Forex vs. Futures: Differences You Should KnowCody WallsForex has become an integral

Forex vs. Futures: Differences You Should Know

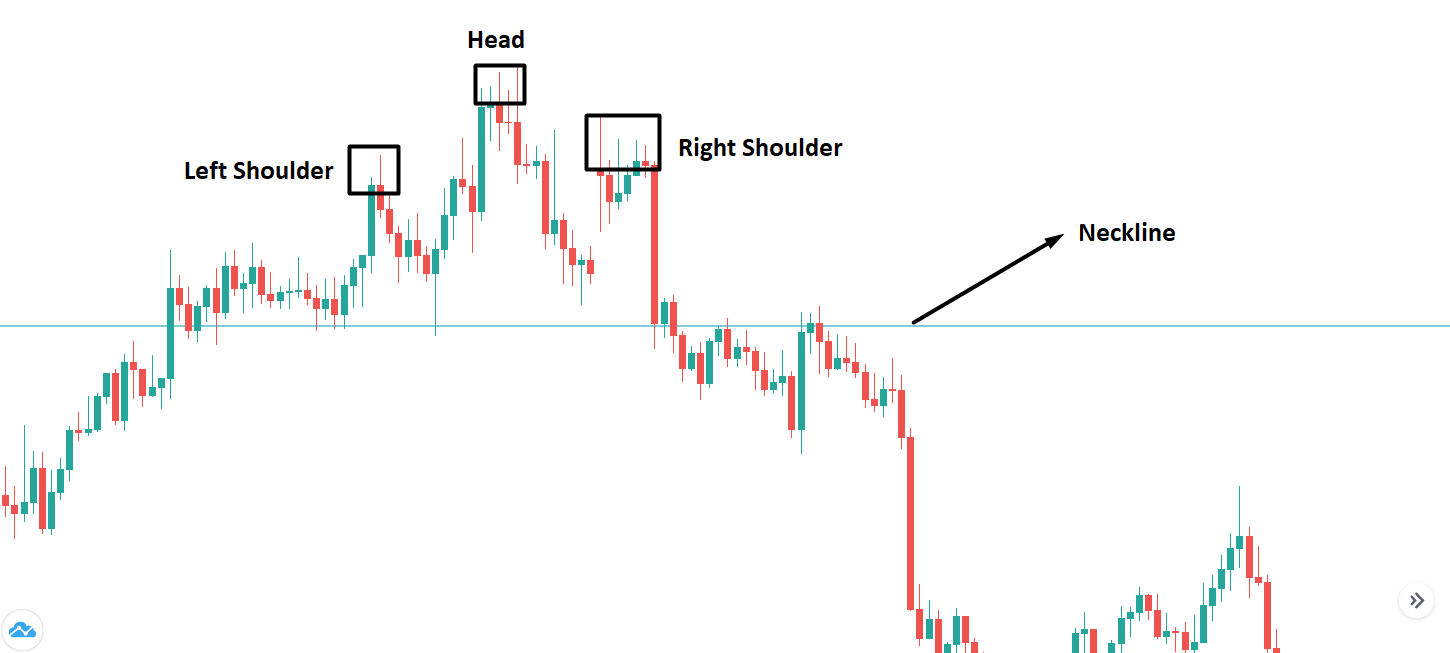

The head and shoulders pattern is a prevalent pattern that can occur at any given time during live trading on the foreign exchange.

Due to its random occurrences, all types of traders and investors can use this pattern in their technical analysis of the market to get better information on entry levels, stop levels, price targets, etc. with the help of the readings taken from it.

On the forex charts , the head and shoulders pattern looks like a singular baseline that has three peaks on it. The middle peak is the highest, and its adjacent peaks are almost close in height.

The peaks on the sides are called shoulders; in the middle is called the head, which is why it is called the head and shoulders pattern. We'll discuss the formations and implications of the pattern in more detail in this article.

This pattern can prove to be very reliable for traders, although, like everything that exists, it has a few drawbacks and limitations.

Let us take a closer look at this pattern, understand how it works, and determine how you can make the best possible use.

Source: https://www.forex.academy/trading-the-most-popular-head-and-shoulders-pattern-forex-strategy/

This pattern is a trend reversal formation that consists of three peaks therefore spotting it on the chart should not be too difficult even for an inexperienced trader.

As you know, the leftmost peak of this pattern is called the left shoulder, the peak at the center is called the head and the third peak which forms on the right is called the right shoulder.

All three of these peaks come together to form this specific pattern.

