Top 10 Forex Chart Patterns Every Trader Should KnowCody WallsOne of the

Top 10 Forex Chart Patterns Every Trader Should Know

Traders unfamiliar with the indecision candlestick pattern often get stumped when running into them at support or a resistance level.

Not everyone is aware of this fact, but the indecision candlestick is a pretty powerful signal which can be a fine addition to any forex trader's price action technical trading strategies.

Terms like Doji or the Spinning Top are generally associated with the indecision candle. Both the Doji and the Spinning Top are similar in structure and nature.

Indecision candlesticks cannot give traders any hints about the path that the market may take in the future, but that doesn't mean that they don't come in handy for forex traders now and then.

Let us take a closer look at the indecision candlestick and try to understand how it works and how you can apply it to your trades to make the most of them.

Source: https://www.quoteinspector.com/images/investing/stock-tracking/

These patterns usually form on the market charts when a situation arises in which buying and selling pressure holds at a brisk pace.

For a pattern to even qualify the candle, its body has to be relatively small and centered within the candle range. That position is usually situated between the highs and the lows.

Furthermore, the indecision candle must also have rather long wicks that can be observed on either side of the body. These wicks are in proportionate lengths as well.

These proportionate wicks are seen as an indication of the fact that the price has attempted to move in both upward or downward directions during a regular trading cycle.

These upward and downward movements essentially mean that the market could not maintain high or low prices during that particular trading session.

This means that the bulls and bears were highly active during the supposed trading session, heavily competing against each other.

Also, after such a significant event, you can note that the market will more or less close around the same area as it opened during the initial session.

This is a telltale sign of indecisiveness in the market because neither the bulls nor the bears could have a conclusive win, which is where the name Indecisive Candlestick comes from.

Source: https://pxhere.com/en/photo/1204308

These candlesticks can be excellent price reversal signals if you want them to be, especially those pop up in key areas on a trader's charts.

Once the trader successfully identifies their significance, he can start prepping for a possible trend reversal or even predicting the end of a counter-trend retracement if the market scenario is in his favor.

Also, the back and forth competition between both the bullish and the bearish forces in the market creates a surge in volatility, opening up a few opportunities for traders who can push through the cracks in time.

Mainly there are two types of indecisive patterns that you will come across at some point in your career as a forex trader. Those patterns are:

Spinning Top indecisive patterns form up whenever the selling or buying pressure on the market are battling it out to either bring the price up or down to take control.

This pattern solely depicts two things. One is the heated competition between buyers and sellers. The other thing that it indicates is that no one was able to take charge of the market.

Simply put, the Spinning Top pattern is used by traders to measure the volatility of the market. Since it is an indecisive pattern, it cannot show who the decisive force on the market was in the end.

One of the best things about this pattern is that you don't even have to invest too much time into it as they are straightforward to identify and read.

