How Do You Lose Money in Forex TradingCody WallsWhat’s stopping a forex

How Do You Lose Money in Forex Trading

One of the most useful tools a trader can ever ask for is chart patterns. With their help, traders can easily understand the market's direction as they formulate based on buying and selling pressure on the market.

Traders often utilize the various forex chart patterns to identify either reversal signals or continuation signals, which helps them seek out the best open positions and price targets to set.

In a nutshell, forex chart patterns take data regarding all the buying and selling that takes place on the foreign exchange and puts them on an easy to read graph or chart.

One of the best qualities of such forex chart patterns is that they tend to repeat themselves, which creates openings and opportunities for the traders to take advantage.

Traders who can recognize such patterns in time gain a decisive advantage over their competitors when they trade. Consequently, they can make better trading decisions.

In this article, we will talk about ten of the most crucial forex chart patterns that you need to be aware of as a trader.

Source: https://www.forex.academy/chart-patterns-the-head-and-shoulders-pattern/

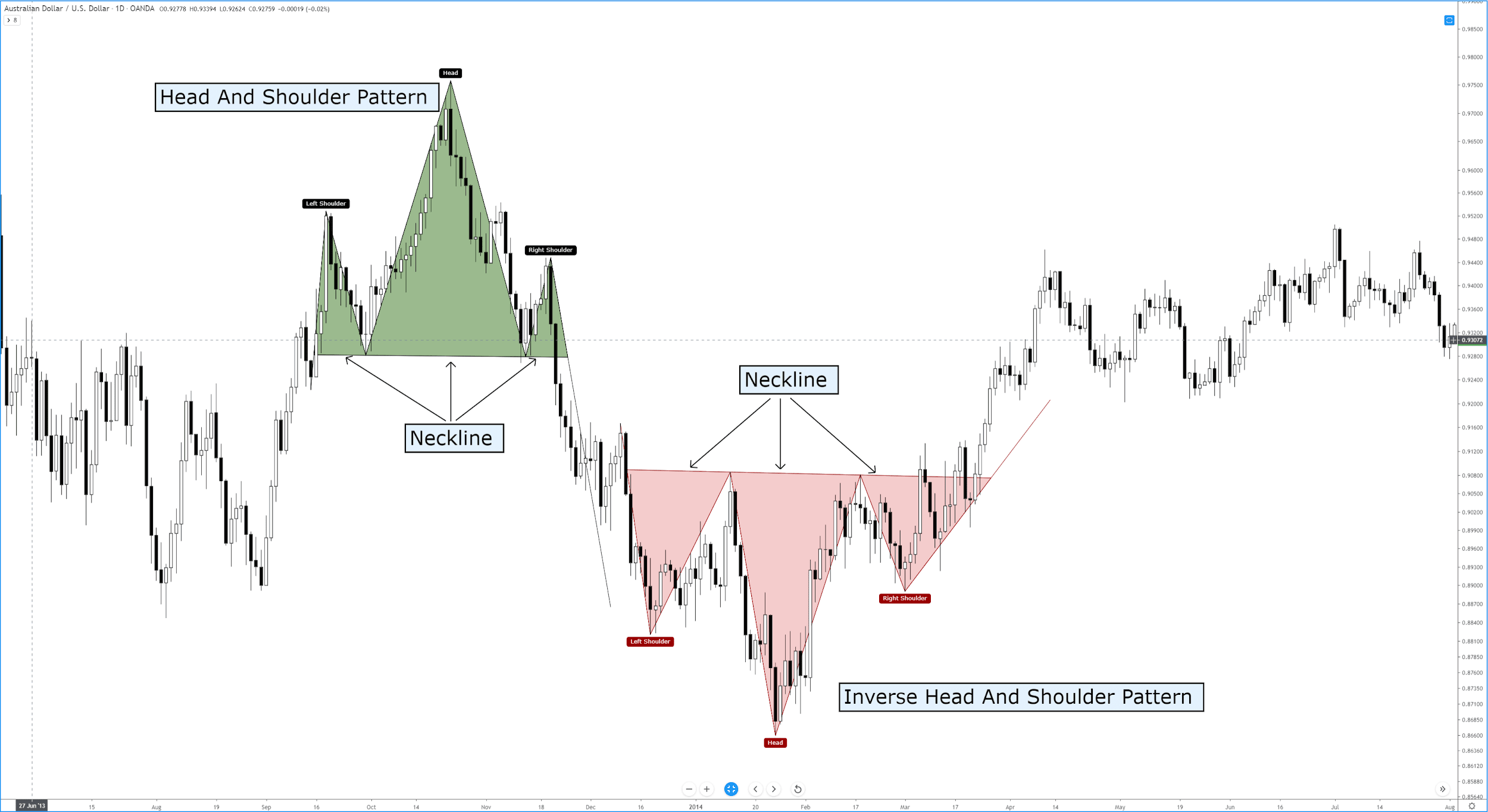

The infamous head and shoulders chart pattern is one of the most famous indicators of an upcoming trend reversal.

This particular pattern is so famous due to its shape, making it somewhat easier to spot on forex charts. It appears to have a baseline with three peaks, which are almost always easy to spot amid all the chart's noise and disturbances.

The single peak in the center is called the head, and it is always taller than its neighboring peaks. The peaks on the left and the right are called the left peak and right peak, respectively.

This pattern is one of the most reliable chart formations that you can ever hope to come across while trading on the foreign exchange. It can accurately predict when an uptrend is about to meet its end.

It is also helpful in predicting a bullish-to-bearish trend reversal for most traders who use it.

Source: https://www.dailyfx.com/education/technical-analysis-chart-patterns/double-top-pattern.html