The head or the peak in the center is always bigger than its neighboring peaks and you can also draw a neckline by connecting the lowest points of the two peaks.

Although keep in mind that the formations you will observe in real trading scenarios will be a little rough and crooked with a little noise between the formations that might throw you off if you don’t analyze the pattern carefully.

Furthermore, you might also run into an inverted version of the pattern, which can be seen forming market bottoms. Here the left shoulder is in decline, followed by an increase with the head, creating a lower bottom with its drop. And the right shoulder is increasing and declining once more to form the bottom on the right side of the inverted pattern.

Source: https://excellenceassured.com/trading/trade-chart-patterns/head-shoulders-top

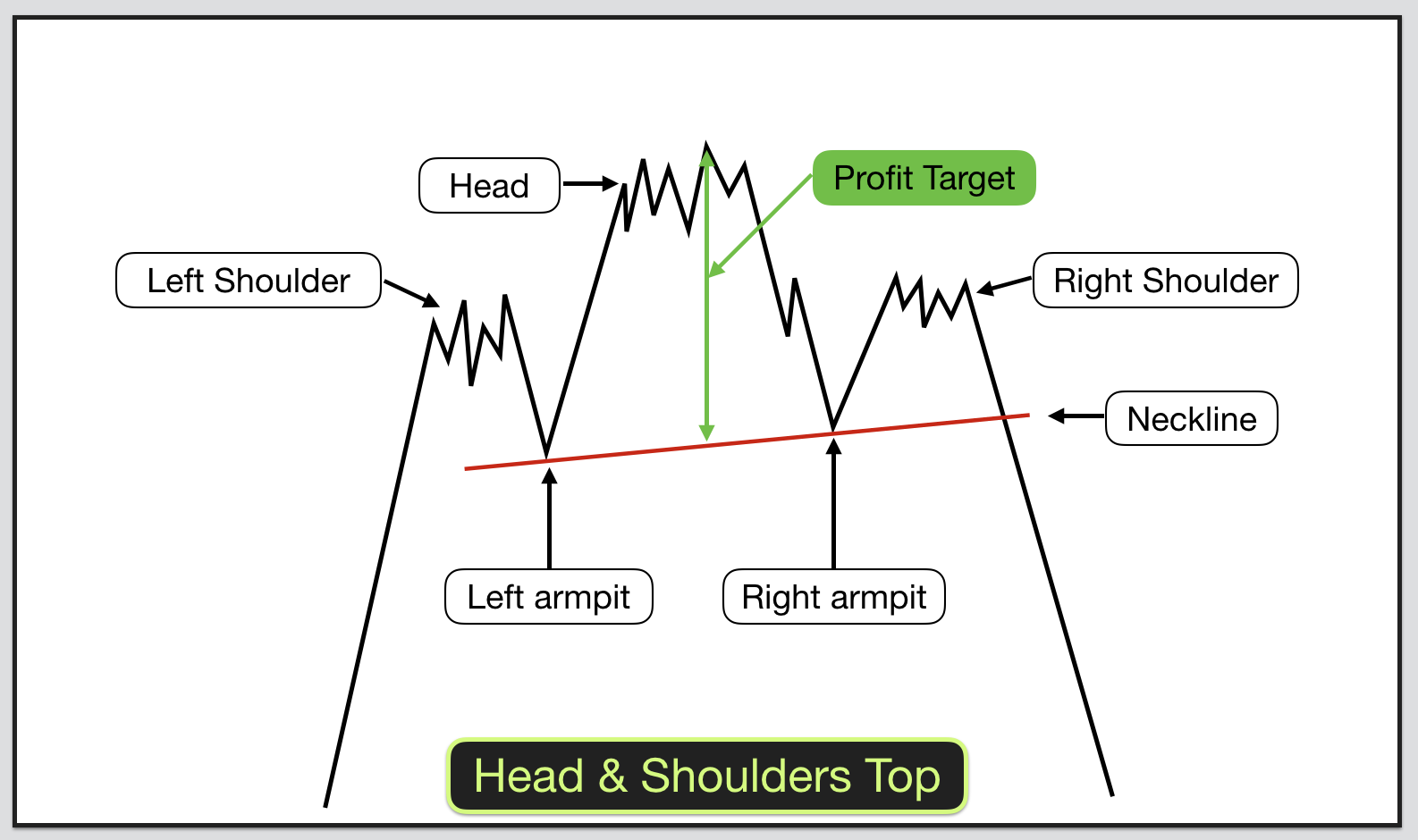

Like most forex trend reversal patterns, the head and shoulders pattern also has a neckline. It is nothing but the level of resistance or support used by fx-traders to determine the best areas for placing orders.