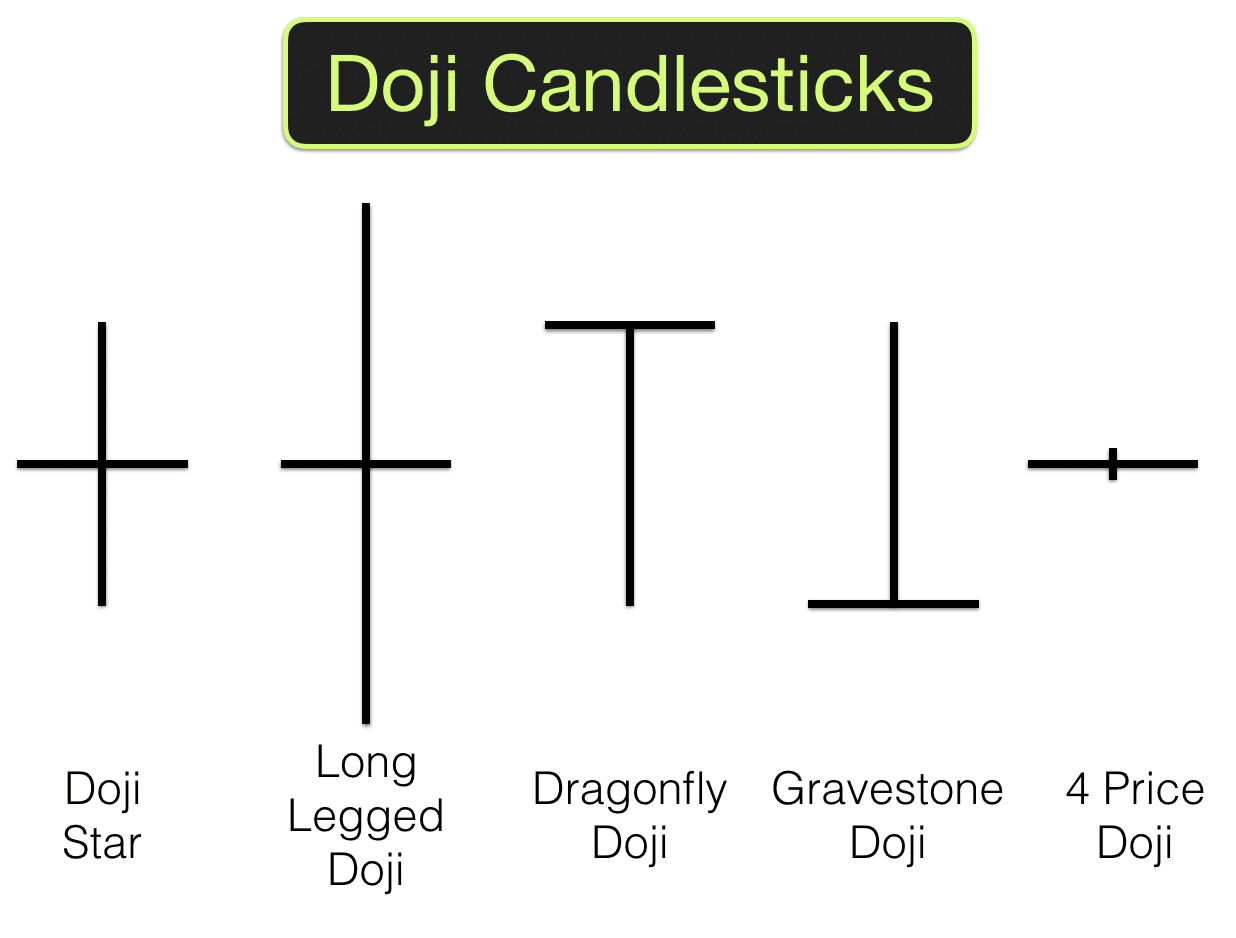

Like the Spinning Top, the Doji pattern is also an indecisive candlestick formation that indicates the market's indecisiveness.

This particular pattern usually forms either at the bottom or at the top of the trends, which is why it is almost always associated with reversals of current price trends. However, it can indicate trend continuations from time to time as well.

Dojis are typically found where the opening and closing price come to an equilibrium. This takes place when bulls try to push prices high, and the bears reject that price and try to get them lowered.

The bulls ultimately fail to keep the prices at their desired level, which gives all the bulls on the market to push it back up. This back and forth push creates the perfect condition for a Doji pattern to form.

There are two significant variants of the Doji pattern that you need familiarize yourself with:

There are multiple variants of the Doji pattern you can study and refer to whenever you see them. Knowing what they are and represent will help you make correct predictions when trading.

This essentially means that there are a handful of ways you can trade this pattern. Still, the important thing is always to confirm the pattern's prediction using an indicator or oscillator.

Usually, a single Doji's appearance is accepted as the universal indication of indecision on the market. However, there have been cases where two Dojis appeared back to back. That sign is taken as an indication of a strong breakout.

Traders should avoid jumping into a trade right after the Spinning Top forms and wait for some confirmation.

It is effortless to get positive or negative confirmation signals if you are using technical indicators or oscillators.

Traders often get confirmation of the Spinning Top pattern as soon as the succeeding candlestick forms, which form at points such as the point below the wick of the Spinning Top.

To summarize, you want to trade the candle with a short body with long wicks on either side. You can also try to get the feel of the market trend using trend lines etc.

Remember to wait for confirmation before commencing trade. Soon as you get proof, trade in the direction that's guaranteed to be profitable.

You can use indecisive candlesticks patterns as a signal which tells you to sit on the bench and wait for more chances to trade on the foreign exchange marketplace.

Its patience and tenacity will get you your profits. Learning how to keep your capital safe and only spend what's necessary will go a long way, helping you stay in the game indefinitely.

One thing to watch out while using indecisive candles is that you may end up seeing a whole lot of them on your charts, and not all of them will be fit for trading.

It is essential to pick your battles while trading forex and wait for the best opportunity to enter trades.

Related Articles

Top 10 Forex Chart Patterns Every Trader Should Know

Top 10 Forex Chart Patterns Every Trader Should KnowCody WallsOne of the

Live Traders Review: Is Live Traders Legit?

Live Traders Review: Is Live Traders Legit?Cody WallsLive Traders is the name

Forex Success Stories: 10 of The Most Successful Forex Traders

Forex Success Stories: 10 of The Most Successful Forex TradersCody WallsEvery forex