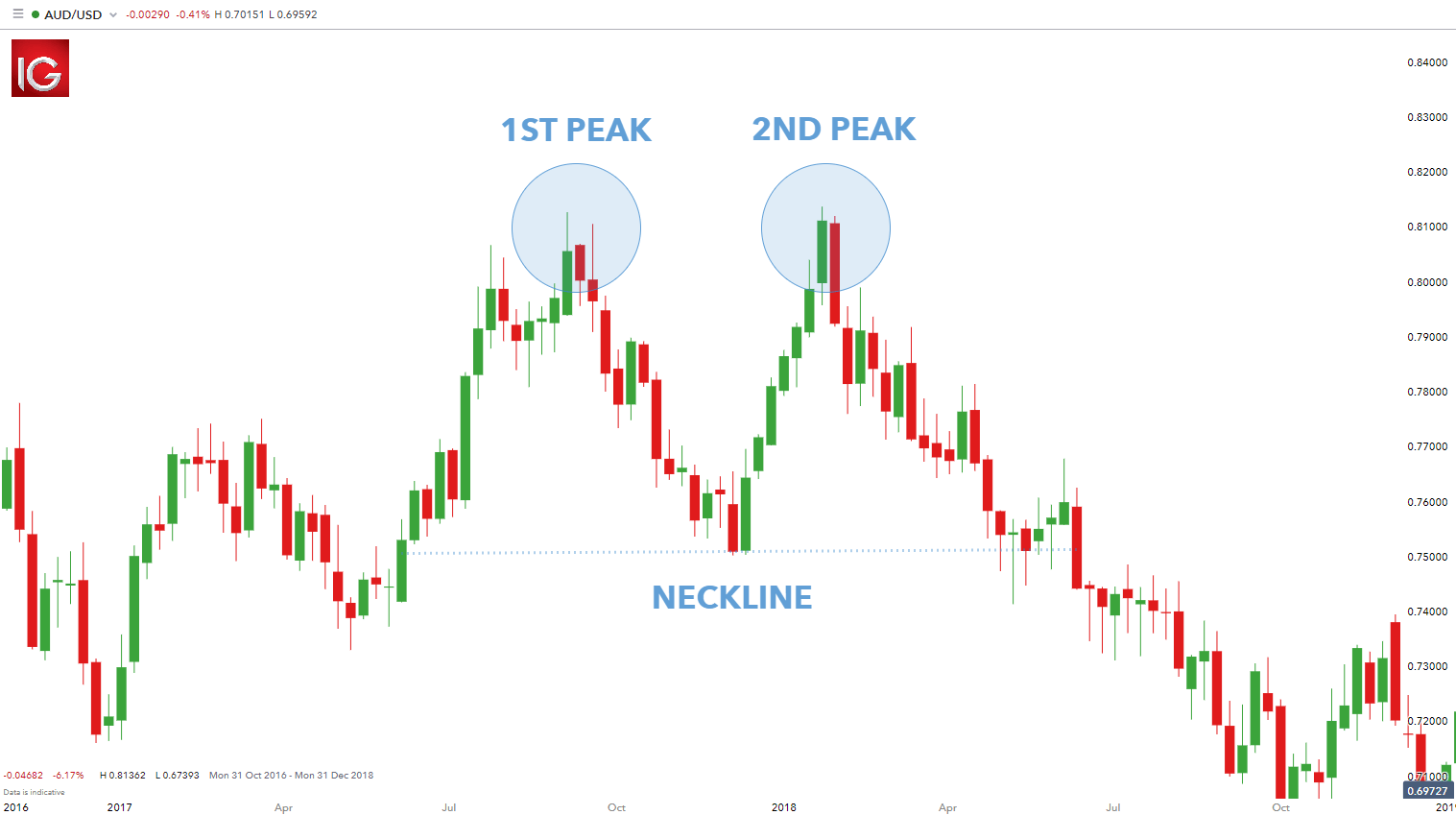

The double top pattern is also a type of reversal patterns similar to the head and shoulders pattern. It is also a bearish reversal pattern, but the difference is that this pattern has two high swings that loom around the same price level.

The price level in the double top pattern forms a peak. It retraces itself back to a support group only to create a peak again just before it moves away from the ongoing trend.

In terms of graphical representation, this pattern almost has an M shape, making it relatively easy for traders to spot it on their trading charts.

Source: https://www.dailyfx.com/education/technical-analysis-chart-patterns/double-bottom-pattern.html

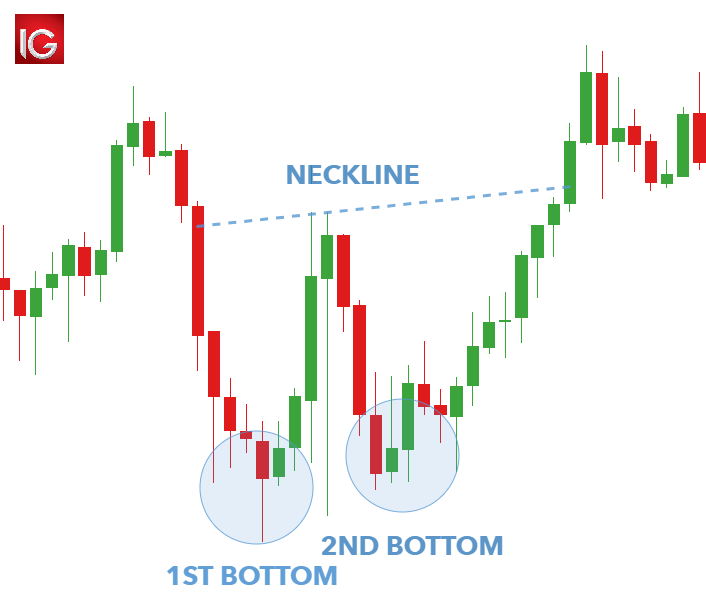

The double bottom is the counterpart of the double top pattern. It happens to be the opposite of it in terms of characteristics.

This pattern has two swing lows instead of the highs of the double top. In terms of graphical representation on forex charts, this pattern forms a W instead of an M.

