IQ Option Tricks and Strategy

IQ Option is a powerful binary options trading platform trusted globally. The platform provides traders with all they need to keep improving their skills and earn profits on their investment journey - be it through educational videos, blogs, newsletters, trading tools, analytical tools, etc.

However, if you're an amateur trader looking to earn quick money from the platform, know it isn't a walk in the park. But with proper knowledge and strategies on hand, even novice traders can start earning well.

To help you out with your trading journey, here are IQ Option tricks and strategies to go through before you start.

IQ Option Trading Strategies

Trading strategies are vital for any trader. These will come in handy as you try to figure out what your trading style will be.

Your trading style will dictate your profit-loss ratio, the amount of money you invest, and even how long you invest in an asset. To help trading aspirants, we've put together some beginner-friendly and renowned forex trading strategies used by thousands of traders.

1. Scalping

This strategy involves earning numerous small profits in place of one large win. To do this, traders set buy and sell thresholds prior to opening the deal and watch the price move in the anticipated direction. These deals can be as short as a few seconds since they are closed as soon as a decent amount of profit is gained.

Scalpers must be prepared to act fast as the price can fluctuate in a blink. They have to make and implement critical financial decisions in a flash.

Since this tactic concerns short timeframes, you cannot use fundamental analysis in scalping. This means you should consider you're exposed to fundamental risks at all times.

2. News Trading

The most potent method in fundamental analysis, news trading, involves traders keeping up to date on all major news and events vital in price fluctuations. Remember, all assets can be moved by prominent economic and/or political events.

Good news will increase prices, while negative happenings will drive them lower. It may sound simple, but predicting reports and the market's reaction is quite the task since traders may react illogically. Sometimes, even with positive news, prices will fall.

Markets may also react late or early. The reaction may not be in accordance with how you feel about the news. After all, the response depends on how the consensus feels.

3. Momentum

The momentum method is relatively easier to understand. To implement the strategy, traders must wait for the charts to show a rapid movement and open the deal. Since IQ Option allows traders to open both long and short positions, the move can be in either direction.

These immense price movements can result from both technical and fundamental aspects, making it imperative for traders to keep a close eye on the charts. In the case of fundamental factors, take, for instance, the earnings reports of publicly traded companies or changes in the board of directors. Depending on the influence, they can cause both positive and negative breakouts.

3. Breakout

If you know technical trading basics, you'll remember support and resistance levels. The breakout method takes advantage of this theoretical concept.

When the price of an asset reaches a particular peak, it won't move upward and will instead come back down, respecting the resistance level. This is likely to happen a couple of times, lowering the price every time it reaches the resistance.

Now, when the price finally breaches the resistance level to go up, technical experts believe it will continue its rally upwards. Thus, once the price breaks through, traders should buy the asset to gain profit.

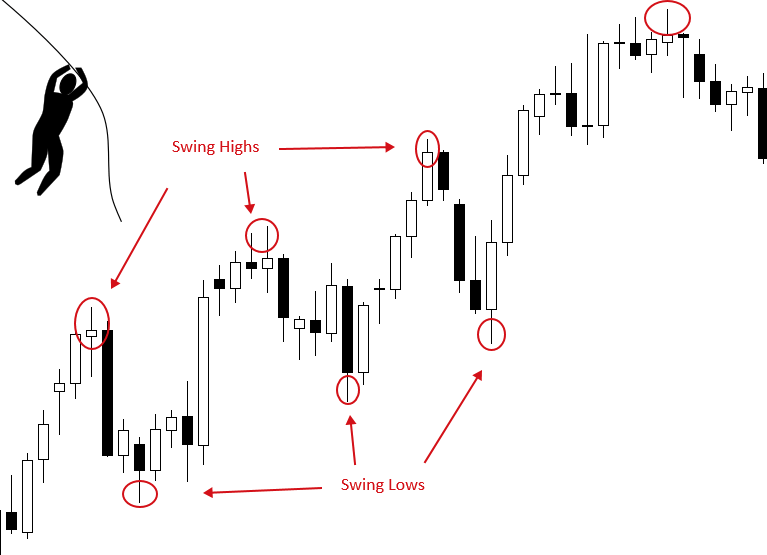

4. Swing Trading

Swing trading is a strategy that consists of taking smaller gains in short-term trends and cutting losses even quicker.

