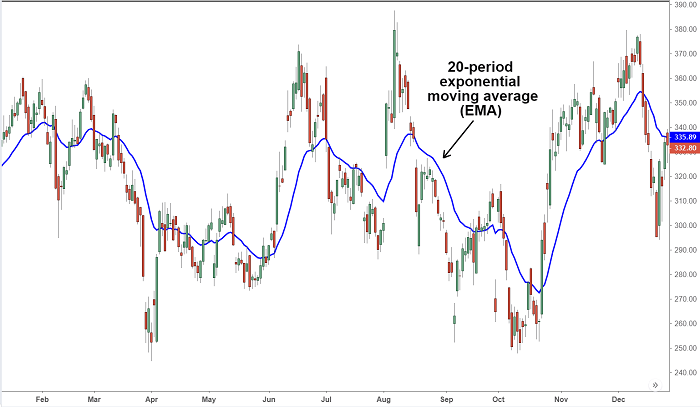

Source: https://www.investopedia.com/terms/e/ema.asp

The exponential moving average strategy will require you to use exponential moving average indicators intensively.

Traders often use two or three such indicators simultaneously to get a better insight into the market as the reading from multiple indicators can help filter out unnecessary data and noise.

This mainly helps the trader pin-point important buying or selling points before entering or exiting a trade.

Using the moving average indicator is very simple, simply look at the current price levels. If they happen to be above the exponential moving average then that is a good time to sell.

Similarly, when the price can be seen hovering below the exponential moving average then it is seen as a good time to buy.

One negative aspect of this strategy is that it only displays the past prices of the market as they are known to lag behind the actual trends.

So complementing this strategy with an additional indicator is the best way to go.

Source: https://2ndskiesforex.com/trading-strategies/dynamic-support-resistance-forex-market/

This is one of those forex scalping strategies which is interested only in support and resistance levels.

Static Support and Resistance levels are the ones that a trader takes note of before commencing trade as they are the highest as well as the lowest point of the support levels.

Dynamic Support and Resistance levels, on the other hand, are said to be in a constant state of flux. Hence they are called dynamic as they are ever-changing.

Traders can take note of these levels to come up with better strategies and determine the safest and most lucrative points of a forex pair.

This strategy is also said to be easier to implement and beginner-friendly in practice. Traders can also combine other indicator tools to supplement this strategy.

Source: https://www.bbva.com/en/what-study-become-good-trader/

It is important to be clear-headed and try to keep things simple while implementing various forex scalping strategies in the field.

As a beginner, you must master one indicator first before moving on to combinations as there is a possibility that you might end up misinterpreting the readings which can be very disastrous for your trades as a few bad trades can disrupt the profits of a scalper.

Lastly, ensure that your strategies are working by either using a demo account to practice or using a significantly small amount to invest and try out your strategies on the foreign exchange.

Related Articles

Top 10 Best Forex Trading Books For Beginners

Top 10 Best Forex Trading Books For BeginnersCody WallsOver the years technological

How to Calculate Cross Rate of Exchange?

How to Calculate Cross Rate of Exchange?Cody WallsBelieve it or not, but

5 Simple and Profitable Forex Scalping Strategies

5 Simple and Profitable Forex Scalping StrategiesCody WallsThose doing their research on