The double bottom pattern is generally seen as the indication of bullish trend reversals, which allows the traders to take advantage of the situation by indulging in a bullish rally.

One thing to take care of while dealing with both the double top and the double bottom pattern is to be entirely sure of their interpretation.

If identified on the right on time and interpreted correctly, both of these patterns can be an invaluable asset to you. However, if misinterpreted, then these or any forex chart patterns can make irreparable your trades.

Source: https://www.chartpatterns.com/wedges.html

Wedge patterns are of two types, falling wedge as well as the rising wedge. While the falling wedge is associated with bullish reversals, the rising wedge is seen as a bearish reversal indicator.

The wedge pattern has over three properties that a trader needs to look for if hunting for it on their charts.

You can spot the rising wedge, usually when a currency's price has been climbing over a reasonable period. However, they have been known to form during a currency price's downward trend as well.

As for the falling wedge, it has been observed to form correctly when a currency's price has been on a decline for a while. The pattern's hot spot is just when the market trend is in its final plunge.

Of the two, the falling wedge has been noted to be more reliable than the rising wedge in terms of predicting the market's price trend.

Just as the name suggests, the cup and handle pattern represents an actual cup and a handle on the forex charts. This pattern is generally associated with bullish signals. It can stay up anywhere from seven to sixty weeks, depending on the market conditions.

Traders using this technical chart pattern tend to gravitate towards a particular strategy where a stop order is placed just above the upper trend line of the handle so that the stop order may trigger on its own in case the price is observed to be breaking the pattern's resistance.

Traders should note that this pattern takes a while to solidify its legitimacy. Sometimes, it might even take years for this pattern to form fully.