Set targets for a more modest 5% - 10% instead of the usual 20% - 25%. For a swing trader, the target isn't gained over weeks or months but rather 5 to 10 days. This way, smaller profits will add up because of the smaller timeframe.

On the other hand, stop losses also have to be moved up from the average of 7% - 8% to 3% - 4%. Smaller gains can only be profitable if losses are kept diminutive. Take quicker losses and maintain a 3-to-1 ratio for profit-loss. This ratio is reasonable since large losses will wipe out all your progress made with smaller gains.

IQ Option Tricks - How to Win?

Although there is no way to keep earning profits without natural losses, there are specific tips to keep in mind to get consistently positive results.

Here is a compiled list of the most noteworthy suggestions to earn profits while keeping your losses at bay.

Risk Management

No strategy is foolproof, and traders need to be aware of all the risks they're taking while trading. Risk management is arguably the most essential aspect of trading successfully.

Test Strategies in Demo Account

The demo account feature is a foolproof way to test out new strategies. It's a powerful feature provided by IQ Option that gives traders a separate account with $10000 worth of dummy money.

Through this article, if you found a strategy you want to try out, it's advisable to do so on the demo account. Sometimes trading strategies sound suitable but end up not working out. With a separate account with dummy money, you don't have to worry about any losses to your hard-earned money. If the strategy performs well, you can implement it on financial assets through your real trading account.

Ensure you try out the strategy several times on the demo account before applying it to your real one. Just one positive outcome doesn't guarantee pleasing overall results as it may just be a fluke.

Another vital aspect is to think of the demo account as your real account. Sure, the demo account ensures you don't lose any real money. But if you invest huge amounts and don't care about the 'losses' you incur, the strategies won't translate to your real account since you wouldn't make such significant investments in the first place.

Therefore, you must use the demo account thinking the money and losses are real. You can learn what works and what leads to losses before investing your actual money.

Choose Proper Tools

Before beginning to trade, you need to prepare the right tools to read the condition of the assets.

Proper tools will help you understand trends and make profits. They will also make your trading routine more organised, giving you steps to follow the movement of prices. Here are a few important ones you need to use:

1. Chart Types

The most basic setting you need to select is the type of chart you want. These charts will visualise the prices of assets, making it easier to catch trends and make deals.

IQ Option provides four different chart types - Linear, Candles, Bars, and Heikin-Ashi. All these chart types have their pros and cons, so you need to try them all out and decide what fits your trading style best.

2. Indicators

The technical analysis aids traders in predicting what will happen to the market next. This is where indicators come into play. Technical indicators will help you evaluate the performance of the asset and decide on the possible outcome. Traders often use a combination of indicators to reinforce their predictions.

You can choose indicators from the 'Popular' section to start with. Make sure to test out your predictions using the demo account first. Get the hang of it, and then move to your real account.

3. Graphical Tools

IQ Option allows users to use a simple line, a trend line, a horizontal or vertical line, and the Fibonacci retracement on different graph types. These tools help you trace out any trend patterns you see, mark resistance and support levels, and identify breakouts when they occur.

These line tools give you the liberty of putting your thoughts on the chart as you wish.

4. Signals

Prior to entering any trade, you need to look for signals that tell you it's a good time to invest. Similarly, once you've put your capital on a trade, you need to keep a lookout for any exit signals to either book profit or minimise losses.

For entry points, you need to brush up on your technical knowledge. For example, you would buy a position when the price breaks out of the resistance level or when the rising RSI confirms entry signalled by a hammer candle.

In case of exit points, you would consider leaving the position when the price crosses below the Bollinger bands or if it goes below the support levels. This will ensure you don't lose too much of your funds.

To succeed at trading on IQ Option, you'll need to conquer these concepts and identify entry and exit signals. Teach yourself all the technical knowledge you need by watching the video tutorials uploaded by IQ Option.

Conclusion

All in all, earning a large profit margin from IQ Option is viable if you are knowledgeable about trading. An expert trader keeps learning about the markets and newer strategies as they emerge. Once you are well-versed in trading, you can find a routine that works for you. Time and effort will pay off, whether you decide to earn consistent small profits or stick through with long positions on assets you like.

As a novice trader, you must practice trading on your demo account and figure out what's best for you!

Português

Português  Indonesia

Indonesia  Thai

Thai  Tiếng Việt

Tiếng Việt  Italiano

Italiano  Français

Français  Deutsch

Deutsch