Determining the neckline is relatively easy. All you need to do is find the left shoulder's position, then select the head's position and the right shoulder, respectively, on the forex chart.

Once you have that information, join the low after the left shoulder with the low forming after the head. Once you do that, you'll have your head and shoulders neckline.

One more thing you need to know about the neckline is that it can also be the point where most traders get pressured into exiting their positions.

Suppose you are working with an inverse pattern. Then join the high that forms after the left shoulder directly with the high that forms after the head, and you'll have your inverse head and shoulders neckline.

Source: https://www.dailyfx.com/education/beginner/what-is-forex.html/

The key is to wait for the right moment once this pattern has been detected on your trading charts. Refrain from trading on this or any other pattern if they are not fully formed.

If you detect a semi-formed pattern, then wait for it to ultimately form as there is a high possibility that those unformed patterns might stop altogether and be of no use to the trader.

In the case of our head and shoulder pattern, the traders are advised to wait for the price action, which is simply the movement of a security price drawn up over a fixed period.

Once the price action is confirmed, wait for the pattern to break the neckline and then commence with your trade. This will ensure that you get the best possible results out of your trades.

The goal here is to dive right in once the pattern is confirmed to complete. A little planning and waiting can go a long way in helping you set down entry points, stop points, and other valuable details.

Some research will tell you that most traders choose their entry point just after a breakout has occurred in the case of entry points.

An alternative entry point would be waiting for a pullback on the neckline, which essentially means a slight drop in currency prices on the forex price generally after a good uptrend.

Source : https://tradesanta.com/blog/stop-loss

Forex strategies for traders ultimately depend on their style and temperament. There are a few schools of thought in placing stop loss in the head and shoulders pattern.

Some forex traders may choose to place their stop losses above the right shoulder, whereas some traders may choose to be more ferocious with their strategies. Let's take a look at a few stop-loss strategies used for this pattern.

The leading reason traders choose this stop-loss strategy is that it gives them ample space between their entries and stops.

This strategy is used by traders who want to slash their stop loss distance.

Source : http://wowonline.org/introduction-to-forex-trading/

Now that you are familiar with the ins and outs of the heads and shoulders pattern, we can start looking at the various strategies used by forex traders worldwide to get the best out of their trades using reversal patterns such as the heads and shoulders one.

Two such strategies followed by traders all over the world are given below:

This is what people call a somewhat conservative approach to this type of trading. The main idea behind this strategy is to be as safe as possible and take your profits before the market reverses.

Support levels will always vary from trade to trade but the main thing to watch out in this strategy is the risk to reward ratio.

If the risk to reward ratio seems to be in your favor then its advisable to take your profit at the first key support level.

This strategy is less conservative and more aggressive when compared to the last one.

When using this method, the trader measures the height of the complete pattern and records his readings which can help him have a specific target area.

The thing that makes the measured objective strategy a risky one is because they are rarely on the mark although they are known to be rather accurate from time to time as well.

Source : https://www.wikihow.com/Trade-Forex

Every trader is inherently aware that no pattern holds the secret key to unlocking all the market profits. It all depends on the way one uses his skills and knowledge to trade successfully.

That being said, the heads and shoulder pattern also has its cons that you need to look out for. Some of which are:

There's a saying that you can't raise your shoulders above the head level, which also applies to the head and shoulders pattern.

When you detect this pattern, always ensure that the head is sticking above both the left and right shoulders. Only then can you be optimistic about your pattern.

The best entry point could be the breakout of neckline riding with a stop either above or below the right shoulder, depending on the market circumstances.

Furthermore, you can easily find the profit target by calculating the difference between the highs and lows combined with the addition or the subtraction of the pattern from the breakout price.

This pattern can form randomly at any given time. That's is why you need to familiarize yourself with all the concepts, strategies, and tactics regarding it so you can make quick decisions on your feet to capitalize on the situation.

Lastly, keep in mind that no system or pattern is perfect in the real world. Still, by using these patterns, one can enhance their strategies and make logical trading decisions while trading using hard data as their guide.

Related Articles

Forex vs. Futures: Differences You Should Know

Forex vs. Futures: Differences You Should KnowCody WallsForex has become an integral

How Do You Lose Money in Forex Trading

How Do You Lose Money in Forex TradingCody WallsWhat’s stopping a forex

High Probability Swing Trading Strategies That Work

High Probability Swing Trading Strategies That WorkCody WallsSwing trading is a popular