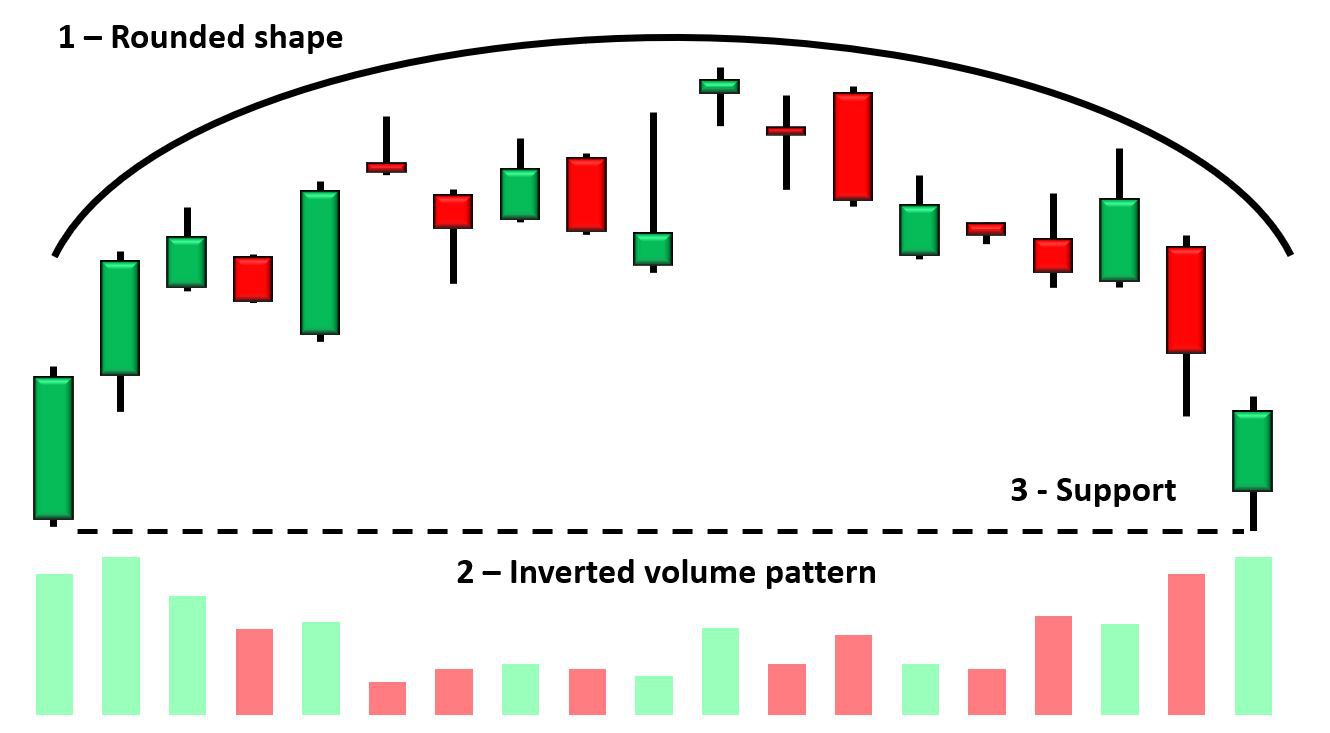

This pattern looks like an inverted U on forex charts, and traders often like to refer to this pattern as the inverse saucer while trading with it.

The rounding top is also one of the very few forex chart patterns that take much longer to form correctly than wedges or the double top/bottom patterns.

However, it doesn't take years to develop like the cup and handle pattern.

The rounding top pattern displays bearish signals for a currency price's upcoming trends. The volume levels may even take flight as the price increases as the trend takes full effect.

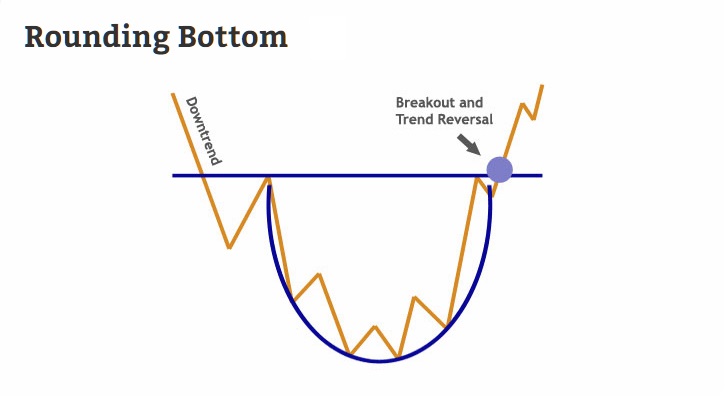

In a nutshell, the rounding pattern bottom is the mere opposite of the top rounding pattern, which earned it the nickname the saucer bottom as it looks like a proper U on the price charts.

This forex chart pattern signals the end of a downtrend with the possibility of an uptrend on the horizons often seen by traders as a signal for going for long positions on their trades.

Since its just an inverse of the top rounding pattern, it may also take some time to form on your price charts fully, so it's better to check with your indicators from time to time for confirmation.

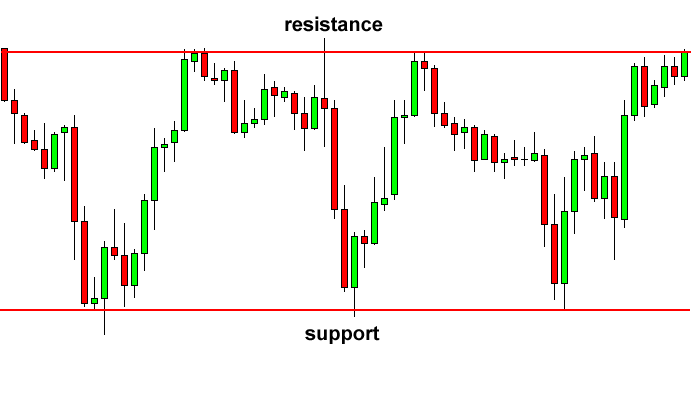

Now the rectangle is not a reversal pattern like the previous entries on this list. Instead, it is a continuation pattern, which means that it is generally used by traders to confirm whether or not a particular trend should go on.

You can either find a bullish rectangle or a bearish rectangle depending on the circumstances that create them. For example, you will find a bullish rectangle during an upward trend and a bearish rectangle during a downward trend.

It essentially depicts a trading area where the bulls and the bears compete with each other where they bulls push the price up when the price nears support. The bears move the price down when the price approaches resistance.

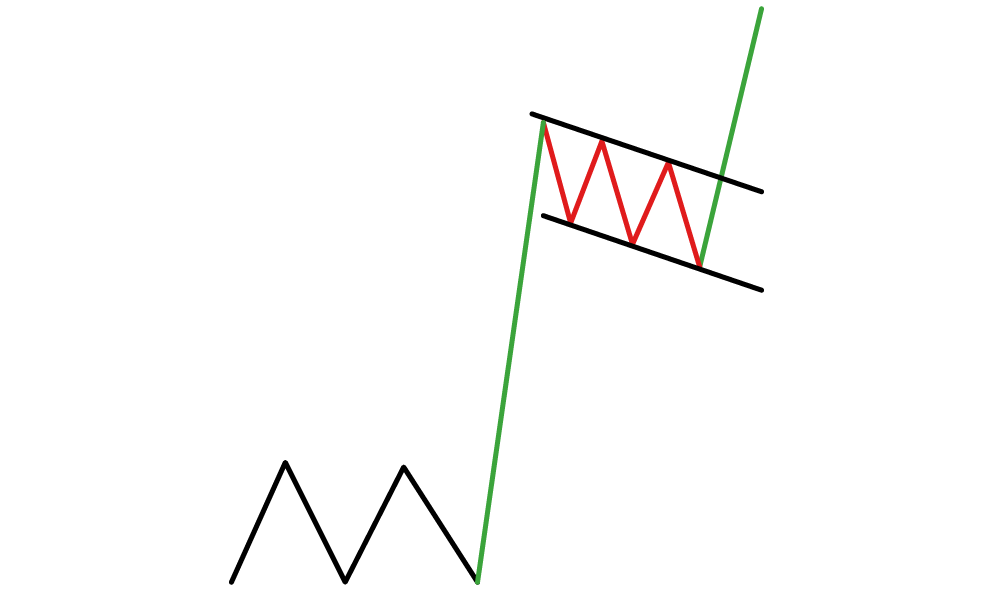

These are almost similar to wedges in characteristics. The only significant difference between the two of them is the trendline. Trendlines in flags are said to be parallel and not converging like the wedges.

Flags can be both bullish or bearish, depending on the circumstances. Bullish flags can be found during an upward market trend with the trend lines running parallelly above and below the price action. To get the confirmation for the continuation of the trend, look for a breakout just above the flag.

Similarly, you look for bearish flags during downtrends. They will be easy to spot since they form an upward slope.

Last but not least, triangles are also continuation signals like rectangle patterns and flags. Triangle patterns are three types: ascending, descending, and the symmetrical triangle, which is the most common of the three.

Ascending and descending patterns are similar to each other. The only difference is that the ascending triangle has a flat upper trendline. In contrast, the descending triangle has a flat lower trendline.

The symmetrical triangle has the unique ability to form during both uptrends and downtrends of the market, and it appears with converging trendlines.

Confirming a continuation is also very simple with the symmetrical triangle as breakout points of the lower trendline during a downward trend is enough indication for the continuation of that downward trend.

Similarly, a breakout of the upper trendline during an upward trend is enough indication for the continuation of that upward trend.

Related Articles

How Do You Lose Money in Forex Trading

How Do You Lose Money in Forex TradingCody WallsWhat’s stopping a forex

Olymp Trade Charity Work: Going Beyond Trading

Olymp Trade Charity Work: Going Beyond Trading Cody WallsAlthough Olymp Trade is

5 Best Forex Account Management Services 2023

5 Best Forex Account Management Services for Passive Income (2023 updated) Cody WallsHaving